In this briefing:

- *TW3/North Asia* That Was The Week That Was 🇰🇷 🇯🇵 11th-17th February 2019 @Smartkarma

- Rakuten to Covertly Cut Merchant Commission Rates?

- Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched

- ZOZO: The Kingmaker Abandons His King

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

1. *TW3/North Asia* That Was The Week That Was 🇰🇷 🇯🇵 11th-17th February 2019 @Smartkarma

TW3 NORTH ASIA – This was a busy week for the North Asian team on Smartkarma. with 967 results announcements and 577 forecasts revisions in Japan and plenty of corporate activity in Korea including LG Uplus/CJ Hello. As is our wont here, we also had a number of providers take opposite sides on a number of issues (e.g. GMO Internet (9449 JP)).

Our Top 3 Insights of the week are Pelham Smithers Associates – SoftBank: Does Nvidia Show It Overpaid for ARM?, Douglas Kim‘s A Surprising Finding of Outperformance & Quarterly Earnings Conference Call Recording in Korea, and Michael Causton ‘s ZOZO: The Kingmaker Abandons His King

The format is a little different this week with Insights grouped by vertical and split between Bullish and Bearish with no country separation. Any feedback for further improvements is always welcome!

EVENT DRIVEN: BULLISH

Softbank Buyback More Than It Appears To Be

Poongsan Holdings Stub Trade: Current Status & Trade Approach

Stake in Quadric.io Denso Attempts to Keep Chip Makers Close

KDDI Tender Offer for Kabu.com (8703 JP) Decided

Nongshim Holdco/Sub Trade: Current Status & Trade Approach

LG Uplus/CJ Hello – CJH Overhang Concerns Will Push It Up

EVENT DRIVEN: BEARISH

LG Uplus – CJ Hello Acquisition: Current Status & Trade Approach

SoftBank: Does Nvidia Show It Overpaid for ARM?

LG Uplus to Acquire CJ Hellovision: What’s Next for Tbroad and D’Live?

Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched

Doosan Heavy & Doosan E&C Rights Offers: Assessment & Estimation

IPOs & PLACEMENTS: BULLISH

Ecopro BM IPO: Valuation Analysis

Nomura Real Estate Master Fund Placement

IPOs & PLACEMENTS: BEARISH

Daiwa House REIT Placement – Well-Flagged but Barely Accretive to DPU

Dreamtech IPO: Valuation Analysis

EQUITY BOTTOM UP: BULLISH

A War Between Netflix & Disney = $$$ for Studio Dragon

Sony: Mispriced, Misunderstood, or Both?

Parco: 4 New Shopping Centres This Year, 28% Rise in Revenue in 5 Years

Hana Financial: Hand It to Hana

EQUITY BOTTOM UP: BEARISH

Tokyo Kiraboshi Financial Group (7173 JP): Red Dwarf

ZOZO: The Kingmaker Abandons His King

Rakuten to Covertly Cut Merchant Commission Rates?

RESULTS COMMENTARY: BULLISH

Shimadzu (7701 JP): 3Q Results Suggest a Trading Range

NCsoft: Major Highlights of 4Q18 Earnings Conference Call

Tsubakimoto Chain Co (6371 JP) Double-Digit Growth Continues

NTT Corp: The Rising Dividend Story Is Playing Out

Fujimi (5384 JP): Silicon Slow, HDD & Industrial Down in 3Q

GMO Internet Reports Solid FY12/18 Despite Heavy Crypto Losses

RESULTS COMMENTARY: BEARISH

Shiseido: 2018 Results – Setting Expectations Too High

Concordia Financial Group (7186 JP): Out of Focus

Olympus: 3QFY03/19 Profits Decline on Litigation-Related Costs

Monex Group (8698 JP): Upside Unlikely on Weak Cryptocurrencies

Robotics: Nabtesco & HDS Results Strong; Still No Reason to Own Fanuc

Recruit Holdings Reports Strong 3Q Results; Remains Expensive

GMO internet FY2018 Results – The Shareholder’s [Re]Turn

THEMATIC & STRATEGY: BEARISH

Stock Outperformance & Earnings Conference Call Recording in Korea

MACRO: BEARISH

No Upside For Korean Companies – Underweight

TECHNICAL: BULLISH

Korea Circuit Long Support for Press Above Overhead Barriers

Fanuc Bullish Trade Points off of Base Line Support

TECHNICAL: BEARISH

2. Rakuten to Covertly Cut Merchant Commission Rates?

Rakuten (4755 JP) has been under pressure recently from Amazon (AMZN US) and other competitors in its core online mall business and now seems to be giving more attention once again to the original Rakuten Ichiba, including a plan to cut shipping fees, although this also looks like a face-saving way to cut merchant commissions.

