DM Wenceslao IPO Preview: Conspicuous Growth

DM Wenceslao and Associates Inc. (DM Wenceslao) is an integrated property developer with a track record in land reclamation, construction, and real estate development. DM Wenceslao is expected to raise approximately US $300M, and is priced at PHP 12 per share (the low-end of the IPO price range).

- Listing Date: June 29, 2018

- Broker Initiation: August 8, 2018

- Lock-up Expiry: December 28, 2018

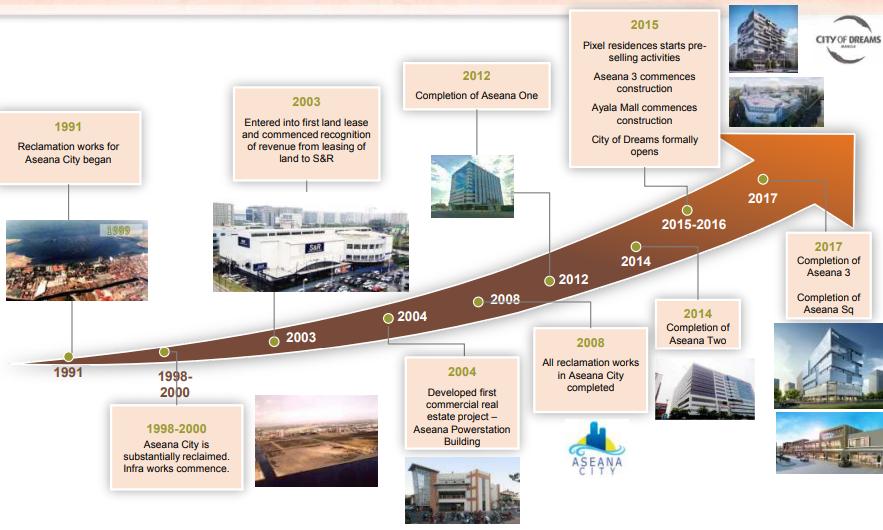

DM Wenceslao pioneered the Aseana City development in 1991, and has continued improving its financial performance. (Source: DM Wenceslao)

Aggregate Sentiment from Smartkarma IP

Smartkarma’s Insight Provider Toh Zhen Zhou has covered DM Wenceslao since April 2018, remaining bullish on this deal throughout.

- Visible Future Growth

Driven by strong growth in all segments (except land sales), DM Wenceslao’s revenue has almost doubled in the past two years.

As an advantage, DM Wenceslao has a large land bank in a strategic location, Metro Manila. The company bought it at a big discount, improving potential profit margins in the future. The company claims that the land bank will meet developmental needs for at least the next ten years. - Long-Term Track Record, Good Reputation, Improving Financials

DM Wenceslao was founded in 1965 by Delfin M. Wenceslao with a vision to transform the urban landscape. The company started with infrastructure projects and has constructed over 100 projects throughout the country, including ports, bridges, and expressways. In addition to this strong track record, DM Wenceslao has also shown further improvement in its past three years financials. - Concentration Risk Reflected Price is Demanding

Considering DM Wenceslao’s concentrated land reserves, pipeline projects, and leased land in the Aseana City area, Smartkarma Insight Provider, Toh Zhen Zhou reckons that a further discount should be given. even after taking a larger discount on the RNAV, DM Wenceslao still offers a good potential upside from its IPO price.

Key Contributors

Toh Zhen Zhou

Top 5%

IPO, Placements and Holding Companies, Smartkarma

Bullish View (April 3, 2018 – June 6, 2018)

Zhen Zhou was bullish on this IPO, satisfied by the potential upside that DM Wenceslao offers.

See all insights from Toh Zhen Zhou starting with DM Wenceslao IPO Review – Priced To Reflect Concentration Risk.