In this briefing:

- Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched

- ZOZO: The Kingmaker Abandons His King

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

- Recruit Holdings Reports Strong 3Q Results; Remains Expensive

- Daiwa House REIT Placement – Well-Flagged but Barely Accretive to DPU

1. Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched

Three months ago, Minebea Mitsumi (6479 JP) announced that it would launch a Tender Offer for U Shin Ltd (6985 JP) and it would take just under three months until the approvals were received and it could officially start the Tender Offer process. It took a couple of weeks longer, as proposed by U Shin’s update on 30 January, which indicated anti-trust approvals had been received.

The background to the Tender Offer was discussed in Minebea Mitsumi Launches Offer for U-SHIN in early November.

My first conclusion in November was that this was the “riskiest” straight-out non-hostile TOB I had seen in a while.

This is a wide-open deal. The buyer owns 1 round lot. The largest holder is an activist. The deal is being proposed at not such a super-high multiple (8x forecast FY earnings for the year ending 31 December 2018) and 4.9x EV/EBITDA. It is 3.7-4.0x when taking into account the 67 different equity positions they held at the end of last year, some of which they have recently liquidated.

from (8 Nov 2018) Minebea Mitsumi Launches Offer for U-SHIN

In the interim, the activist dropped their position in half (necessitating a filing of a Large Shareholder Report for going below 5% – and they may have completely liquidated by now), and an investment bank has gone above 5% since then.

The financial advisory “valuations” at the time were more than questionable. A discussion of the valuation levels can be found in the previous insight (I don’t need to repeat them here, just go there).

Today, the company raised its OP and Ordinary Income forecasts for the year ended 31 December 2018, but lowered its Net Income forecast by 98.8% due to writeoffs at many overseas facilities. Then the promptly reported earnings (also only in Japanese) a few seconds later (only available in Japanese).

Op is now forecast to drop 2% in 2019 vs 2018, but the 2019 forecast is 11+% higher than the 2018 forecast was just yesterday. The forecast for Net Income is ¥99.35/share, putting the deal at <10x forecast PER. And even less if one considers that the cross-shareholdings could be reduced.

The New News

Today Minebea Mitsumi announced the launch of its Tender Offer, to commence tomorrow, at the same price as originally planned (¥985/share), and to run for 38 days.

This deal is still perplexing to me. It’s easy enough from an industrial standpoint. I mean, why not buy relatively cheap assets then see if you can cross-sell or assume some attrition. But for investors… I wonder why they put up with this.

2. ZOZO: The Kingmaker Abandons His King

United Arrows’ (7606 JP) decision to cancel its e-commerce services contract with ZOZO Inc (3092 JP) was not a surprise at all but could not have come at a worse time. While a move to direct operation of its online store was expected, United Arrows did not have to choose a moment when Zozo’s stock was collapsing. That it did shows how much cooler relations are between the two firms, a critical development given United Arrows was the principal reason for Zozo’s emergence as the leading fashion mall in the early 2000s.

United Arrows will still be selling through Zozotown and its president last week praised Zozotown’s capacity to bring new and younger customers to its brand. The bigger problem is that United Arrows relies less and less on sales from Zozotown each year and more from its own online store – direct e-commerce sales have increased from 20% of all e-commerce sales in FY2016 to 27% in 9M2018.

At Baycrews, another leading merchant on Zozotown, 50% of e-commerce sales are from its own online store, up 12 percentage points in two years.

A further problem is that other merchants are leaving. We reported before that Onward’s departure, while significant, is less of a threat than it might first appear given that Onward already garners 70-75% of sales from its own store so it did not cost much to leave Zozo.

However, another big retailer, Right On, also quit Zozo last month despite the fact that more than 50% of its online sales come from Zozo and it has intermittently been one of the top 20 merchants on Zozo. Right On has struggled in recent years, so leaving Zozo cannot have been an easy decision, suggesting just how seriously upset it was.

Other merchants are likely to view these departures with some concern. Six months ago, the idea of quitting Zozo was not even a remote thought in Japan’s fashion industry but it is now a lively subject of discussion. While most merchants will stay, the recent high profile departures will make a threat to leave look much more real, giving merchants more leverage to negotiate, particularly on Zozo’s take rates.

