This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. WeRide IPO: High-Risk Venture Investment and Unproven Business Model

- WeRide, a pure-play autonomous driving company with operations in 7 countries, may raise up to $120M in upcoming IPO in the United States.

- WeRide is expected to IPO this week. The company’s amended prospectus puts the price range per ADS at $15.50 to $18.50, implying a market cap of ~$4.6B at the midpoint.

- The company has raised ~$1.4B in equity financing to date and was backed by Qiming Venture Partners and the venture capital fund of the Renault Nissan Mitsubishi Alliance, among others.

2. Brainbees (FirstCry) IPO Trading – Decent Subscription and Valuation

- BrainBees Solutions (FirstCry) raised around US$500m in its India IPO.

- FirstCry is India’s largest multi-channel retailing platform for Mothers’, Babies’ and Kids’ products in terms of GMV, for the year ending Dec 2022 (9M23), according to RedSeer.

- In our previous notes, we looked at the company’s past performance and valuations. In this note, we talk about the trading dynamics.

3. WeRide IPO – Stiff Competition and Bleak Sentiment. Premium Valuation Doesn’t Help

- WeRide (WRD US) is looking to raise US$119m in its US IPO.

- WeRide provides autonomous driving products and services from L2 to L4 of driving automation.

- We had looked at the firm’s past performance in our earlier notes. In this note, we discuss our thoughts on valuation.

4. China Resources Beverage Pre-IPO – Thoughts on Valuation

- China Resources Beverage is looking to raise US$1bn in its upcoming Hong Kong IPO.

- China Resources Beverage manufactures and sells packaged drinking water and RTD soft beverages in China.

- In our earlier notes, we talked about the company’s past performance and undertook a peer comparison. In this note, we will look at valuations.

5. Hindustan Zinc OFS Early Look – Due for a Correction, Large Selling Pressure Looming

- Vedanta Ltd (VEDL IN) is looking to raise US$760m from selling some stake in Hindustan Zinc (HZ IN).

- Overall, while the deal would represent just 2.6% of the firm’s outstanding shares, the deal is a large one to digest at 41 days of the stock’s three month ADV.

- In this note, we take an early look at the deal, and comment on the deal dynamics.

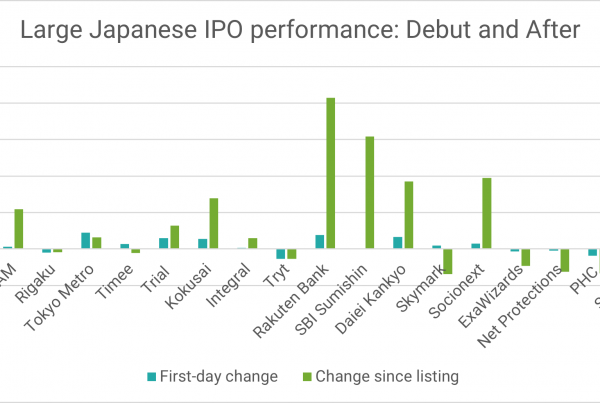

6. ECM Weekly (12th Aug 2024) – Ola Electric, Brainbees, WeRide, Akum, CR Beverages, Eternal Beauty

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the prior week witnessed a number of listings with divergent results.

- Given the market volatility, there was only one large placements in the prior week.

7. WeRide (WRD US) IPO: The Bear Case

- WeRide (WRD US), a provider of autonomous driving products and services, seeks to raise up to US$119 million through a Nasdaq IPO and US$321 million through a concurrent private placement.

- In WeRide (WRD US) IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

- The bear case rests on a volatile revenue profile, high customer concentration risk, widening losses that raise doubts on the path to profitability, elongated cash collection cycles and cash burn.

8. P N Gadgil Jewellers Pre-IPO – Strong Revenue Growth but Margin Worry Persists

- P N Gadgil Jewellers (1742652D IN) looking to raise up to US$132m in its upcoming India IPO.

- P N Gadgil Jewellers (PNGJ) is an Indian organized jewellery player. Its product offerings include traditional as well as modern and functional jewellery designs, in gold, diamond, silver and platinum.

- In this note, we look at the company’s historical performance.

9. Ola Electric (OLAELEC IN) : Soaring High – How Much Higher Can It Go?

- Ola Electric’s stock has surged since its Friday listing, despite a lukewarm IPO response. We look at a possible base-to-bullish case valuation range for Ola Electric’s stock price.

- With the e2W market up 96% YoY in July and Ola Electric’s sales soaring 114%, the momentum is strong. Likely catalyst on the horizon adds to investor optimism.

- Currently, on FY2026E EV/Revenue, Ola Electric trades on par with its closest Indian e2W peer.

10. ACME Solar Holdings – Strong Sector Tailwinds but Need to Keep an Eye on Profitability

- ACME Solar Holdings (1700918D IN) is looking to raise US$360m in its upcoming India IPO.

- ACME Solar (ACME) is a renewable energy firm with a portfolio of solar, wind, hybrid and firm and dispatchable renewable energy (FDRE) projects.

- In this note, we talk about the company’s historical performance.