In this briefing:

- Dreamtech IPO: Valuation Analysis

- Global Solar Energy Stocks Are Bottoming

- Korea M&A Spotlight: LGUplus to Acquire CJ Hellovision: What’s Next for Tbroad and D’Live?

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

- Recruit Holdings Reports Strong 3Q Results; Remains Expensive

1. Dreamtech IPO: Valuation Analysis

- The bookbuilding of the Dreamtech Co Ltd (192650 KS) IPO will start in about 6 business days. This report provides a valuation analysis of this company. Dreamtech makes modules and sensors for smartphones, auto vehicles, home appliances, and health care products. In late January 2019, the company reduced the IPO price range to 11,000 won to 13,000 won (from 13,400 won to 16,700 won previously).

- The comps have better sales growth, net margin, and net profit growth than the company. However, Dreamtech has slightly better ROE and balance sheet strength than the comps. Therefore, we believe it is appropriate to put a 10-20% discount on the comps’ average P/E valuation of 17.6x in 2017 and 2018.

- Our base case valuation of the company is 13,961 won, which is only 7% higher than the high end of the IPO price range (13,000 won). Thus, given the lack of enough upside, we would avoid this deal. However, if the deal is priced at the low end of the IPO price range (11,000 won), it could potentially be attractive. Our base case valuation is based on 15x P/E, which is a 15% discount to the average P/E multiples of its peers in 2017 and 2018. We also used net profit of 29.1 billion won, which is the average estimated net profit of the company in 2017 and 2018.

2. Global Solar Energy Stocks Are Bottoming

In today’s report we highlight the following actionable solar energy names: First Solar (FSLR), SolarEdge Technologies (SEDG), GCL-Poly Energy (3800-HK), Meyer Burger Technology AG (MBTN-CH), Enphase Energy (ENPH), JinkoSolar Sponsored ADR (JKS), TerraForm Power (TERP), Beijing Enterprises Clean Energy Group (1250-HK), GCL New Energy (451-HK), and Viatron Technologies (141000-KR).

3. Korea M&A Spotlight: LGUplus to Acquire CJ Hellovision: What’s Next for Tbroad and D’Live?

- It was finally announced today that LG Uplus Corp (032640 KS) will acquire a 50 percent + one share in Cj Hellovision (037560 KS) for 800 billion won.

- LG Uplus’ acquisition of CJ Hellovision is likely to further accelerate the consolidation of the Korean cable TV/media sector. KT Corp (030200 KS) is now likely to aggressively try to acquire D’Live cable company. SK Telecom (017670 KS) has shown some interests in acquiring Tbroad cable company.

- Potential M&A Valuation Price for Tbroad- If we assume our base case EV/EBITDA valuation multiple to be 5.5x for Tbroad and assume annualized EBITDA of 181.8 billion won in 2018, this would suggest an implied EV of 1.0 trillion won. After adjusting for net cash, the implied market cap would be 1.2 trillion won for Tbroad. Thus, if Taekwang Industrial decides to sell just over 50% stake in Tbroad, this could potentially be worth about 600 billion won. Taekwang Industrial currently has a market cap of 1.7 trillion won so its stake (53.9% stake in Tbroad) could be nearly 35% the value of its entire market cap.

- The long battle to acquire CJ Hellovision has been completed (with the final stamp of approval from FTC). This move should help to consolidate the cable TV industry with SK Telecom and KT potentially battling out for either Tbroad or D’Live. In the midst of these uncertainties, there could be some further positive momentum for Taekwang Industrial (003240 KS), the majority owner of Tbroad.

