This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Midea Group H Share Listing (300 HK): Valuation Insights

- Midea Group Co Ltd A (000333 CH) has launched its H Share listing at HK$52.00-54.80 per share. Pricing will be on 13 September, and the listing on 17 September.

- We previously discussed the listing in Midea Group H Share Listing: Latest Updates Points to a Business in Rude Health and Midea Group H Share Listing: AH Discount Views.

- Our valuation analysis suggests that the H Share listing range is attractive. We would participate in the listing.

2. Midea Group HK IPO Valuation Analysis

- We would subscribe to the HK offering of Midea Group due to its attractive valuations, strong fundamentals, and meaningful price discount relative to the A shares.

- We believe a premium valuation relative to the comps is appropriate for Midea Group due to its higher sales growth, EBIT margin, and ROE.

- Pricing of this offering is expected to be completed on 13 September and listing on 17 September.

3. Midea HK Listing: Valuation Insights

- Chinese home appliance maker Midea has announced the terms for its IPO. The company plans to raise $3.46bn at an indicative price range of HK$52.0-54.8 per share.

- The company has a diversified product portfolio, well-balanced exposure to domestic as well as overseas markets and a growing robotics business.

- As we expected, the HK offering is priced at around 25% discount to it’s A-shares and our analysis suggests that Midea’s HK offering is priced attractively.

4. Midea A/H Listing – Bigger Deal, Better Pricing

- Midea Group Co Ltd A (000333 CH) aims to raise up to US$3.5bn in its H-share listing, the deal is somewhat larger than what was being spoken about earlier.

- Midea Group is one of the world’s largest home appliance manufacturing companies with a presence in over 200 countries. Its A-shares have been listed since 2013.

- We have covered the deal background in our previous notes. In this note, we talk about valuations.

5. K Bank IPO – The Biggest IPO in Korea in 2024

- K Bank is the biggest IPO in Korea in 2024. The IPO price range is from 9,500 won to 12,000 won. It is offering 82 million shares in this IPO.

- According to the bankers’ valuation, the expected market cap of the company is from 4.0 trillion won to 5.0 trillion won.

- The IPO deal size is 779 billion (US$579 million) to 984 billion won (US$732 million).

6. Pre-IPO Midea Group H Share (PHIP Updates) – Some Points Worth the Attention

- China’s home appliance industry is facing challenges. Even with large-scale “trade in” activities, its expansion effect on market size still appears limited, making it difficult to trigger significant growth momentum.

- However, Midea still achieved strong performance growth in 24H1. Both revenue and net profit showed double-digit growth rates. Midea’s business expansion and product profitability are much better than peers.

- Performance drivers are overseas business and air conditioners. Our forecast is Midea’s 2024 net profit would reach about RMB37 billion. Valuation of Midea could be higher than Haier Smart Home.

7. Terumo Placement Follow-Up – Correction Has Been Inline with Recent Cross-Shareholding Unwind

- A group of shareholders are looking to raise around US$1.36bn from selling ~5% stake in Terumo Corp (4543 JP).

- We have covered the background of the deal in our earlier note, Terumo Placement – US$1.4bn Secondary Selldown, Buyback Should Aid Deal Dynamics.

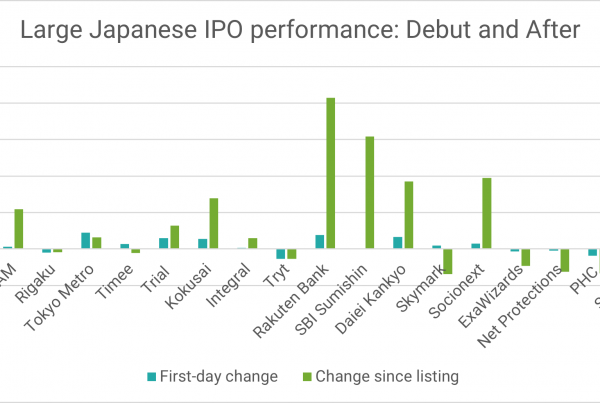

- In this note, we talk about the updates since and look at the performance of some of the past large Japan deals.

8. Terumo (4543 JP): The Current Playbook

- Since the US$1.4 billion secondary placement announcement, Terumo Corp (4543 JP)’s shares are down 3.5% from the undisturbed price of JPY2,771 per share (29 August).

- Looking at recent large Japanese placements is instructive to understand the potential trading pattern. So far, Terumo’s shares have followed the pattern of previous large placements.

- The offering will likely be priced on 10 September. Despite Kokusai and Honda’s disappointing performance, the average large Japanese placement tends to generate positive returns.

9. LG Electronics India IPO: Potential Big Gains. Booming Demand, Buoyant Valuations

- LG Electronics’s India business IPO could be valued above USD 7 billion, exceeding market expectations, driven by its dominant position in India’s growing home appliances market and strong sector valuations.

- Favourable market conditions and robust sector growth make now an ideal time for LG Electronics (066570 KS) to launch its India IPO, securing high investor interest and compelling valuations.

- In a recent interview, LG Electronics(066570 KS) CEO William Cho mentioned that an Indian market debut is one of several options being considered to revitalise the company’s consumer electronics business.

10. Bajaj Housing Finance IPO- Forensic Analysis

- Bajaj Housing Finance (BHF IN) upcoming IPO is worth INR 65.6 bn, comprising of fresh issue worth INR 35.6 bn and offer for sale worth INR 30 bn.

- The company reports strong KPIs and has been better than peers in several aspects. AUM growth is strong and is driven by Developer Financing and Lease Rental Discounting.

- There are few important cautions regarding the NHB observations and assignments.