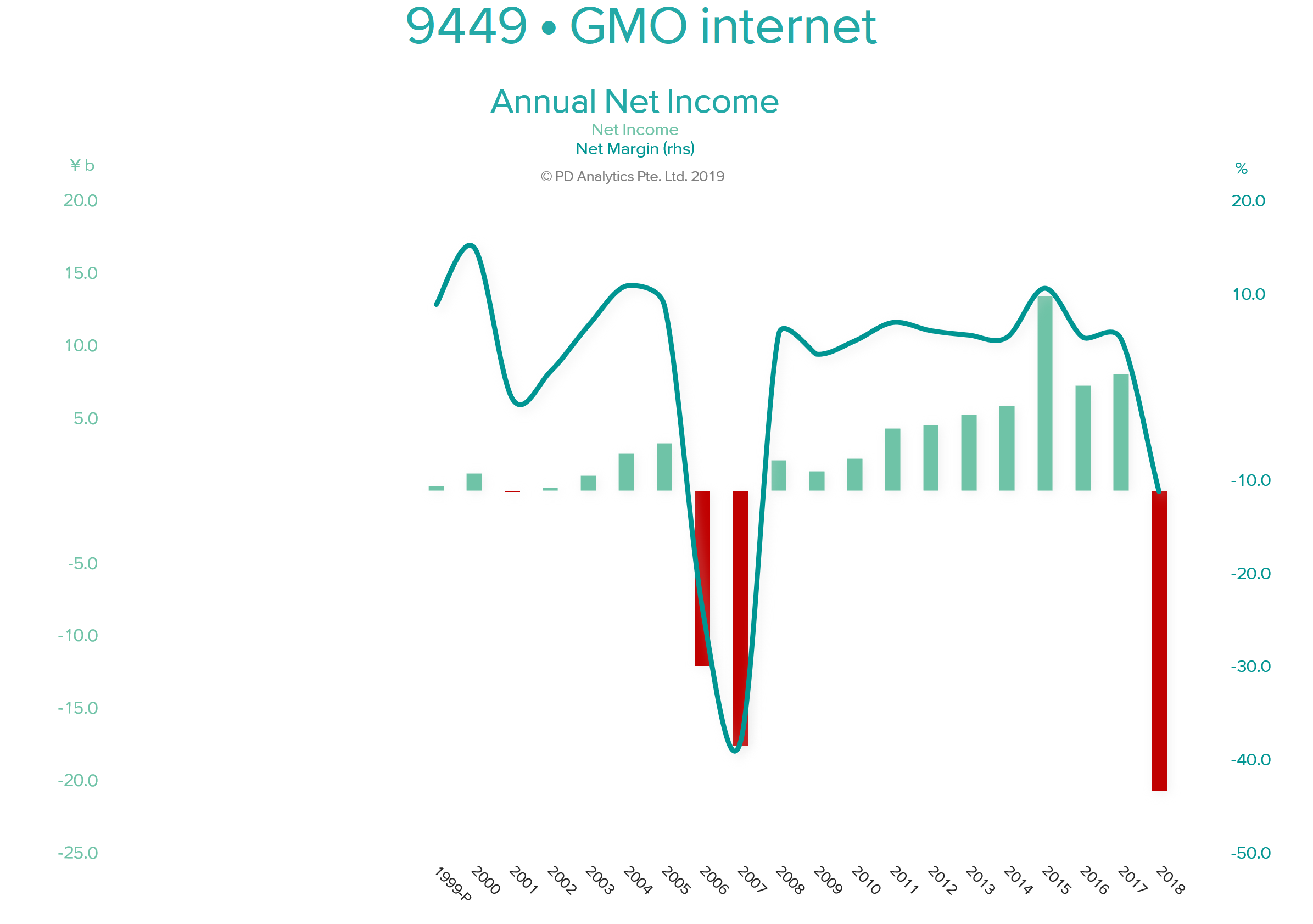

3. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

4. Recruit Holdings Reports Strong 3Q Results; Remains Expensive

Recruit Holdings (6098 JP) reported its 3Q FY03/19 financial results on Wednesday (13th February). Recruit’s revenue and EBITDA were up 6.0% YoY and 11.1% YoY respectively in 3Q FY03/19. This was mostly due to 1) consolidation of the results of Glassdoor Inc. (the company which operates the employment information website glassdoor.com), 2) steady growth in Japanese staffing operations and 3) growth in beauty and real estate app users during the quarter, partially offset by slowdown in global recruitment activity.

Despite its strong 3Q results and steady topline and bottom line growth over the forecast period, at a FY2 EV/EBITDA multiple of 16.0x, Recruit doesn’t look particularly attractive to us. Recruit’s internet advertising business and employment business peers, Yahoo Japan (4689 JP) and Persol Holdings (2181 JP) are trading at FY2 EV/EBITDAs of 6.8x and 7.5x respectively.

| FY03/18 | FY03/19E | FY03/20E |

Consolidated Revenue (JPYbn) | 2,171 | 2,327 | 2,478 |

YoY Growth % | 11.9% | 7.2% | 6.5% |

Consolidated EBITDA (JPYbn) | 258 | 288 | 312 |

EBITDA Margin % | 11.9% | 12.4% | 12.6% |

5. Daiwa House REIT Placement – Well-Flagged but Barely Accretive to DPU

Daiwa House Reit Investment (8984 JP) (DHR) is raising about US$329m in its placement to fund the acquisition of properties.

The deal scores well on our framework owing to strong price and earnings momentum. The assets to be acquired are a good mix of logistics, retail, and hotel.

However, the properties to be acquired mostly have an NOI yield lower than the average NOI yield of DHR’s existing assets in the respective asset classes. Despite increasing the portfolio value by almost 10%, the ten properties are only expected to be 1.37% accretive to DPU.

That said, DHR’s acquisition has been well-flagged as it was highlighted in its September presentation.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.