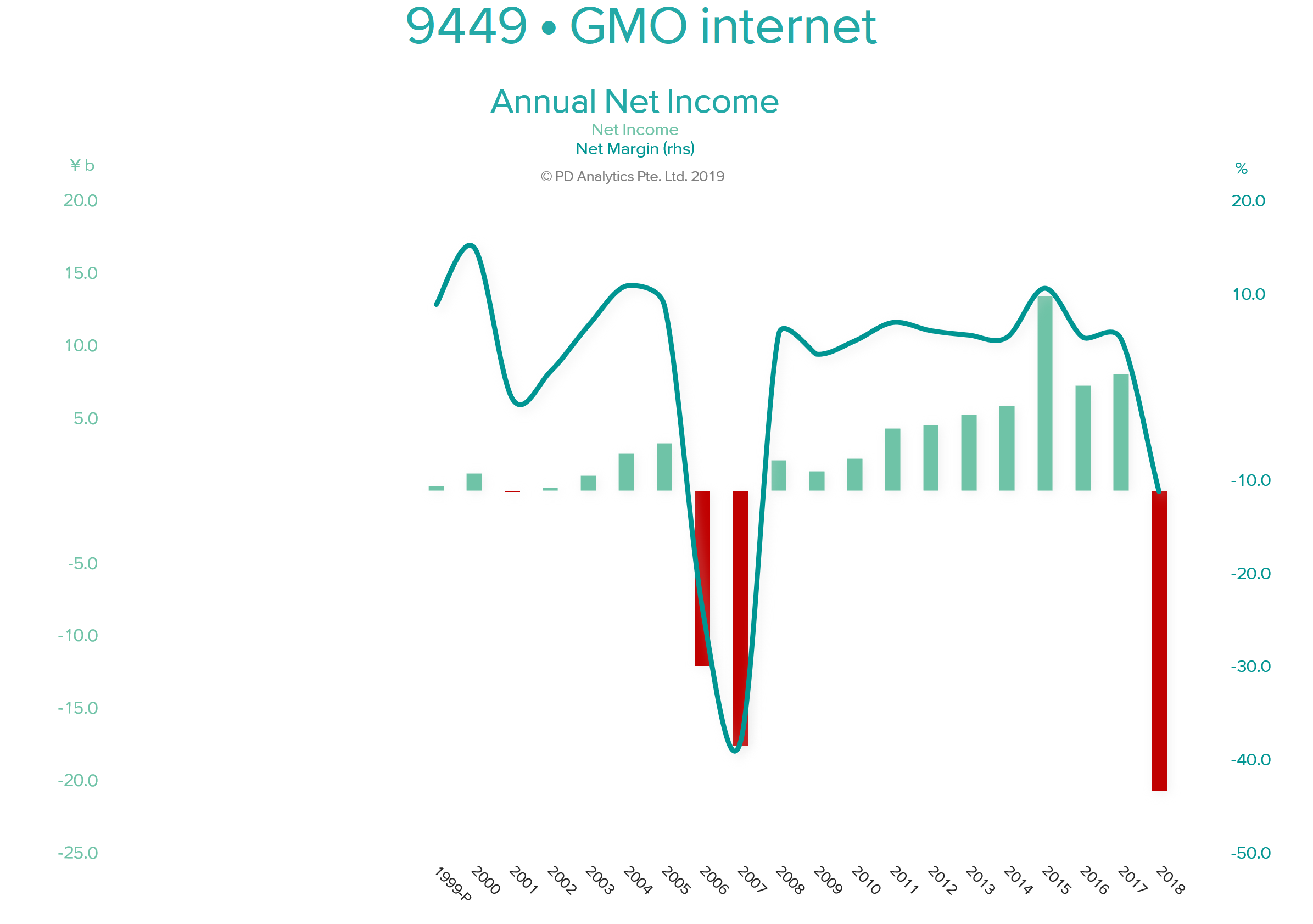

4. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

5. Recruit Holdings Reports Strong 3Q Results; Remains Expensive

Recruit Holdings (6098 JP) reported its 3Q FY03/19 financial results on Wednesday (13th February). Recruit’s revenue and EBITDA were up 6.0% YoY and 11.1% YoY respectively in 3Q FY03/19. This was mostly due to 1) consolidation of the results of Glassdoor Inc. (the company which operates the employment information website glassdoor.com), 2) steady growth in Japanese staffing operations and 3) growth in beauty and real estate app users during the quarter, partially offset by slowdown in global recruitment activity.

Despite its strong 3Q results and steady topline and bottom line growth over the forecast period, at a FY2 EV/EBITDA multiple of 16.0x, Recruit doesn’t look particularly attractive to us. Recruit’s internet advertising business and employment business peers, Yahoo Japan (4689 JP) and Persol Holdings (2181 JP) are trading at FY2 EV/EBITDAs of 6.8x and 7.5x respectively.

| FY03/18 | FY03/19E | FY03/20E |

Consolidated Revenue (JPYbn) | 2,171 | 2,327 | 2,478 |

YoY Growth % | 11.9% | 7.2% | 6.5% |

Consolidated EBITDA (JPYbn) | 258 | 288 | 312 |

EBITDA Margin % | 11.9% | 12.4% | 12.6% |

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.