ECM Weekly (14 June 2020) - JD, Burning Rock, Kangji Med, Hygeia Healthcare, Pop Mart, Bohai Bank

Aequitas Research puts out a weekly update on the deals that have been covered by the team recently along with updates for upcoming IPOs.

Markets were a little shaky this week after the big one-day drop in the U.S. on Thursday. A handful of placements broke their respective deal prices but overall, IPO pipeline and bookbuilds are still moving along well as far as we hearing.

Burning Rock Biotech (BNR US) launched its bookbuild on earlier this week and will list this coming Monday. Ke Yan, CFA, FRM covered it in:

In Hong Kong, NetEase (9999 HK)'s secondary listing held up well above its pricing of HK$123 per share on the back of strong ADR trading of late which should bode well for JD.com Inc (ADR) (JD US)'s listing next week.

- JD Secondary Listing - Behaving Better than NetEase, so Far

- NetEase Secondary Trading Update - Index Flows to Provide near Term Support

We are also preparing for a handful of upcoming Hong Kong IPOs, starting with Hygeia Healthcare Group (1702613D CH) and Kangji Medical (1498779D CH) which was said to be premarketing its IPO. We also shared more on-the-ground research and early thoughts on recently filed, Nongfu Spring (NON HK), POP MART (POP HK), and China Bohai Bank (BOHAIBZ HK) .

- Hygeia Healthcare (海吉亚) Pre-IPO: PHIP Updates and Thoughts on Valuation

- Kangji Medical (康基医疗) Pre-IPO: COVID-19 Impacts and Thoughts on Valuation

- Nongfu Spring (农夫山泉) IPO: Bottle Size Matters, Photos on the Ground

- Pop Mart Pre-IPO - The Positives - Expanding Portfolio+Wider Distribution= Explosive Earnings Growth

- China Bohai Bank (渤海银行) Pre-IPO - Youngest Nationwide Joint-Stock Commercial Bank

Hong Kong IPO pipeline still looks promising. Simcere Pharma filed its draft prospectus with the Hong Kong Exchange this week while WeDoctor and Jiangxiaobai (a competitor to Moutai but targeting the younger crowd) are preparing for their respective IPO on the Hong Kong Exchange. Zhenro Services (ZS HK) and Smoore International (0959165D CH) were also reported to have sought for approval. We covered this IPOs in:

- Smoore Tech (麦克韦尔) IPO: Hidden E-Cigarette Player Behind the FEELM Technology

- Smoore Tech (麦克韦尔) Pre-IPO: 6Y and 1H2019 Financials Show Technology Driven Growth

- Smoore Intl (思摩尔国际) Pre-IPO: Tripling Capacity in Three Years

- Smoore Intl (思摩尔国际) Pre-IPO: Thoughts on E-Cig Regulation

- Zhenro Services (正荣服务) Pre-IPO - Diversifying Away from Zhenro Property Group

- Zhenro Services (正荣服务) Pre-IPO - Peer Comparison and Thoughts on Valuation

Other research on upcoming IPOs, placements and lock-up expiry:

- Venus Medtech Lock-Up Expiry: Could Face Selling Pressure

- XD Inc. (心动有限公司) Trade Idea - Lock-Up Expiry - Existing Shareholders May Look to Sell

- Topsports Placement - Parent Selling but Discount Is Enticing at the Low-End

- NIO (蔚来) Placement - Out of the Woods, for Now

- China Yongda Auto Placement - An Opportunistic Raise on the Back of Good Track Record

- Infratil Placement - Better Balance Sheet Flexibility with Focus on Existing Assets

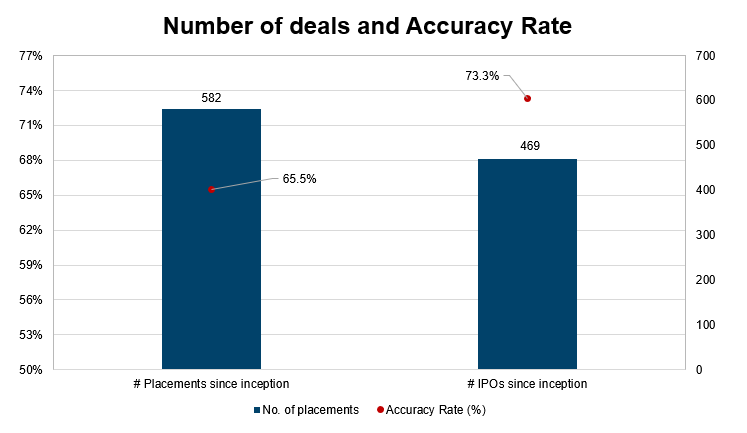

Accuracy Rate:

Our overall accuracy rate is 73.3% for IPOs and 65.5% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings this week

- Simscere (Hong Kong, ~US$1bn)

- Happiest Minds (India, US$100m)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- ECM Weekly (27 June 2020) - Smoore, Ocumension, Hepalink, Immunotech, Sri Trang Gloves, Yum China HK28 Jun 2020

- JD.com Reduce and Buy a Correction23 Jun 2020

- ECM Weekly (20 June 2020) - Hygeia, Kangji, Genetron, JD.com, Archosaur, Pop Mart21 Jun 2020

- Kangji Medical (康基医疗) Pre-IPO: COVID-19 Impacts and Thoughts on Valuation11 Jun 2020

- JD Secondary Listing - Behaving Better than NetEase, so Far10 Jun 2020

- ECM Weekly (7 June 2020) - JD & NetEase HK Bookbuild, Burning Rock & Nongfu Spring Valuation07 Jun 2020