ECM Weekly (27 June 2020) - Smoore, Ocumension, Hepalink, Immunotech, Sri Trang Gloves, Yum China HK

Aequitas Research puts out a weekly update on the deals that have been covered by the team recently along with updates for upcoming IPOs.

It has been a hectic week in the ECM space. In Hong Kong, Hygeia Healthcare Group (6078 HK) and Kangji Medical (9997 HK) will list on Monday while Shenzhen HepaLink Pharmaceutical (H) (HEPALINK HK) and Immunotech Biopharm (IMMBIO HK) launched their bookbuild earlier this week and will be listing the week after.

- Hygeia Healthcare (海吉亚) IPO Trading: Upside Might Take Time to Crystalize

- Kangji Medical (康基医疗) IPO Trading: Ample Upsides as Peer Performed Well

- Shenzhen Hepalink (海瑞普) A+H: Hot Deal that Might Not Fly

- Immunotech Biopharm (永泰生物) IPO: Behind the Curve in Cell Therapy

In Thailand, Sri Trang Gloves' bookbuild closed mid-week and will debut next week.

There are also more than a handful more approvals that have came through with PHIP filed on HKEX. We have covered most of the names in our notes this week:

- GreenTown Management Holdings (绿城管理) Pre-IPO - Peer Comparison and Preliminary Thoughts on Valuation

- Cathay Media (华夏视听) Pre-IPO: Volatile Drama Earnings Smoothened by Private University

- Yum China HK Listing - Early Look - Relatively Bigger Deal Should Have a Relatively Bigger Impact

- Ocumension (欧康维视) Pre-IPO: All Ready for a Great Listing Except a Block Buster

- Smoore Intl (思摩尔国际) Pre-IPO: PHIP Updates, A Slow yet Encouraging Start in 2020

As if those were not enough, four more property and construction management services companies filed their draft prospectus and, out of which, KWG Living Group and A-City Group stand out in terms of size as they are expecting to raise about US$400m each. Hillhouse-backed Genor Biopharma has also filed its draft prospectus (under the name JHBP (CY) Holdings) and was earlier expected to raise about US$200m in its IPO.

Beyond Hong Kong, we may start to see more listings come through in India soon as we are getting more newsflow of listings in the country. This week there was also the re-filing of Mindspace REIT.

For China ADRs, there was only Agora Inc. (API US)'s listing on Friday, which did well, to say the least. Agora's shares closed about 150% above its IPO price, which was already priced 11% above the original range. Clearly, I was wrong to focus on valuation and data disclosure and not see Agora for the potential it could achieve.

- Agora Inc. IPO - Same Issues at Unattractive Valuation

- Agora IPO Trading - Hyped Up and Priced Above Top-End

It has also been a busy week for placements and we are seeing deals not just from Australia but across Asia Pacific. Here are our coverage for the week:

- Challenger Placement - Room for New Shareholders But We Remain Lukewarm

- MINT Placement - Known Asset, More Data Centres, Less SME Exposure -> Heading in the Right Direction

- GLP J-REIT Placement - Setting a New Trend for JREITs

- XD Inc. (心动有限公司) Placement - Company Sells First to Lock-In Cash

- Embassy Office Parks REIT Placement - To Big to Swallow if Its Not a Reverse Enquiry

- IDP Education Placement - Last Deal Was a Smash Hit, This One Won't Be as Lucky

- HDFC Placement - Early Look - Looking to Raise US$1.9bn

- Qantas Placement - Banking on a Trans-Tasman Travel Bubble

- Osotspa Placement - Resilient Business but Founding Family Is Selling

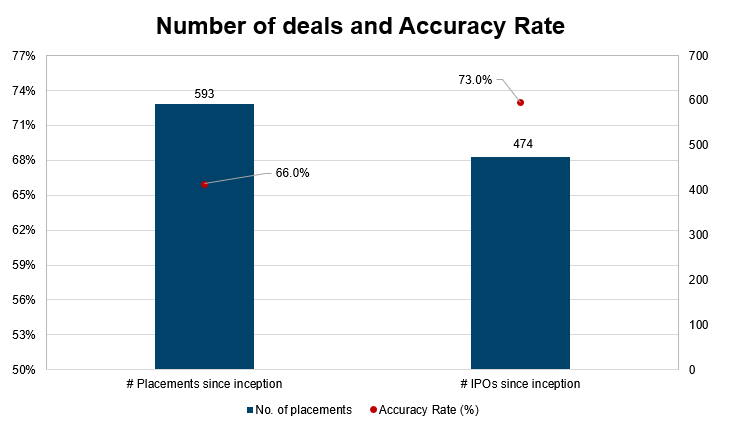

Accuracy Rate:

Our overall accuracy rate is 73% for IPOs and 66% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings this week

- KWG Living Group (Hong Kong, ~US$400m)

- A-City Group Limited (Hong Kong, ~US$400m)

- Genor Biopharma (JHBP (CY) Holdings) (Hong Kong, ~US$200m)

- Roiserv Lifestyle Services (Hong Kong, >US$100m)

- Jiayuan Services (Hong Kong, ~US$100m)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Hong Kong IPO hopefuls pile in applications

- GDS Holdings' Secondary Hong Kong Listing Could Bring in $1 Billion

- China developers seek cash in IPOs and spin-offs

- IPO from India's largest asset management company UTI AMC is ready to hit the street

- Chinese online property site Beike seeks $2bn in New York IPO

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- AREIT Pre-IPO - First Philippines REIT Listing Comes with Its Peculiarities13 Jul 2020

- ECM Weekly (12 July 2020) - Ocumension and Smoore, Simcere, Blue Moon, Weihai City Bank, Radiance12 Jul 2020

- ECM Weekly (4 July 2020) - Smoore, Ocumension, Zhenro Services, Archosaur Games05 Jul 2020

- ECM Weekly (27 June 2020) - Smoore, Ocumension, Hepalink, Immunotech, Sri Trang Gloves, Yum China HK28 Jun 2020

- Hygeia Healthcare (海吉亚) IPO Trading: Upside Might Take Time to Crystalize26 Jun 2020

- Smoore Intl (思摩尔国际) Pre-IPO: PHIP Updates, A Slow yet Encouraging Start in 202026 Jun 2020

- ECM Weekly (20 June 2020) - Hygeia, Kangji, Genetron, JD.com, Archosaur, Pop Mart21 Jun 2020