Rakuten is also investing in new logistics infrastructure to try and match the customer services levels of Amazon and ZOZO (3092 JP).

As part of this effort, Rakuten just announced a 9.9% stake in a logistics firm called Kantsu. The deal is part of Rakuten’s strategy to accelerate the move towards consolidated shipments of orders on Rakuten Ichiba – one of the key weaknesses of the Rakuten model compared to Amazon and Zozo.

Rakuten also just announced its year-end results this week: Domestic GMVs rose 11.2% to ¥3.4 trillion for the year ending December 2018. While GMVs rose and revenue increased by 9.2% to ¥426 billion, operating income on domestic e-commerce fell 17.7% to ¥61.3 billion partly due to higher logistics costs. For 4Q2018, operating income fell 27.3%.

3. Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched

Three months ago, Minebea Mitsumi (6479 JP) announced that it would launch a Tender Offer for U Shin Ltd (6985 JP) and it would take just under three months until the approvals were received and it could officially start the Tender Offer process. It took a couple of weeks longer, as proposed by U Shin’s update on 30 January, which indicated anti-trust approvals had been received.

The background to the Tender Offer was discussed in Minebea Mitsumi Launches Offer for U-SHIN in early November.

My first conclusion in November was that this was the “riskiest” straight-out non-hostile TOB I had seen in a while.

This is a wide-open deal. The buyer owns 1 round lot. The largest holder is an activist. The deal is being proposed at not such a super-high multiple (8x forecast FY earnings for the year ending 31 December 2018) and 4.9x EV/EBITDA. It is 3.7-4.0x when taking into account the 67 different equity positions they held at the end of last year, some of which they have recently liquidated.

from (8 Nov 2018) Minebea Mitsumi Launches Offer for U-SHIN

In the interim, the activist dropped their position in half (necessitating a filing of a Large Shareholder Report for going below 5% – and they may have completely liquidated by now), and an investment bank has gone above 5% since then.

The financial advisory “valuations” at the time were more than questionable. A discussion of the valuation levels can be found in the previous insight (I don’t need to repeat them here, just go there).

Today, the company raised its OP and Ordinary Income forecasts for the year ended 31 December 2018, but lowered its Net Income forecast by 98.8% due to writeoffs at many overseas facilities. Then the promptly reported earnings (also only in Japanese) a few seconds later (only available in Japanese).

Op is now forecast to drop 2% in 2019 vs 2018, but the 2019 forecast is 11+% higher than the 2018 forecast was just yesterday. The forecast for Net Income is ¥99.35/share, putting the deal at <10x forecast PER. And even less if one considers that the cross-shareholdings could be reduced.

The New News

Today Minebea Mitsumi announced the launch of its Tender Offer, to commence tomorrow, at the same price as originally planned (¥985/share), and to run for 38 days.

This deal is still perplexing to me. It’s easy enough from an industrial standpoint. I mean, why not buy relatively cheap assets then see if you can cross-sell or assume some attrition. But for investors… I wonder why they put up with this.

4. ZOZO: The Kingmaker Abandons His King

United Arrows’ (7606 JP) decision to cancel its e-commerce services contract with ZOZO Inc (3092 JP) was not a surprise at all but could not have come at a worse time. While a move to direct operation of its online store was expected, United Arrows did not have to choose a moment when Zozo’s stock was collapsing. That it did shows how much cooler relations are between the two firms, a critical development given United Arrows was the principal reason for Zozo’s emergence as the leading fashion mall in the early 2000s.

United Arrows will still be selling through Zozotown and its president last week praised Zozotown’s capacity to bring new and younger customers to its brand. The bigger problem is that United Arrows relies less and less on sales from Zozotown each year and more from its own online store – direct e-commerce sales have increased from 20% of all e-commerce sales in FY2016 to 27% in 9M2018.

At Baycrews, another leading merchant on Zozotown, 50% of e-commerce sales are from its own online store, up 12 percentage points in two years.

A further problem is that other merchants are leaving. We reported before that Onward’s departure, while significant, is less of a threat than it might first appear given that Onward already garners 70-75% of sales from its own store so it did not cost much to leave Zozo.

