In this briefing:

- Olympus Corporation (7733 JP): Overvalued with Too Many Controversies

- Growing MVNO Market Share in Japan Looks Positive for Evolving Entrants like Rakuten (4755 JP)

- The GER Weekly EVENTS Wrap: Pinduoduo, Softbank, Healthscope, M1, and Near-Term M&A Catalysts

- Subaru: Continuing Quality Issues and Employee Suicide Point to Sustainability Issues

- Japan: Moving Average Outliers – Tech[nical] Rebound

1. Olympus Corporation (7733 JP): Overvalued with Too Many Controversies

Olympus Corporation is currently trading at JPY4,525 per share which we believe is overvalued based on our EV/EBIT valuation. The company generates nearly 80.0% of its revenue from its Medical Business where it is the global market leader for gastrointestinal endoscopes. Despite Olympus’ market share and technology leadership, the segment has been hit by investigations related to its duodenoscopies and has been fined for violating safety regulations. In addition, the Medical Division is also subject to several bribery-related investigations by the US Department of Justice and could risk losing its market share if the allegations are proven given the industry is highly competitive. Meanwhile its Imaging Business which offers cameras and lenses, is operating in a contracting market, where the segment continues to see declining revenues and is loss making.

To add to all of the above, the company is under scrutiny for governance-related issues such as lack of board diversity as well as poor corporate culture. On the positive side, the management has announced a plan to transform its business, including appointing three new (non-Japanese) directors to its board, all due to the pressure from its largest shareholder ValueAct Capital. The Management has mentioned that they will be proposing one of the partners of ValueAct as one of the three new directors at its shareholder meeting in April 2019, which is encouraging. However, that being said, we are yet to witness any tangible improvement in the way the company has conducted itself since the exposure of its accounting fraud in 2011 and has not been able to stay free of controversy. Hence, in our opinion the hefty premium at which the shares are currently trading is not justified suggesting to us that the potential turnaround in governance quality is being priced in too fully at this point. It is uncertain what other skeletons may be in Olympus’ closets and it seems premature to afford the stock a premium valuation.

2. Growing MVNO Market Share in Japan Looks Positive for Evolving Entrants like Rakuten (4755 JP)

In the latest data, MVNOs (mobile virtual network operators) have reached 7.0% market share of Japan’s main 3G and LTE (4G) services with over 12m subscribers.

Government support remains robust for the MVNOs. Mr. Suga, the Chief Cabinet Secretary, has suggested that MVNOs, in all forms, should expand to 50% of the market in the future.

As Rakuten (4755 JP) prepares for its full MNO (mobile network operator) service launch later this year, the Rakuten MVNO services continues to execute well, taking market share and building a formidable foundation of subscribers. Rakuten is now Japan’s largest MVNO by customer numbers. We expect Rakuten will struggle to make a reasonable return on its MNO on a standalone basis, but it may strengthen the company’s overall ecosystem and create enough synergies to add positive value to the group.

3. The GER Weekly EVENTS Wrap: Pinduoduo, Softbank, Healthscope, M1, and Near-Term M&A Catalysts

In this version of the GER weekly events wrap, we assess the recent lock-up expiry for Pinduoduo (PDD US) which may have led to a short squeeze. Secondly, we assess the debt tender for Softbank Group (9984 JP) which may be supporting the equity. Finally, we provide updates on bids for M1 Ltd (M1 SP) and Healthscope Ltd (HSO AU) as well as update a list of upcoming M&A and equity bottom-up catalysts.

The rest of our event-driven research can be found below.

Best of luck for the new week – Rickin, Venkat and Arun

4. Subaru: Continuing Quality Issues and Employee Suicide Point to Sustainability Issues

Our thesis on Subaru has maintained for some time that margins were inflated due to under-spending and that these costs would surface in one form or the other over time.

As it turns out, the costs were incurred through recalls as Subaru downgraded its FY OP guidance from ¥300bn to ¥220bn on 5 Nov. What continues to concern us is the constant stream of negative news flow on quality and sustainability-related issues. While the latest announcements do not imply excessive direct costs for the company, they continue to raise the question of whether corners were being cut and thus create doubt about the formerly excellent and still very high OPMs generated by Subaru.

We remain negative on Subaru as we expect margins to remain under pressure and believe top line may stagnate or shrink over the next one to two years.

5. Japan: Moving Average Outliers – Tech[nical] Rebound

– MARKET COMPOSITE –

SLOW & STEADY RECOVERY – From December 25th’s lows of 8% by number and 11% by value, the percentages of Japanese stocks above the weighted sum of moving averages have continued to recover to now 19% by number and 26% by value. Total Market Value has now risen by 11.2% from the Christmas Day low and is overdue a ‘breather’.

