This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Goodman Group (GMG AU): Much Bigger Index Impact of US$2.5bn Equity Offering

- Goodman Group went into a trading halt and then announced results and an underwritten equity placement of A$4bn (US$2.54bn) to pursue growth opportunities across logistics and data center operations.

- The stock has dropped since CIC’s stake sale in December but still continues to handily outperform peers.

- There will be some passive buying in the stock at the time of share settlement and more a few days later to mop up around 37% of the offering.

2. Hang Seng Index (HSI) Rebalance Preview: Inclusion Candidates for March

- Post market close on Friday, Hang Seng Indexes will announce the changes for the Hang Seng Index (HSI INDEX) that will be implemented at the close on 7 March.

- With no constituent changes, one-way turnover will be 2.75% with 3 stocks being capped downward. This gives the index committee the opportunity to add more stocks without significantly increasing turnover.

- The return of the high and medium probability inclusions has matched the performance of the Hang Seng Index over the last few months, Shorts have climbed in some names.

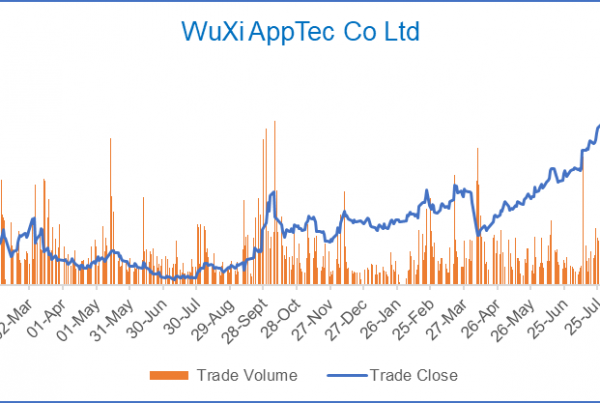

3. Alibaba (9988 HK): Results This Week; Over US$1bn Passive Selling in 3 Weeks

- Alibaba Group Holding (9988 HK) stock has rallied bigly over the last month and has gained 55% over that period.

- That has led to Alibaba‘s weight in the HSI INDEX, HSCEI INDEX, HSTECH INDEX and HSIII Index rising above the cap of 8%/12% and passives will sell on 7 March.

- We estimate passive trackers will need to sell US$1.2bn of stock due to capping. Shorts have been increasing, and quarterly results will be announced on 20 February.

4. India: March Rebalance Announcement Tomorrow; Round-Trip Trade Over US$2.5bn

- The Index Maintenance Sub-Committee of NSE Indices will meet on 21 February to conduct a semi-annual and quarterly review of stocks in various Nifty equity indices.

- The changes will be announced after market close tomorrow and will be implemented at the close of trading on 28 March.

- Based on the forecast index changes and capping changes for a few indices, the round-trip trade will be over US$2.5bn and many stocks will have over 0.5x ADV to trade.

5. [Quiddity Index Feb25] Nikkei 225 Mar Rebal: 2 or 3 IN, 2 or 3 OUT, ~$3bn 1-Way, 1 Squeeze.

- The data observation period is done. No rank changes in the top candidates since mid-Jan. Capping for Fast Retailing (9983 JP) is confirmed.

- For me, it is 2 or 3 ADDs, depending. Kokusai Electric (6525 JP) is still tops. BayCurrent Consulting (6532 JP) second. Shift Inc (3697 JP) third.

- Kokusai is +26.7% in 5 weeks since I wrote bullishly, despite news/confirmation of getting the boot from a global index at end-Feb. Baycurrent is +39.7% (link). Now we count flows.

6. Tam Jai (2217 HK): Toridoll (3397 JP)’s Scheme Privatisation at HK$1.58

- Tam Jai International (2217 HK) announced a scheme privatisation offer from TORIDOLL Holdings Corporation (3397 JP) at HK$1.58 per share, a 75.6% premium to the last close price.

- The key condition is the scheme approved by at least 75% disinterested shareholders (<10% disinterested shareholders rejection). No disinterested shareholder holds a blocking stake.

- The offer price is final. While 53% below the IPO price, the offer is attractive compared to peer multiples and historical trading ranges. This is a done deal.

7. MV Australia Equal Weight Index Rebalance Preview: Potential Changes in March; Multiple Overlaps

- With 6 days left to review cutoff, there are 2 potential adds and 3 potential deletions for the MV Australia Equal Weight Index at the March rebalance.

- Even if there are no constituent changes, capping changes will lead to one-way turnover of 3% and a round-trip trade of A$159m.

- The final list of inclusions/exclusions will depend on price movements till next Friday and whether the provider makes any significant changes to the free float of stocks in the universe.

8. Tam Jai (2217 HK): Toridoll (3397 JP)’s Excellent Offer

- After Tam Jai (2217 HK) was suspended, in Tam Jai (2217 HK) Suspended: Expect Toridoll (3397 JP) To Make An Offer I expected an Offer from TORIDOLL Holdings (3397 JP).

- I also thought an Offer price ~HK$1.50/share would be welcome, but wasn’t hopeful. We got both – a Scheme from Toridoll at HK$1.58/share (best & final).

- Clean deal. Just a question of timing. Docs may be delayed to incorporate FY25E (Mar Y/E) financials.

9. CVC Extends Macromill (3978) Bid and Invites Two Funds To Reinvest – More Interesting Than You Think

- Today, the closing date of the Tender Offer for Macromill, Inc (3978 JP) by CVC saw the tender offer extended by an extra 10 days with new news.

- Price had been declared final. One very large shareholder had said they would not tender. Two more were negotiating. Those two will now tender and reinvest in the back end.

- This does not mean the tender offer is a done deal, but it is worth examining.

10. JIC Launches Shinko (6967) Deal At ¥5,920/Share

- Today quite late, the JIC Consortium announced the launch of the Shinko Electric Industries (6967 JP) Tender Offer expected “mid-February”. Price is still ¥5,920/share.

- This is basically going to be all arbs and passive now. And arbs gonna arb.

- Congrats if you bought the lows in late November early December. Great trade. Congrats if you bought the last delay dip. Now we can all go home.