In this briefing:

- 58.com Inc. (NYSE: WUBA): Regulatory Pressure Has Long Term Implications

- MYOB (MYO AU): Shareholders Are Caught Between a Rock and a Hard Place

- Infosys Ltd (INFO IN): Another Buyback Coming? Not a Bad Idea, but How Much It Can Really Help?

- SoftBank Corp (9434 JP) & Arteria Networks (4423 JP): A Tale of Two IPOs

- MYOB Caves And Agrees To KKR’s Reduced Offer

1. 58.com Inc. (NYSE: WUBA): Regulatory Pressure Has Long Term Implications

● We notice that Anjuke’s Oct.-Nov. traffic declined. We attribute this decline to the tightening of registration requirement in various cities, which will reduce the number of housing leads on WUBA platform;

● We, however, believe new home business will deliver strong revenue for WUBA this year, contributing Rmb2bn in revenues by our estimate;

● We rate the stock Buy and cut TP from US$84 to US$79.

2. MYOB (MYO AU): Shareholders Are Caught Between a Rock and a Hard Place

On 24 December, MYOB Group Ltd (MYO AU) announced that it entered into a scheme implementation agreement under which KKR will acquire MYOB at $3.40 per share, which is 10% lower than 2 November offer price of A$3.77. MYOB claims its decision to recommend KKR’s lower offer was based on current market uncertainty, long-term nature of its strategic growth plans and the go-shop provisions of the deal.

We believe that KKR’s revised offer is opportunistic, but MYOB’s shareholders are caught between a rock and a hard place. Shareholders can take a short-term view and grudgingly accept the revised offer. Alternatively, shareholders can take a long-term view by rejecting the offer and hope MYOB’s strategic growth plans and a market recovery can reverse the inevitable share price collapse.

3. Infosys Ltd (INFO IN): Another Buyback Coming? Not a Bad Idea, but How Much It Can Really Help?

As per reports, Infosys Ltd (INFO IN) may consider a proposal for a share buyback of $1.60 billion very soon. The buyback announcement is likely to be made on January 11 when the company board meets to consider the 3Q FY19 results. Before this, in November 2017, Infosys Ltd (INFO IN) had announced a buyback and spent Rs130 bn to buy a total of 113mn equity shares. This fresh buyback could be an important development and could be an important support for the stock, it is also sensible for other reasons.

There are no major acquisitions in recent times by Infosys Ltd (INFO IN) and if this is likely to be the trend for near future, share buyback is not a bad idea. The company is still struggling with some of the legacy issues and the priority as of now is to streamline the organic growth. We think Infosys Ltd (INFO IN) is also cautious with inorganic growth opportunities as the company had serious issues with acquisitions in the past. What could be another key driver behind this is that in valuation terms, Infosys Ltd (INFO IN) is not very expensive.

4. SoftBank Corp (9434 JP) & Arteria Networks (4423 JP): A Tale of Two IPOs

During the second half of December 2018, Japan saw two telecom companies list on the Tokyo Stock Exchange: Softbank Corp (9434 JP) and ARTERIA Networks (4423 JP). After years of industry consolidation, which saw several stocks delist, this felt like a Christmas miracle (at least for those watching the sector’s stocks).

It would be hard to find two companies in the same industry that are so different – both in their business models as well as in how their IPOs were positioned to investors. One stock is 100 times larger than the other, but this is not a story of David and Goliath. It is two unique stories in parallel.

While each company took a very different approach to selling its stock, both have suffered from the subsequent broader market weakness, irrespective of company specifics. We can’t say it has been the worst of times, but it certainly has been a tough time with SoftBank Corp down 13% and Arteria down 20% from their IPO prices.

In this Insight we explore how each company approached its IPO and how each has fared since.

5. MYOB Caves And Agrees To KKR’s Reduced Offer

It could have gone either way.

After securing a 19.9% stake from Bain in early October and initially pitching A$3.70/share, in a textbook bear hug, KKR (marginally) bumped its indicative offer to A$3.77/share to a get a look under the hood, then following seven weeks of due diligence, backtracked with a lower price of A$3.40/share, citing adverse market conditions.

MYOB Board’s response last week to the reduced offer was to inform KKR that it is not in a position to recommend the revised proposal, however, “it remains in discussions with KKR regarding its proposal”, leaving the door open for ongoing negotiations. KKR for its part, said there were no landmines following the DD process. The price action last Friday suggested the outcome was a coin toss.

Today, KKR and MYOB entered into Scheme Implementation Agreement (SIA) at $3.40/share, valuing MYOB, on a market cap basis, at A$2bn. MYOB’s board unanimously recommends shareholders to vote in favour of the Offer, in the absence of a superior proposal and subject to an independent expert concluding the Offer is in the best interest of shareholders. The Offer price assumes no full-year dividend is paid.

The agreement provides a “go shop” provision until the 22 February 2019 – when MYOB is expected to release its FY18 results – to solicit competing proposals.

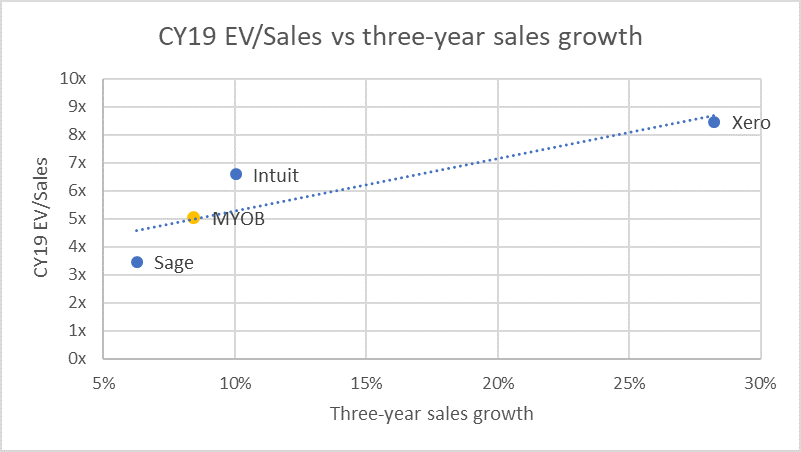

The Offer appears reasonable when compared to peers and with regards to the 14% decline in the ASX technology index; but conversely, could be construed as being opportunistic.

A Scheme Booklet is expected to be dispatched mid-March with an estimated implementation date of 3 May. Currently trading at a 3.8%/11% gross/annualised spread. 1 January makes a new year and there will be investors who would want to take an agreed deal at 11%.