This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

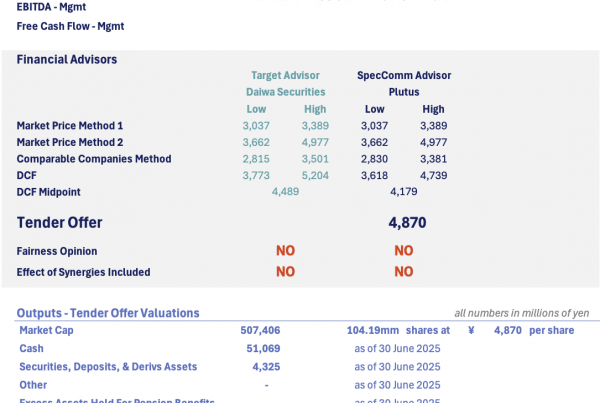

1. 7&I (3382) – In Limbo, Dipping, But Stories Coming Together

- In the past month we have seen Seven & I Holdings (3382 JP) earnings, confirmation of the York Holdings timeline, stories about Apollo, KKR, and CP Group providing MBO financing.

- We’ve also seen Itochu confirm the financing request from the Ito family, and two American banks tapped to provide LBO financing.

- York Holdings itself gets created this month, and a buyer decided “in spring” with a Group Buyer/Outcome possibly decided by the May AGM. Looks skewed to me.

2. Japan: Last Look at Potential Passive Selling in February

- There are 14 Japanese stocks at risk of being deleted from global passive portfolios in February. The number will be smaller depending on the day of the review period chosen.

- Selling from passive trackers will range from US$176m-354m and the impact ranges from 3.1-18.4 days of ADV. Short interest has increased in nearly all stocks over the last 4 weeks.

- The forecast deletes have underperformed the TSE Tokyo Price Index TOPIX on average over the last 1-3 months, while there has been marginal outperformance over the last week or two.

3. China/HK: Passive Activity Expected Later This Month

- There could be up to 10 adds/ 29 deletes for the China global index in February. The actual number of changes will be smaller depending on the review date chosen.

- The flow on the forecast adds varies from US$17.5m-US$175m (0.05x-15x ADV) while the flow on the forecast deletes varies from US$14.4m-US$100.4m (0.25x-22.75x ADV).

- Bestechnic Shanghai (688608 CH) is a potential inclusion to multiple indices in June and there will be much larger passive flows to the stock then.

4. Australia: Last Look at Potential Passive Selling in February

- There are 6 stocks in Australia that could be deleted from global passive portfolios later this month, though the probability of deletion varies across the stocks.

- If deleted, passive trackers will need to sell between US$234m-330m in the stocks. Impact is high at between 7-23 days of ADV.

- The potential deletions have underperformed the S&P/ASX 200 (AS51 INDEX) over nearly every time period from 1 week to 3 months. Shorts have increased on all stocks recently.

5. NIFTY NEXT50 Index Rebalance Preview: Final List of Potential Changes in March

- With the review period now complete, there could be 7 changes (including 2 migrations) for the NSE Nifty Next 50 Index (NIFTYJR INDEX) in March.

- Bajaj Housing Finance (BHF IN) and Swiggy (SWIGGY IN) are a hair’s breadth apart on market cap and only one of them could be added to the index.

- With quantitative criteria now being used to add stocks to the F&O segment, it is possible there is no change to the index methodology to limit inclusion to F&O members.

6. Kaonavi (4435 JP) – Small HR Software Co Gets 121% Premium LBO from Carlyle

- Another Japanese smallcap takeover at a huge premium. Must be a day ending in “y.” It is a thing recently.

- Interestingly, this is NOT an MBO. It is an LBO. Carlyle is buying out Kaonavi Inc (4435 JP) at ¥4,380/share which is 19x book and 89x EBIT. Nice price.

- I expect this gets done easily because the co-CEO with 28.7% and Recruit with 20.6% are putting in. There’s another easy 9.7%. One more holder and this is done.

7. S&P/NZX Index Rebalance Preview: Couple of Changes in March

- There could be one constituent change each for the NZX10 Index and the NZX50 Index/ NZX50 Portfolio Index in March.

- The flows are limited but the impacts are huge, and the stocks could move ahead of the announcement of the changes.

- A2 Milk Co Ltd (ATM NZ) is a potential inclusion to the NZX10 Index, but the inflows will be completely overshadowed by the potential deletion from a global index.

8. Taiwan Top 50 ETF Rebalance Preview: Eva Air (2618 TT) Winging Its Way In

- Eva Airways (2618 TT) is forecast to be added to the Yuanta/P-Shares Taiwan Top 50 ETF in March, replacing Formosa Chemicals & Fibre (1326 TT).

- Passive trackers will have 1 day of ADV to buy in Eva Airways (2618 TT) and over 3 days of ADV to sell in Formosa Chemicals & Fibre (1326 TT).

- Positioning on Eva Airways (2618 TT) does not appear excessive while Formosa Chemicals & Fibre (1326 TT) seems to be oversold.

9. SBI Sumishin NetBank (7163) – Oops! NTT Docomo May Not Be There As a Buyer

- On Friday, SBI Sumishin Net Bank (7163 JP) fell 12.5% in the last 90 minutes of trading. This was not due to their Q3 earnings release (out 30 January).

- It seemed due to investor disappointment in the content of the NTT earnings call. As discussed in the forked insight, there had been speculation NTT would buy SBI Sumishin.

- Investors had thought NTT would pay more than 28x earnings and a ¥600bn premium to book to buy the business. At 23.7x Mar25e EPS and 4.1x book, it’s still expensive.

10. Nifty IT Index Rebalance Preview: Oracle Financial Services Could Replace L&T Tech

- Oracle Financial Services (OFSS IN) could replace L&T Technology Services Limited (LTTS IN) in the Nifty IT Index (NSEIT INDEX) at the March rebalance.

- L&T Technology Services Limited (LTTS IN) will also be excluded from the F&O segment at the close on 27 March, so there could be some interesting dynamics at play.

- Passive trackers will need to trade between 0.5-0.6x ADV in the stock. The impact in terms of delivery volume increases to 1.6-2.2x.