In this briefing:

- ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

- Moore’s Law May Not Be Dead, After All

- RRG Weekly – Is Modi Government Cooking the Books? Brexit Risks Rise. South Africa Could Surprise

- Bits and Bytes : Facebook Feels the WeChat Burn + Why Does Lyft Want to List ?

- Tesla – Now We Know The Y, But Not the How

1. ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Starting with bad news in Korea, Homeplus REIT (HREIT KS)‘s IPO was pulled on the 14th of March which when it was supposed to price. The reason cited was weak demand which stemmed from growth concerns and difficulty in valuing this business.

On the other hand, Hong Kong’s IPO market is getting busier. This week alone, we had Dongzheng Automotive Finance (2718 HK) and Koolearn (1797 HK) that have already opened for bookbuilding and will price next week. We also heard that Sun Car Insurance is already started pre-marketing and it will likely open its books next week. The company had only just re-filed their draft prospectus last week.

Another upcoming Hong Kong IPOs would be Tianjin CanSino Biotechnology Inc (1337013D HK) which we heard had already started pre-marketing. Ke Yan, CFA, FRM updated his assumptions and valuation of the company in his insight, CanSino Biologics (康希诺) IPO: Valuation Update (Part 3).

In India, the focus is on Embassy Office Parks REIT (EOP IN) as this is the country’s first ever REIT IPO. It is also the first time there is a strategic tranche in an Indian IPO which has been taken up by Capital Group. Sumeet Singh has pointed out in his insight that with cost of debt of the REIT being at 9 – 9.25%, it is hard to fathom buying equity at a FY2020E dividend yield of 8.25%. This yield had already been inflated by the lack of interest payments. For detailed explanation, read his insight, Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond.

In other countries, we heard that Leong Hup International (LEHUP MK) is aiming to pre-market next month whereas, in Australia, there had been chatter that Prospa Advance Pty (PGL AU) may be back for an IPO again after it had beaten its own estimates from the IPO prospectus.

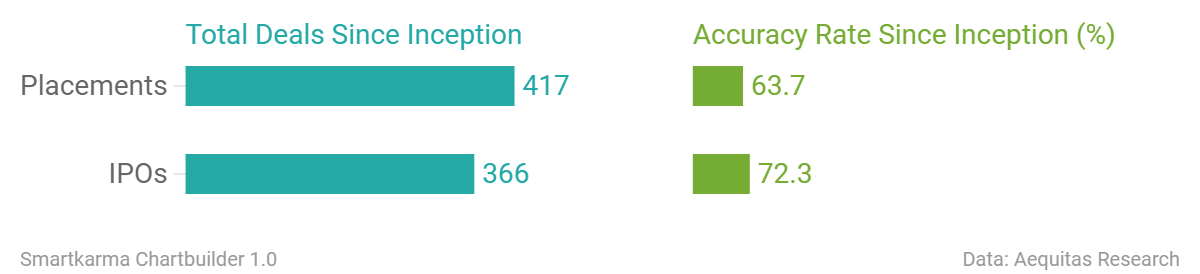

Accuracy Rate:

Our overall accuracy rate is 72.4% for IPOs and 63.7% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- FriendTimes Inc. (Hong Kong, >US$100m)

- Frontage (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- UBS and Rivals to Pay $100 Million to Settle Hong Kong IPO Cases

- Chinese Luxury Car Finance Firm Seeks $428 Million in Hong Kong IPO

- Online Educator Koolearn to Raise up to $233 Million in Hong Kong IPO

- Resurgence in Indian IPO market likely only after general elections

- Homeplus K-REIT Withdraws $1.5 Billion Korean IPO on Weak Demand

- Prospa may revive listing plan after beating prospectus forecasts

- Luckin Coffee chairman said to tap banks for $200m loan in exchange for IPO role

This week Analysis on Upcoming IPO

- Homeplus REIT IPO: A Key Landmark Deal in the History of the Korean REIT Market

- Up Fintech (Tiger Brokers) IPO Quick Take – It’s Not like Futu, Won’t Perform like It Either

- Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond

- CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

2. Moore’s Law May Not Be Dead, After All

For years semiconductor makers and investors have worried that Moore’s Law will end. Although it is not difficult to find proponents of this argument today, this Insight provides evidence that the venerable phenomenon not only is still moving forward, but that it has, in some cases, been moving faster than it has in the past.

