Independent research house, Celent, has recently published a report on MiFID II, research unbundling and the future of investment research.

In the report, John Dwyer, Senior analyst at Celent evaluates the current provision of investment research and what the future may look like. Vitally, his focus is not on the problems associated with trying to “fit” the existing research industry into a post MiFiD2 world, but how the industry will innovate and change.

John details the powerful part that platforms will play in the future of research, as incumbent providers with legacy systems become less and less relevant. “It is the insight rather than the power of the voice which should determine the value in the marketplace….. the fragmented future of research will embody a P2P [peer to peer] structure.”

Other factors are also in play that will help transform the investment research market at a global level. Asset managers competing for global business will have to demonstrate the same levels of transparency as their European counterparts, and will have to make changes to how they access research. Alongside the regulatory push, there are significant political, technological and economic changes occurring globally.

This brings new challenges for market participants demanding clear perspectives regarding capital allocation. As John says, “for active managers in an unbundled environment, research access may become a critical driver of absolute and relative performance.” Timely, independent and useful insight is ever more important.

Research as a Product Vs Research as a Service

From the beginning, Smartkarma has forged its own path. This has been driven by our belief that bringing real, lasting and positive change to the research industry requires an entirely new business model and an entirely new culture; a complete overhaul of how the industry operates and prices, from the ground up.

Anything less is simply providing a bandaid solution to the “problem” of regulation. As Celent notes, “regulation is merely the catalyst to resolving pain points which have existed for a long time”.

We are surprised and excited to see Celent recognise and validate this unique and fundamental difference in Smartkarma’s approach, coining the phrase “Research as a Service” or RaaS to delineate us from the other platforms; the “Research as a Product” (RaaP) marketplaces.

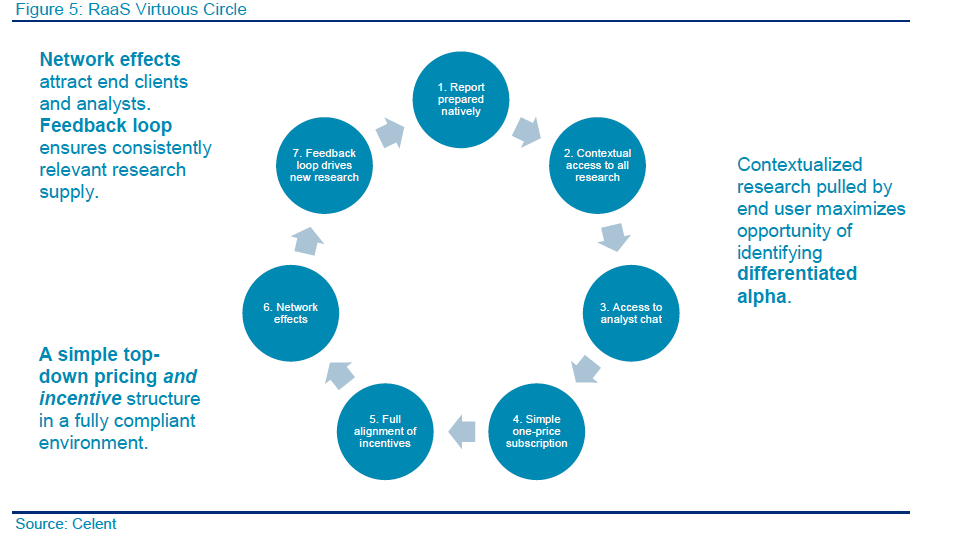

Celent sees the many benefits of a “Research as a Service” model:

- Subscription-based pricing providing end users access to all research.

- Native publication of research reports permits contextual delivery to end users as well as maintaining quality and ensuring independence.

- Accessing the long tail of analysts offering uncorrelated insights.

- All analysts are jointly incentivised to collaborate and to enhance the intellectual capital / substantive nature of the research on the platform.

- Increased potential for differentiated alpha and network effects.

The RaaS Virtuous Circle

Societe Generale – A Milestone?

In recognising the power of our unique business model, and the substantial role that P2P platforms will inevitably play in the future, Celent also recognised the bold step that Societe Generale has made in partnering with us.

Celent suggest that this agreement “may come to represent a key milestone in the evolution of investment research”.

You can read more about our partnership HERE.

We are creating a bright, yet radically different future for research. We are proud to be joined on this journey by our growing community of visionary Insight Providers, clients and partners.