ECM Weekly (27 April 2019) - Luckin, Duiba, Leong Hup, ARA US Hosp, Douyu, So-Young, Yunji

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Placements took a back seat this week and IPO activity came roaring back to life.

Starting in the US, the two highly anticipated IPOs, Luckin Coffee (LK US) and Douyu (DOYU US), filed their prospectus with the SEC. We have already shared our early thoughts on the companies. Look out for more insights as we crunch through the numbers in the following weeks leading up to its IPO launch.

- Luckin Coffee (瑞幸咖啡) Early Thoughts - Caffeine Rush

- Luckin Coffee (瑞幸咖啡) App Walk-Through and Channel Checks

- Douyu (斗鱼直播) IPO: Leader At a Cost

Yunji Inc. (YJ US) and So-Young (SY US) opened their IPOs for bookbuild. We covered their valuation in:

Back in Hong Kong, Shenwan Hongyuan Group (H) (6806 HK) plunged 12% on its debut on Friday. As per Ke Yan, CFA, FRM's insight, risk-reward after the plunge implies that Shenwan is trading at a deeper discount to its A-share than it deserves. Considering that there had already been a big potion of adjusted free-float traded, stabilization can easily support the share price from here back to its IPO price.

Duiba Group (1753 HK) also opened its IPO for bookbuild this week. We heard that books are covered as of Friday. Valuation leaned on the expensive side as bankers probably took advantage of the strong rally in advertising peers to offer it at a higher valuation. We think that the IPO will only offer upside from the bottom end of the price range.

Activity is also picking up for Singapore and Malaysia after a long lull. ARA US Hospitality Trust (HOTEL SP) and Eagle Hospitality REIT filed their prospectus with MAS while ARA US Hospitality's IPO is already taking orders for bookbuild. Sumeet Singh penned his thoughts on the REIT and its valuation in:

- ARA US Hospitality Trust IPO - Performance of Past Overseas Linked Listings Doesn't Bode Well

- ARA US Hospitality Trust IPO - Matured Portfolio with Few Signs of Growth

Malaysia's Leong Hup International (LEHUP MK) finally launched its IPO after initial delays.

Accuracy Rate:

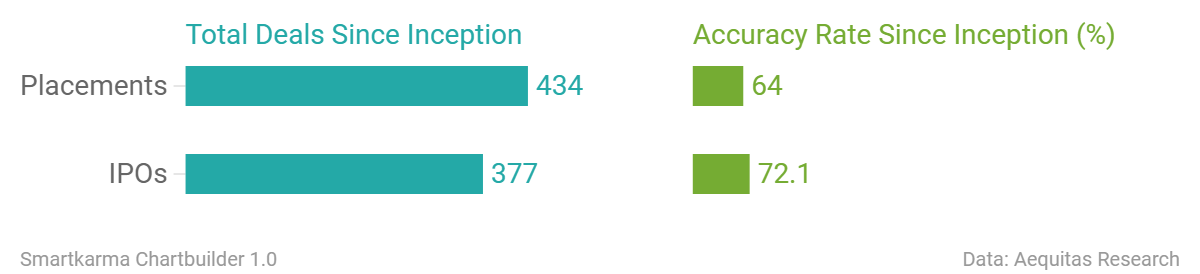

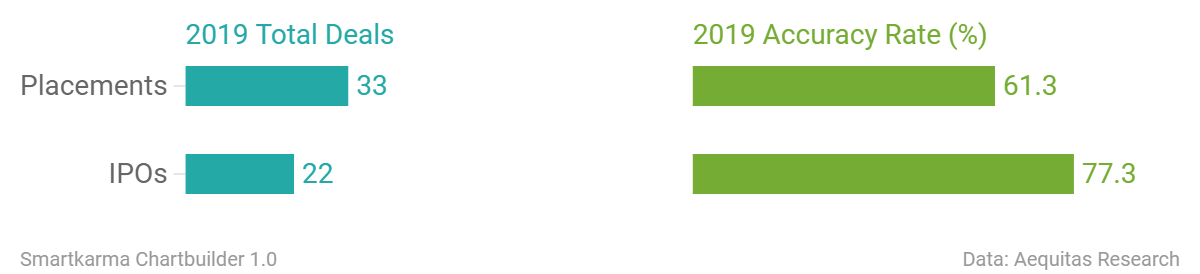

Our overall accuracy rate is 72.1% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- Ascentage Pharma (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- China’s oldest brokerage Shenwan Hongyuan takes a nosedive as Asia’s biggest IPO of the year gets off to a dismal start

- Chi-Med opts for 'home market' for third listing, files HKEX IPO

- Eagle Hospitality Trust lodges IPO prospectus

- ARA US Hospitality Trust Seeks $451 Million in Singapore IPO

- GIC-backed Luckin Coffee, China's Starbucks challenger, files for US IPO

- Singapore’s GLP plans $3b IPO of US warehouse assets

Analysis on Upcoming IPO

- Clarity Medical (清晰医疗) IPO: Proxy to HK SMILE Surgery Demand

- Haitong UniTrust Intl Leasing Pre-IPO - Shape Shifting

- Viva Biotech (维亚生物) IPO: Valuation Rich Even at Low End

- Luckin Coffee (瑞幸咖啡) Early Thoughts - Caffeine Rush

- Luckin Coffee (瑞幸咖啡) App Walk-Through and Channel Checks

- Douyu (斗鱼直播) IPO: Leader At a Cost

- So-Young (新氧) IPO Review - Decent Upside from the Low-End

- ARA US Hospitality Trust IPO - Matured Portfolio with Few Signs of Growth

- ARA US Hospitality Trust IPO - Performance of Past Overseas Linked Listings Doesn't Bode Well

- Duiba (兑吧) IPO Review - Interactive Ad Leader

- Hutchison-China Meditech (和黄医药) H-Share Listing: MNC Partnerships Endorsed Its R&D Capabilities

- Yunji (云集) IPO Review - Expensive Goods

- Leong Hup IPO - Privatization Was at Lower Multiples and Key Subsidiary Too Is Trading Cheaper

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- Luckin Coffee (瑞幸咖啡) IPO Review - Marketed Valuation Is Closer to Our Blue-Sky Scenario07 May 2019

- ECM Weekly (4 May 2019) - Hansoh, Douyu, Eagle Hospitality, Mulsanne, Luckin04 May 2019

- Luckin Coffee (瑞幸咖啡) - Blue-Sky/Bear-Case Valuation03 May 2019

- Leong Hup IPO - Privatization Was at Lower Multiples and Key Subsidiary Too Is Trading Cheaper26 Apr 2019

- Shenwan Hongyuan (申万宏源) A+H: A/H Premium and Liquidity Suggest a Quick Trade26 Apr 2019

- ECM Weekly (18 April 2019) - Duiba Group, MabPharm, Huami, Cofco Meat, Innovent, Times China18 Apr 2019