ECM Weekly (9 Feb 2020) - Mr. DIY, Kingsoft Cloud, SBI Cards, CAMS, Equitas SFB, Akeso Bio

Aequitas Research puts out a weekly update on the deals that have been covered by the team recently along with updates for upcoming IPOs.

Even though equity capital markets have been fairly quiet in Asia, there had been a few interesting IPOs coming up this year.

Starting off in India, we get more information on Life Insurance Corp of India (LIC)'s mega IPO. It was reported that estimates is putting LIC's IPO at India's next financial year which is from April 2020 to March 2021 and the deal will likely raise about US$11.2bn–$14bn if one assumes that 10% stake is sold in the IPO. Regardless, it will be the largest IPO in India to date.

Aside for mega deals, we are also hearing that SBI Cards (SBICARDS IN) is looking to get regulatory approval for its IPO in the upcoming week and will likely target to list towards the end of the month or in March. Sumeet Singh has already shared his thoughts on SBI Cards' valuation.

Other India IPO early coverage:

- Equitas Small Finance Bank Pre-IPO - Another Forced Small Finance Bank Listing

- Computer Age Management Services Pre-IPO - Quasi Monopoly Status Muddled by Inconsistent Performance

In Hong Kong, Ke Yan, CFA, FRM covered Akeso Biopharma Inc (1495016D CH)'s IPO. The company made headlines for getting rejected by HKEX. It was reported by FT that the rejection was the result of a typo in the draft prospectus which gave a prospective listing date in the second quarter, rather than the first quarter as intended. The company has already re-filed its draft prospectus shortly after the rejection.

We are also hearing that Mr. DIY will be looking to list by Q1. We have covered the deal extensively with peer comparison and thoughts on valuation this week:

- Mr D.I.Y. Pre-IPO - Peer Comparison - Small Stores with Dominant Market Share

- Mr D.I.Y. Pre-IPO - Assumptions and Thoughts on Valuation

Other IPOs we have covered this week include Kingsoft Cloud's potential IPO which was earlier said to have confidentially filed with the SEC for a US listing:

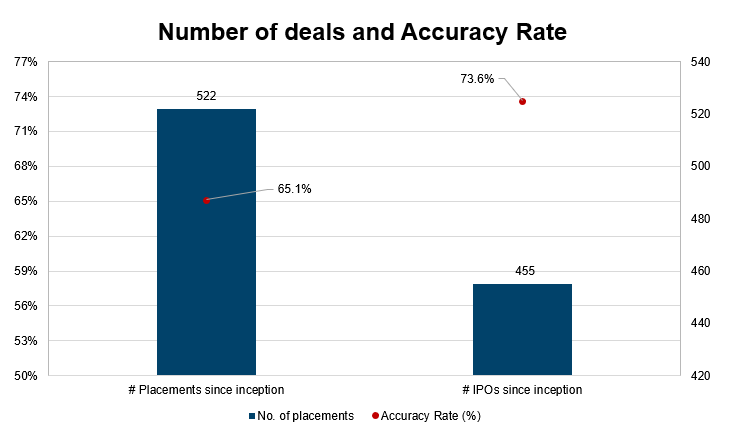

Accuracy Rate:

Our overall accuracy rate is 73.6% for IPOs and 65.1% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings this week

- Akeso Biopharma (Hong Kong, re-filed)

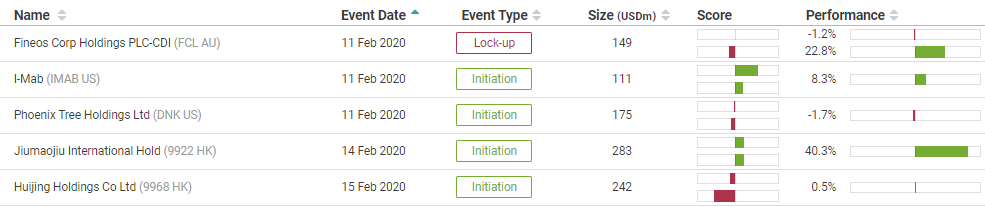

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

Analysis on Upcoming IPOs

- Kingsoft Cloud (金山云) Pre-IPO: The Leading Cloud Provider in China

- SBI Cards and Payments Pre-IPO - Valuations - A Tale of Two Revenue Streams

- Mr D.I.Y. Pre-IPO - Peer Comparison - Small Stores with Dominant Market Share

- Mr D.I.Y. Pre-IPO - Assumptions and Thoughts on Valuation

- Akesobio (康方生物) Pre-IPO: Late in the PD-1 Game but Products Are Promising

- Yeahka (移卡) Pre-IPO - Peer Analysis and Early Thoughts on Valuation

- Computer Age Management Services Pre-IPO - Quasi Monopoly Status Muddled by Inconsistent Performance

- Equitas Small Finance Bank Pre-IPO - Another Forced Small Finance Bank Listing

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- ECM Weekly (23 Feb 2020) - SBI Cards, United Hampshire US REIT, China Bright Culture01 Mar 2020

- ECM Weekly (23 Feb 2020) - SBI Cards, Peijia Medical, Shenzhen Hepalink, Home First Finance23 Feb 2020

- ECM Weekly (16 Feb 2020) - ThaiBev Brewery, ByteDance, China Bright Culture, Equitas SFB, LIC16 Feb 2020

- Kingsoft Cloud (金山云) Pre-IPO: The Leading Cloud Provider in China05 Feb 2020

- SBI Cards and Payments Pre-IPO - Valuations - A Tale of Two Revenue Streams04 Feb 2020

- ECM Weekly (2 Feb 2020) - Smoore, Innocare, Kilcoy Global, Mr. DIY02 Feb 2020