This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. 7&I (3382) – MBO Off, SC “Engaging Constructively with ACT”, Skepticism Higher, Questions And More

- The MBO is off. Itochu Corp (8001 JP) has apparently not been able to agree with Ito-san on board composition/representation and management control. That the MBO is off isn’t surprising.

- 7&i says they “continue to engage constructively with ACT and alternate proposals but news articles suggest that almost 6mos after proposing an NDA, ACT still haven’t had access to financials.

- The shares are off hard today to a level below where ACT’s first bid was considered “not even worth discussing”. There will be questions at the AGM and before.

2. 7&I (3382) – Bain Gets York Holdings with a Surprising Price, And We Approach Deal Deadlines

- Over the weekend, the Nikkei and Jiji reported the 7&i Board met Saturday and decided Bain would have preferred negotiating rights to buy York Holdings. They bid “over ¥700bn.”

- That’s a trifle lower than the ¥1.2trn Reuters reported (on Christmas Day) Bain bid but details aren’t known. Proper structuring would get the vast majority to 7&i in post-tax cash.

- For 7&i to decide by the AGM (which could be contentious), they need time to debate. Bids are likely needed in 3wks. In the meantime, “Trump Risk” lurks.

3. Seven & I Holdings (3382 JP): A Potential Derailing of the MBO

- Bloomberg reports that the MBO is stalling due to disagreements within the consortium over who will control Seven & I Holdings (3382 JP) after it is privatised.

- The Nikkei reported that Itochu Corp (8001 JP) was set to withdraw from the MBO consortium. Along with CP ALL PCL (CPALL TB)’s non-participation, the MBO’s financing is in trouble.

- An Alimentation Couche-Tard (ATD CN) bid remains in play but has issues. While progressing, the Board’s restructuring plan fails to prove a credible alternative.

4. Japan Post Bank (7182 JP): Another BIG Offering of US$4bn Expected; Overhang Will Be Removed

- Media reports indicate that Japan Post Holdings (6178 JP) could sell JPY 600bn (US$4.02bn) of Japan Post Bank (7182 JP) with the announcement coming as early as this week.

- The selldown is driven by Japan Post Holdings (6178 JP) needing to reduce its holding in Japan Post Bank (7182 JP) to 50% or lower by March 2026.

- Passive index trackers will buy around 11.4% of the offering at the time of settlement of the placement shares with the balance being bought in January 2026.

5. Korea: Short Selling Is Back in March; Trade Ideas

- Since short selling was banned in November 2023, short interest has plunged in Korea as shorts were covered. Markets have not done much over the last 16 months though.

- Foreign investor holdings have dropped from 32.05% in July to 28.57%. The top 25 stocks bought by foreign investors outperformed the top 25 stocks sold by 128% in 16 months.

- There will be trade opportunities across indices, pref/ords, index migrations and deletions, potential market upgrades and overvalued stocks being sold.

6. Seven & I Restructures but Discontent Rises Among Franchisees and Customers

- York HD is due to take over operation of all group business except Seven Eleven at the end of February and press reports suggest Bain’s bid has been accepted.

- All of which is fine but this leaves Seven Eleven Japan which is struggling against rivals. Even franchise owners are becoming more critical.

- A recent survey by Nikkei also suggested that consumers are increasingly favouring Lawson and Familymart and 30% visited Seven Eleven stores less frequently in 2024. This is a big problem.

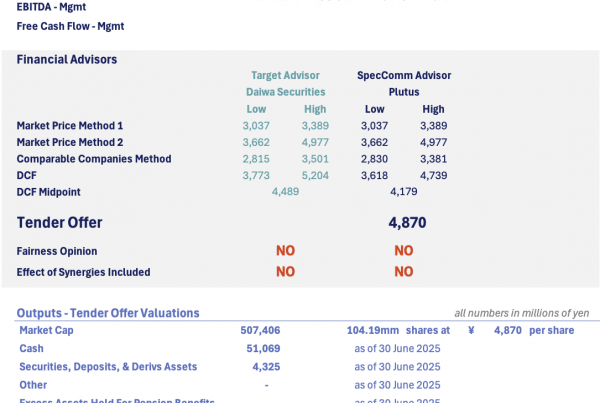

7. JPH Launches “MBO” (LBO with SARs for Family/Execs) For Trucker Tonami Holdings (9070). Too Cheap.

- Yesterday, Japan Post Holdings (6178 JP) announced an MBO for Tonami Holdings (9070 JP) whereby the family/execs will stay on. JPH will own 99.97%, the execs/family 0.03%.

- This deal is yet another in a line of logistics deals dating back the last 2+ years where the premium has been quite big. This time is +74%.

- But this is not overly expensive. Makes me go hmmmm…

8. CICC (3908 HK) & China Galaxy (6881 HK): The Next Mega Brokerage Merger

- Reportedly, China International Capital Corporation (3908 HK) and China Galaxy Securities (6881 HK), two of China’s leading state-backed brokerages, intend to merge via a share swap, forming China’s third-largest broker.

- This report/rumour arrives shortly after the successful merger of Guotai Junan Securities (2611 HK) (GJS) and Haitong Securities (6837 HK).

- As with GJS/Haitong, expect a Merger by Absorption structure, and that Galaxy (or CICC?) issue new A and H shares to the target. I’d be picking up CICC shares here.

9. Nidec Says It Won’t Raise Price on Makino (6135)

- Nidec Corp (6594 JP) released a multi-page document regarding its bid for Makino Milling Machine Co (6135 JP) yesterday.

- It talked a bit about the back-and-forth with Makino, and gave Nidec’s side of the story. Makino has been making their side public too. A meeting is due early March.

- In the document, there was a line suggesting Nidec won’t raise price even against a counteroffer. They didn’t need to say that. The question is what Makino will do.

10. Merger Arb Mondays (24 Feb) – Seven & I, Proto, Tam Jai, Pentamaster, Vesync, Canvest, Domain

- We summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Seven & I Holdings (3382 JP), Smart Share Global (EM US), Tam Jai International (2217 HK), Vesync (2148 HK), ESR Group (1821 HK), Goldlion Holdings (533 HK).

- Lowest spreads: Makino Milling Machine Co (6135 JP), Shibaura Electronics (6957 JP), Millennium & Copthorne Hotels Nz (MCK NZ), Domain Holdings Australia (DHG AU), Avjennings Ltd (AVJ AU).