– SECTORS –

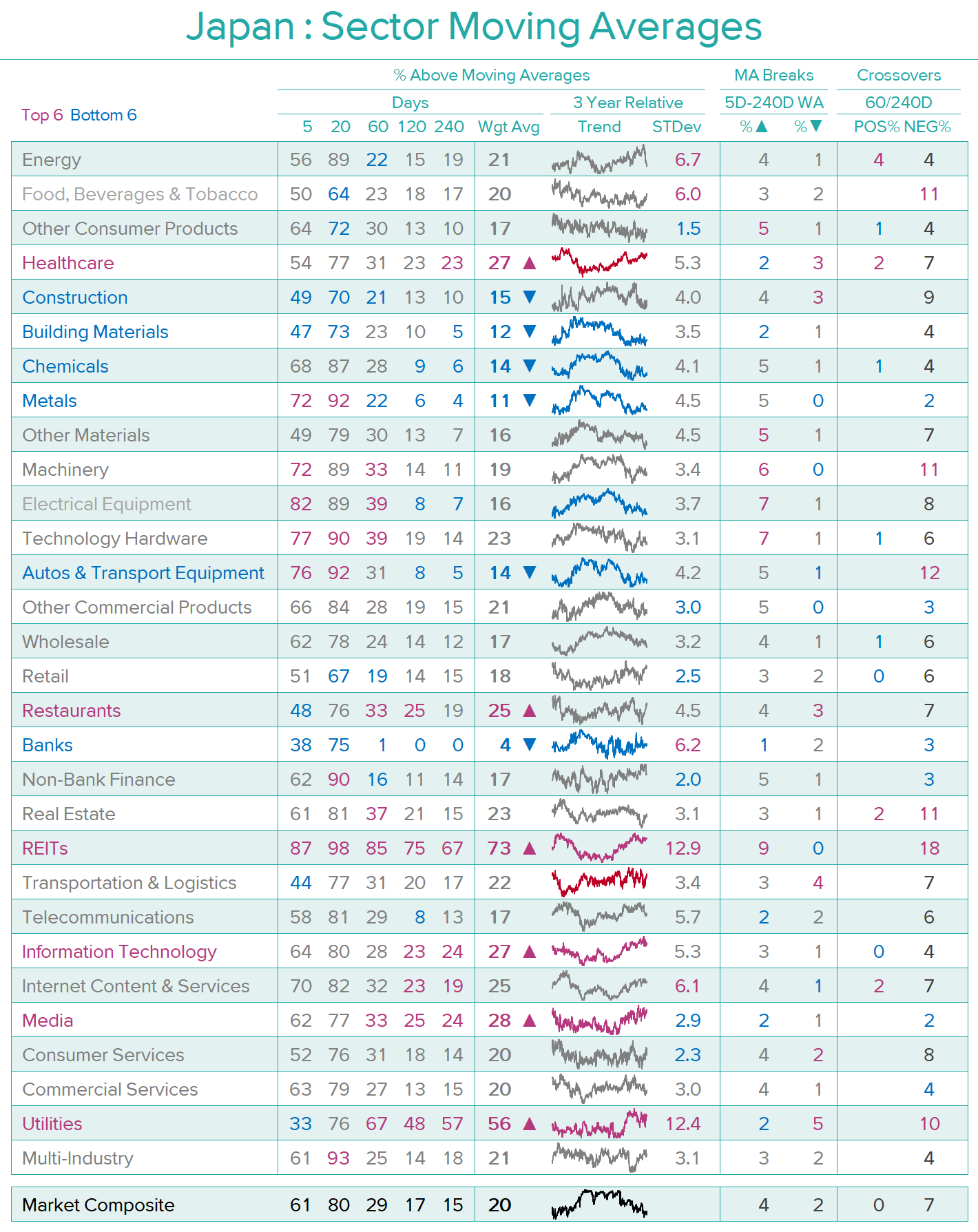

SECTOR BREAKDOWN – The top six sectors measured by their percentage above the weighted average of 5-240 Days remain domestic and defensive. REITs, Information Technology, Media, Healthcare and Utilities continue from our previous review with Restaurants replacing Transportation. Equally predictable is the bottom half-dozen – Banks, Autos, Metals, Building Materials, and Chemicals remain from two weeks ago, with Construction replacing Autos.

– COMPANIES –

Source: Japan Analytics

COMPANY MOVING AVERAGE OUTLIERS – As with the Market Composite and Sectors, the Moving Average Outlier indicator uses a weighted sum of each company’s share price relative to its 5-day, 20-day, 60-day, 120-day and 240-day moving averages. ‘Extreme’ values are weighted sums greater than 100% and less than -100%. We would caution that this indicator is best used for timing shorter-term reversals and, in many cases, higher highs and lower lows will be seen.

In the DETAIL section below, we highlight the current top and bottom twenty-five larger capitalisation outliers, as well as those companies that have seen the most significant positive and negative changes in their outlier percentage in the last two weeks and provide short comments on companies of particular note. UUUM (3990 JP) is currently the most ‘extreme’ positive outlier, and Welcia (3141 JP) the most ‘extreme’ negative outlier

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.