ECM Weekly (10th October 2021) - Japan Post, MicroPort Medbot, MicroTech, FWD, Medbanks, 4Paradigm

Aequitas Research puts out a weekly update on the deals that have been covered by the team recently along with updates for upcoming IPOs.

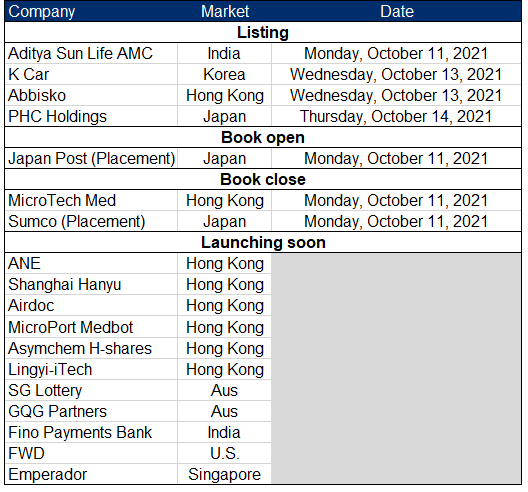

Events next week:

ECM activity is certainly starting to heat up in Asia Pacific. In particular, Japan has had a steady stream of large placements. This week Japan Post Holdings (6178 JP) was the center of attention as plans of the Japanese government selldown is slated to open this Monday, and price on the 25th of October. The selldown has been well-flagged and it will be a quasi clean-up. We revisited Hulic Co Ltd (3003 JP) just before its pricing and so far, Hulic’s share price has been holding up above its deal price.

- Japan Post Holdings Placement - The Final US$8bn Countdown - Past Deal Didn't Do Well

- Hulic Placement Update - Correction in Line with Our Expectation

- Chinasoft Placement - Small Deal and Proceeds Will Be Put to Good Use

Back to IPOs, in Hong Kong, MicroTech Medical Hangzhou (2235 HK) launched its bookbuild on Wednesday and it will close this coming Monday. The company's listing debut is on 19th October. We think valuation looks full despite the strong cornerstone line-up.

- MicroTech (微泰医疗) IPO: Demanding Valuation Despite a Decent Story

- MicroTech (微泰医疗) Pre-IPO: Thoughts on Valuation

We initiated on IPOs in the pipeline, Medbanks Network Technology (1690522D CH), an healthcare service provider with an oncology and pharmacy tilt, and 4Paradigm (1764934D HK), a platform-centric AI enterprise solutions provider.

- Medbanks (思派健康) Pre-IPO - Caught a Lucky Break

- 4Paradigm (第四范式智能) Pre-IPO - Stupendous Growth but Needs Better Disclosure of Certain Data

We also shared our thoughts on valuation of Shanghai MicroPort MedBot Group (MMG HK), which is set to capture significant market share in China's laparoscopic robotic surgical market.

- MicroPort MedBot Pre-IPO - Thoughts on Valuation

- MicroPort MedBot Pre-IPO - RoboDoc - PHIP Updates and a Look at Its Largest Competitor

In the U.S, FWD Group Holdings (FWD US) has been doing its rounds, meeting investors. We took a closer look at how the company compares to regional insurance competitors and share our thoughts on its valuation.

Last, but not least, tearsheets for newly filed IPOs this week:

Accuracy Rate:

Our overall accuracy rate is 73.8% for IPOs and 67.8% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings this week

- Green Tea Group (Hong Kong, US$200m, refiled)

- Farm Fresh (Indonesia, US$125m)

News on Upcoming IPOs

Hong Kong/China

- MicroPort MedBot pre-markets HK IPO of up to US$1bn

- MicroTech Medical pre-markets US$300m HK IPO

- Futu plans HK secondary listing

- Didi’s Closest China Rival Eyes New Fundraising, Potential IPO

- Shares of Transcenta, DRC Bank fall on debuts

- Tencent-backed Linmon Media plans US$300m HK IPO

- Agile Group Shelves Hong Kong IPO Plans of Unit A-City

- CNOOC to return home for Rmb35bn Shanghai IPO

- China Evergrande New Energy Vehicle Group cancels A-share IPO

- Dongfeng Motor changes A-share listing venue from ChiNext to SZSE main board

- Four companies file for Star IPOs to raise a combined Rmb7.13bn

- Zhejiang Dahua Technology to list machine vision unit

- ZJMI Environmental Energy clears hearing for Rmb2bn Shanghai IPO

- Haier Smart Home seeks approval

- Evergrande fights for survival

- China Chip Firm Horizon Said to Eye Moving U.S. IPO to Hong Kong

- Yonghe plans to seek HK listing approval this month

- Baidu’s iQiyi Is Said to Pick Banks for Hong Kong Second Listing

US/China ADR

India

- Sebi proposes wider IPO price band

- Sebi proposes sweeping changes to HNI allotment process for IPOs

- Fino Payments Bank, Popular Vehicles win IPO approval

- MobiKwik wins Sebi nod for IPO

- Aditya Birla AMC IPO subscribed 5.24x

- NTPC Said to Plan IPOs of 3 Units, Could Raise $2 Billion

- SEBI approves Fino Payments Bank’s ₹1,300 crore IPO, Paytm next in line

- New investors in talks to join PharmEasy’s pre-IPO funding round

- Paytm Is Said to Be in Talks With ADIA, BlackRock for IPO Stakes

Japan/Korea

Others

Others

- Genie Solutions cancels IPO

- GQG Partners pre-markets ASX IPO

- SG Lottery anchors think about 4pc yield, 15x earnings, SG Lottery brokers weigh into valuation debate: pre-IPO reports land, SG Lottery IPO pre-markets A$5bn ASX IPO

- Human services group APM puts $1b-plus raising to investors

- 2degrees merger discussions confirmed by its majority-owner

- Trilogy pauses 2degrees’ NZX, ASX listings

- Autopact readies sales data for potential IPO investors

- Vulcan Steel Sets IPO Price at A$7.10 Per Share

- Cisarua starts IPO investor education

- Farm Fresh files for US$125m IPO

- Data Center REIT, Thai Brewer Mulling Singapore IPOs: ECM Watch

- Emperador plans to pre-market SGX listing this month

- Synergy Grid to start pre-marketing Ps26.3bn share sale this week

Analysis on Upcoming IPOs

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- Japan Post Below 900 - Reaching for Our Buy Zone24 Oct 2021

- ECM Weekly (24th October 2021) - Japan Post, SiteMinder, MicroPort Medbot, PolicyBazaar24 Oct 2021

- ECM Weekly (17th October 2021) - SG Lottery, GQG, Judo Bank, Vulcan Steel, Biocytogen, Kakao Pay17 Oct 2021

- Medbanks (思派健康) Pre-IPO - Caught a Lucky Break07 Oct 2021

- Japan Post Holdings Placement - The Final US$8bn Countdown - Past Deal Didn't Do Well07 Oct 2021

- ECM Weekly (3rd October 2021) - MicroPort Medbot, MicroTech Med, Airdoc, Abbisko, FWD, PHC Hldgs03 Oct 2021