ECM Weekly (9 Nov 2019) - Phoenix Tree, I-Mab, Tyro Payments, Pharmaron, Heaven-Sent

Aequitas Research puts out a weekly update on the deals that have been covered by the team recently along with updates for upcoming IPOs.

Hong Kong IPOs' performance was mixed this week. ESR Cayman (1821 HK)'s struggled to hold above its IPO price after an strong debut while Changsha Broad Homes (2163 HK), which just got listed on Wednesday, is already trading 7% below its IPO price. On the other hand, Shanghai Kindly Instrument-H (1501 HK) closed 29% above its IPO price on the first day of trading.

Next week, Sinomab Bioscience Ltd (3681 HK) and China Feihe (6186 HK) will listed on the 12th and 13th of November respectively. Pharmaron IPO has been approved and filed its PHIP while Heaven-Sent Gold Group has already launched its IPO bookbuild. Ke Yan, CFA, FRM share his thoughts on valuation for both IPOs in:

- Heaven-Sent Gold (硅谷天堂黄金) IPO: An OTM Option

- Pharmaron (康龙化成) A+H Listing: 3Q2019 Numbers and Thoughts on Valuation

China ADRs listings have been pushing through with their IPOs at lower valuation as seen from Ecmoho (MOHO US), 36Kr Holdings (1753455D US) and Q&K International (QK US)'s much smaller deal size than initially filed. This doesn't bode well for new IPO filings like YX Asset Recovery (YX US), which we hear is premarketing for its IPO, Phoenix Tree, I-Mab, Ehang and etc.

- Phoenix Tree (Danke) Pre-IPO - Another WeWork - Nothing Is Improving Apart from Revenue

- I-Mab (天境生物) Pre-IPO: Strong Management and Investor Backing with Differentiated Products

In other markets, we are also hearing that Bangkok Commercial Asset Management (BAM) is starting its premarketing this month after getting regulatory approval for the IPO in October. There were also reports that Sri Trang Gloves will look to IPO in 1H 2020.

In Australia, despite the setbacks, Tyro Payments (TYRO AU)'s IPO is looking promising so far as Sumeet Singh analyzed the company's business model and track record in:

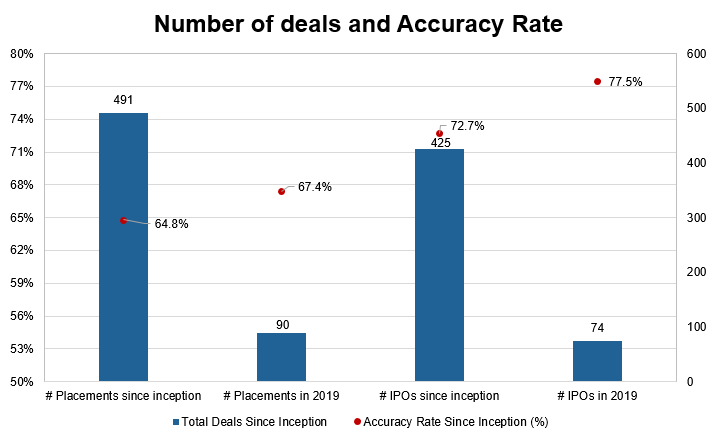

Accuracy Rate:

Our overall accuracy rate is 72.7% for IPOs and 64.8% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings this week

- Burger King India (India, ~US$150m)

- Liwayway (Global) Company (Hong Kong, ~US$100m)

- Renrui Human Resources (Hong Kong, re-filed)

- Beijing Enterprises Urban Resources (Hong Kong, re-filed)

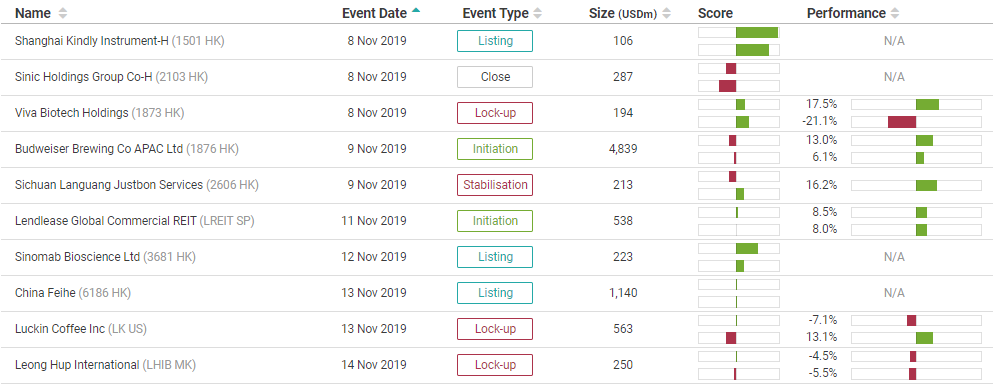

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Alibaba Start Pre-IPO Road Shows in Hong Kong Next Week

- Burger King India files papers for IPO

- Philippine electronics maker Cal-Comp defers $210m IPO again

- China Considers Up to $10 Billion Stake in Saudi State Oil Giant’s IPO

- China’s Megvii Considers Delaying IPO on Blacklist Concerns

- TikTok IPO no longer music to investors' ears

- Indonesia's Lion Air targets up to $1bn IPO in 1Q20

Analysis on Upcoming IPOs

- Phoenix Tree (Danke) Pre-IPO - Another WeWork - Nothing Is Improving Apart from Revenue

- I-Mab (天境生物) Pre-IPO: Strong Mgmt & Investor Backing with Differentiated Products

- Pharmaron (康龙化成) A+H Listing: 3Q2019 Numbers and Thoughts on Valuation

- Tyro Payments IPO - A Lot to like Apart from Its Earnings Profile and Churn Rate

- Heaven-Sent Gold (硅谷天堂黄金) IPO: An OTM Option

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- ECM Weekly (1 Dec 2019) - Venus Medtech, Alphamab, CMC REIT, XD, BAM01 Dec 2019

- ECM Weekly (24 Nov 2019) - Alibaba, OneConnect, Tyro Payments, New Frontier Corp, AlphaMab24 Nov 2019

- ECM Weekly (16 Nov 2019) - Alibaba, Freee, Megvii, Pharmaron, Canaan, XD16 Nov 2019

- ECM Weekly (3 Nov 2019) - Alibaba, China Feihe, Cal-Comp Tech, Shanghai Kindly, SinoMab, Sinic03 Nov 2019

- ECM Weekly (28 Oct 2019) - Samhi Hotel, JS Global, Megvii, Innocare, Bytedance27 Oct 2019