This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Japan: Potential Passive Selling in February

- Currently, 9 stocks could be deleted from global passive portfolios in February. The deletion will lead to liquidity events where trackers will need to sell multiple days of ADV.

- There has been a buildup on shorts on few stocks with minimal positioning in the other stocks. That could change once the calendar ticks over to 2025.

- Kokusai Electric (6525 JP) is a potential inclusion to the Nikkei 225 (NKY INDEX) in March and this deletion could provide liquidity to enter a position ahead of that announcement.

2. Honda (7267 JP) – MAMMOTH New ¥1.1Trln Stock Buyback

- Today, along with the announcement of Memorandum of Understanding between Honda Motor (7267 JP), and Nissan Motor (7201 JP) to work towards negotiating a Joint Holding Company by June 2025…

- Honda cancelled their existing ¥100bn buyback, and initiated a truly mammoth NEW Buyback – up to 1.1 billion shares (23.7% of TSO), spending up to ¥1.1trln on market through Dec-2025.

- Assuming the stock pops, it is probably “only” worth 15-18%, but that’s still a LOT. At that rate it boosts BVPS by 8+% on its own, and EPS by 17%.

3. KOSPI Size Indices: Overlap Between Global Passive Selling & Downward Migrations

- The review period for the March rebalance of the KOSPI Size Indices commenced on 1 December and will end on 28 February.

- A quarter of the way through the review period, we forecast 37 migrating stocks. Among new listings, 1 could be added to LargeCap, 3 to MidCap and 2 to SmallCap.

- Four downward migrations were deleted from a global index in November. Now, three more downward migrations could be deleted from the same global index in February.

4. Korea: Potential Relegations from K League 1

- There are quite a few stocks in Korea that have underperformed their peers and could be deleted from global passive portfolios in February.

- There are still 3 weeks left for the stocks to redeem themselves and avoid relegation from the K League, so watch out for big price moves.

- Based on our estimate of passive assets, trackers will need to trade between US$45m to US$114m of the stocks. Impact will vary between 2.6x-30x of ADV to trade.

5. LG CNS IPO: Limited Float Pushes Back Passive Buying

- LG CNS (LGCNSZ KS) is looking to raise up to KRW 1,199bn (US$830m), valuing the company at KRW 6 trillion (US$4.15bn) at the top end of the IPO price range.

- As a member of the IT sector, inclusion in the KOSPI200 Index will only take place via Fast Entry (near impossible) or as a large-scale company.

- Inclusion in global indices could commence in September 2025 and will be easier if the identity of the pre-IPO minority shareholders is disclosed or if the strategic investors sell.

6. [Japan Activism] Exedy (7278) – Murakami-San Selling into the Buyback

- Exedy Corp (7278 JP) announced a big buyback. Murakami-san did not sell the first pop. The shares fell. Exedy started buying back and the shares went up. Now Murakami’s selling.

- Today after the close, Murakami Group companies announced that City Index Elevens had started selling. They sold 1.25% of shares out in 6 trading days to 16 December.

- I expect they sold another 2% in the past week through today. Shares tanked today. This is not a good signal. And it comes earlier than I expected.

7. Nidec Goes Hostile On Makino Milling at ¥11,000/Share

- This morning, Nidec Corp (6594 JP)announced that it intended to launch a Tender Offer on Makino Milling Machine Co (6135 JP) without the support of Makino management.

- The same pattern as Takisawa Machine Tool (6121 JP). Nidec decides, relying on the METI Guidelines for Corporate Takeovers for procedure, announces, and puts the onus on the Target to accept.

- But shareholders should hope Makino Milling takes a page from the example provided by Chilled & Frozen Logistics Holdings (9099 JP) back in spring 2024. This could get funky.

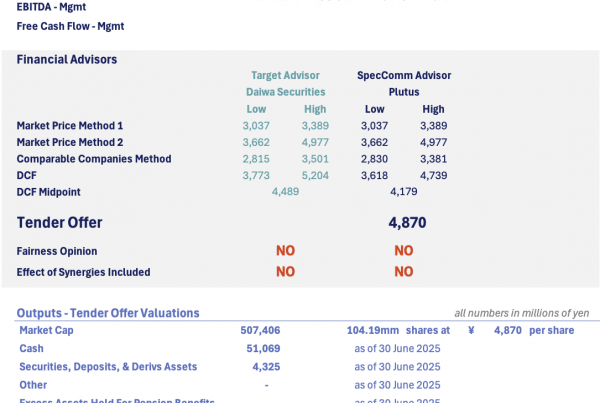

8. NEC Networks (1973 JP) Next To Last Showdown – NEC Lowers Minimum, Bumps Tiny, Ignores Synergies

- On Friday, NEC Corp (6701 JP) raised the price for its Tender Offer on Nec Networks & System Integr (1973 JP) from ¥3,250 to ¥3,300.

- It also lowered the minimum to 10.153mm shares (6.82%). It had proposed to do so earlier but NESIC demanded a bump, and NEC didn’t want to.

- Now it’s bumped. That’s the “final price.” But it still does not include “a fair allocation of a portion of the value that cannot be realised without an acquisition.”

9. GA Pack (468 HK): The State of Play

- On 20 December, Shandong Xinjufeng Technology Packaging (301296 CH) satisfied the precondition for its Greatview Aseptic Packaging (468 HK) offer. The offer document will be despatched by 27 December.

- Analysing the EGM vote on 18 October suggests that the 50% minimum acceptance condition will be met if no competing management offer is made.

- Management will oppose the offer, but the last EGM protest votes suggest that many minorities will ignore management. At the last close, the gross/annualised spread was 2.3%/25.3%.

10. Henlius (2696 HK): Interesting Shareholder Movements with the Vote on 22 January

- Shanghai Henlius Biotech (2696 HK)’s IFA opines that Shanghai Fosun Pharmaceutical (Group) (2196 HK)’s HK$24.60 offer is fair and reasonable. The vote is on 22 January.

- The key condition is approval by at least 75% of independent H Shareholders (<10% of all independent H Shareholders rejection). There are recent movements in H Share substantial shareholders.

- Key shareholders should be supportive of the cash/scrip offer. At the last close and for a 15 February payment, the gross/annualised spread is 2.9%/16.9%.