3. RRG Weekly – Is Modi Government Cooking the Books? Brexit Risks Rise. South Africa Could Surprise

- Russia: Recent study estimates that unreported activity accounts for about 20% of GDP. Moscow could use this lost tax revenue.

- Singapore: MAS qtrly survey of professional forecasters estimates 2019 GDP growth at 2.5% for this year, down from median estimate of 2.7% in the September survey.

- South Africa: Morgan Stanley is calling for outperformance by South African economy and stocks in the coming months. Focus on Healthcare and Retail Names)

- India: Modi’s government is accused of politicizing economic data government in a growing debate over the credibility of India’s official growth estimates.

4. Bits and Bytes : Facebook Feels the WeChat Burn + Why Does Lyft Want to List ?

Facebook Inc A (FB US) : Mark Zuckerberg sees the light or is facing the WeChat burn? It seems like the whole tilt towards ensuring a more safe, secure environment lies in its play to emulate WeChat…eventually. But first, it needs to address specific issues of data protection, security and privacy that plague the company and possibly think around altering its current revenues via the advertisement model.

The company certainly seems to be moving towards making a token/coin and is even hiring blockchain specialists. Could it look to make a Stablecoin? Work on a M-Pesa model ? Target remittances in countries like India? It seems a long road and arduous road ahead- but it has been dropping directional hints along the way.

Lyft Inc (0812823D US) : Why does Lyft Inc (0812823D US) want to list exactly aside locking in money before the number one player swamps the market ? Could it be regulatory changes on the anvil ? And would those be food for thought for Asia plays – Grabtaxi Holdings Pte (0967655D SP)DiDi Chuxing (1284375D CH) and Olacabs ?

5. Tesla – Now We Know The Y, But Not the How

The eagerly awaited and long promised Model Y is out and it looks…like Model 3. That’s OK, just no shock and awe which Tesla really needed to jumpstart sales momentum–and a wave of sorely needed cash reservations.

Tesla Motors (TSLA US) unveiled Model Y on, perhaps not coincidentally, March 14th which also is Pi Day. Pi is the fundamental ratio which demonstrates that all circles are related–as Model Y is overwhelmingly related with the seminal Model 3 which contributes 75-80% of the newcomer’s platform and technology.

Which means Model Y may be originating with Model 3’s many inherent problems, as I discussed in Tesla’s Plan B 2.0; Y Not, just as Tesla also is juggling the ramp-up of the newly launched $35,000-base model of Model 3 along with sales expansion into Europe and China as well as building a new plant on a shoestring in Shanghai. All this just as the company also has lurched into a radical new online-only sales model with apparently little if any considered preparation (see Tesla’s New Plan: Buy Before You Try).

No wonder Tesla’s Vice President of Engineering Michael Schwekutsch just quit, an ominous signal.

Another is that Model Y won’t be available until late 2020–at best–which is much later than expected. It’s still not clear when or where Model Y will be in full production or, even more critical, when Tesla will make even a penny of profit on it. Model 3 only recently became marginally profitable, excluding the likely money-losing $35k version, and sales of more profitable but aging Models S and X are in accelerating decline.

And, as I observed last week, Tesla’s track record of long delays in delivering new models coupled with Model 3’s alarming quality and reliability may seriously diminish the hoped-for early bird reservation cash which the company sorely needs to ease its liquidity crunch. At the same time, the pending arrival of Model Y over the next year or so is likely to further dampen already waning demand for Model 3.

In any case, it’s too late for Tesla to preserve profitability in the calamitous first quarter, if not for the full year.

Continue reading for Bond Angle analysis.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.