However, another big retailer, Right On, also quit Zozo last month despite the fact that more than 50% of its online sales come from Zozo and it has intermittently been one of the top 20 merchants on Zozo. Right On has struggled in recent years, so leaving Zozo cannot have been an easy decision, suggesting just how seriously upset it was.

Other merchants are likely to view these departures with some concern. Six months ago, the idea of quitting Zozo was not even a remote thought in Japan’s fashion industry but it is now a lively subject of discussion. While most merchants will stay, the recent high profile departures will make a threat to leave look much more real, giving merchants more leverage to negotiate, particularly on Zozo’s take rates.

5. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

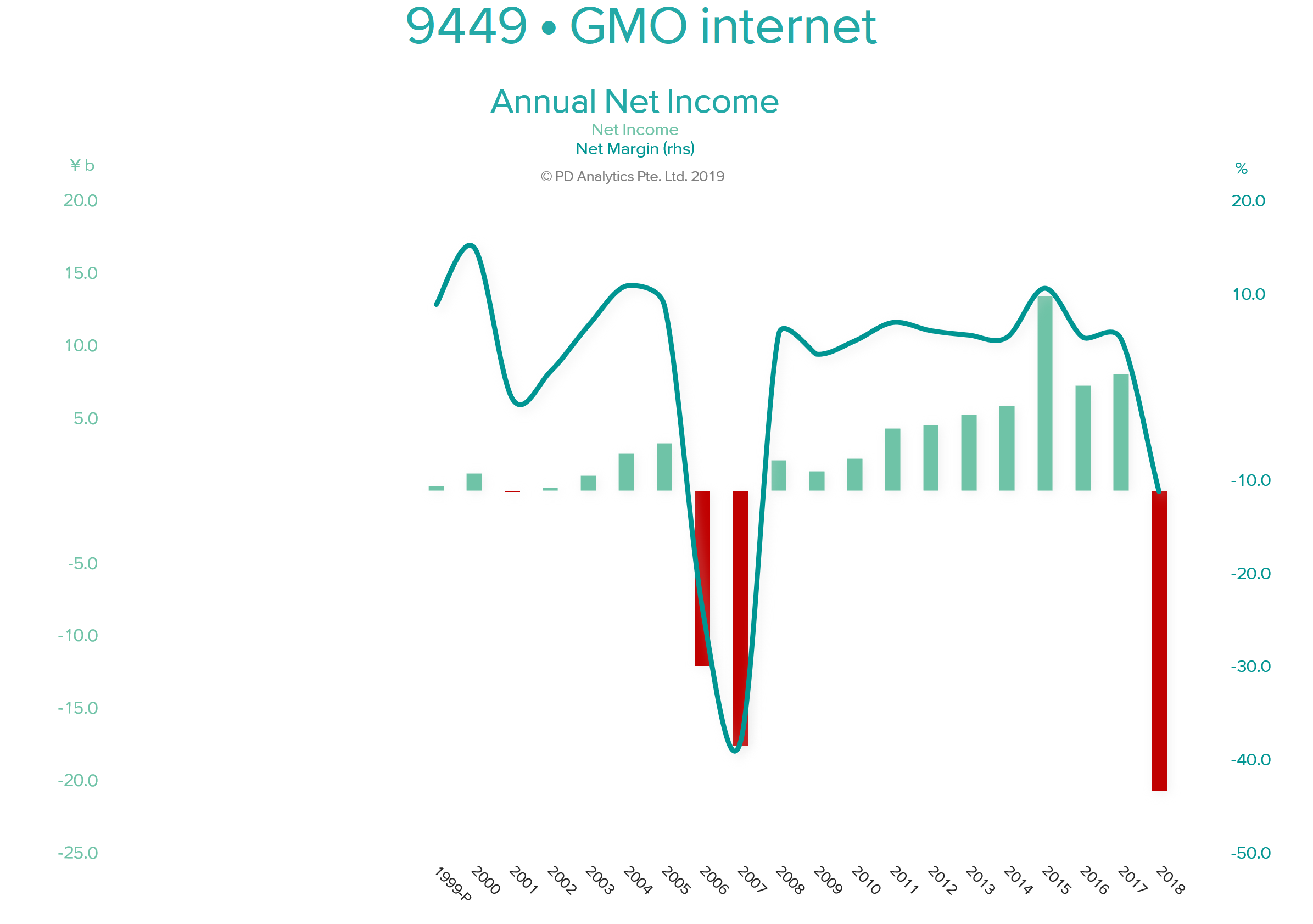

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.