In this briefing:

- Micron’s Guidance Bombshell Signals Troubled Times Ahead For Beleaguered Semiconductor Segment

- Overview of My Winners and Losers in 2018…and 5 High Conviction Ideas Going into 2019

- Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

- Singapore REIT – 4 Investment Themes for the S-REIT Sector in 2019

- Global Banks – DBS Frail Against Global Peers

1. Micron’s Guidance Bombshell Signals Troubled Times Ahead For Beleaguered Semiconductor Segment

After months of skirting around inventory build-up and a weakening demand outlook, Micron used their latest earnings report to call closing time on a revenue and profitability party that began in Q4 2016 and just got better and better with each passing quarter.

Micron reported Q1 FY2019 results on December 18’th and while revenues were largely in line with recently lowered guidance from the company, their outlook for both Q2 and 2019 as a whole was worse than even the most bearish of expectations.

Citing high inventory levels at key customers, Micron guided Q2 FY2019 revenues for $6 billion at the midpoint, down a staggering $1.9 billion, 24% QoQ and 18% YoY. At the same time, Micron revised down their CY2019 bit demand growth forecast for both DRAM (from 20% to 16%) and NAND (35%, the bottom of the previously forecasted range). The company plans to adjust both CapEx and bit supply output downwards to match.

In the wake of their guidance bombshell, Micron’s share price closed down almost 8% the following day to end the session at $31.41, a level last seen in August 2017. Micron is unique in reporting out of sync with its industry peers, making it the proverbial canary in a coal mine. The company’s gloomy outlook and clarion call for further CapEx reductions in a bid to rebalance supply and demand spells troubled times ahead for an already beleaguered semiconductor segment ahead of the upcoming earnings season.

2. Overview of My Winners and Losers in 2018…and 5 High Conviction Ideas Going into 2019

In a follow up to my note from last year Overview of My Winners and Losers in 2017…and 5 High Conviction Ideas Going into 2018 I again look at my stock ideas that have worked out in 2018, those that have not and those where the verdict is still pending.

Last year I provided 5 high conviction ideas and here is their performance in a brutal year for Asian Stock Markets:

Company | Share Price 27 Dec 2017 | Share Price 20 December 2018 | Dividends | % Total Return |

0.70 HKD | 0.88 HKD | 0.01 HKD | +27% | |

0.20 SGD | 0.27 SGD | 0.0 SGD | +35% | |

2.39 HKD | 2.82 HKD | 0.147 HKD | +24% | |

0.84 SGD | 0.85 SGD | 0.02 SGD | +3.5% | |

1.44 MYR | 0.32 MYR | 0.0 MYR | -79% |

4 out of 5 had a positive performance.

Below I will make a new attempt to provide five high conviction ideas going into 2019.

3. Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

- We’ve reviewed 10 companies in the sector. Of those, three are the consensus favorites of our Tokyo based panel of industry, financial and economics observers of the IR initiative over many years.

- Based on pachinko alone, the stocks of these companies are fully valued. Based on potential tailwind from a license award within 6 months, they could be vastly undervalued.

- Each of the three noted here brings strength to a bid less based on financials than corporate focus, outlook and experience in the field.

4. Singapore REIT – 4 Investment Themes for the S-REIT Sector in 2019

Singapore real estate investment trusts (“S-REITs”) have been one of the best performing sectors on the Singapore stock market in 2018. In view of the surge in selling activities by institutional investors this year, the resilience of the S-REIT sector came as a pleasant surprise to investors. Fundamentals of the S-REIT sector remain strong.

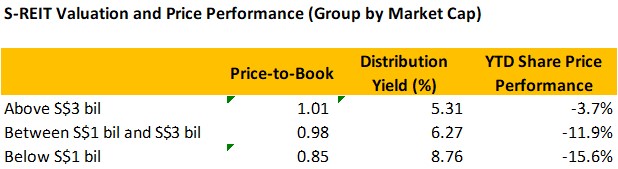

The bigger S-REITs continue to perform well, trading close to their book values and at low yields. The small-cap S-REITs (market capitalization below S$1 bil) tends to be worst performers. Whilst valuation may seem attractive, the low valuations are usually attributable to the additional risk premiums that investors require to compensate for the lack of scale, diversification and growth opportunities as well as the poor track record of some of these S-REITs.

In the coming year 2019, there are 4 investment themes for the S-REIT sector and below are ideas for investors to position their S-REITs portfolio for these themes:

Theme 1: “Safe-haven” asset class for investors

Theme 2: Merger and Acquisition

Theme 3: Growing Overseas Asset Exposure

Theme 4: The Rise of Alternative Property Asset Classes

5. Global Banks – DBS Frail Against Global Peers

Oil prices are now similar to where they were during 2017 when Singapore’s banks faced significant credit quality stresses. This was due to oil service sector lending, where bad loans here have generally not even declined. With a key driver of this sector distress in the past showing radical weakness yet again, the risk is resurgence in credit costs at Singapore banks during 4Q18. At the same time, global banks are telling a story. It is one not of a robust global economy, but one that is weakening. We have written at length about our concerns of rising rates due to policy rather than real demand, and it remains core to our global bank view. Perhaps Canada’s weak inflation rate – coming below target – is just another global example in addition to countries in Europe and UK, that underlying demand is simply not that robust?