In this briefing:

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

- Recruit Holdings Reports Strong 3Q Results; Remains Expensive

1. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

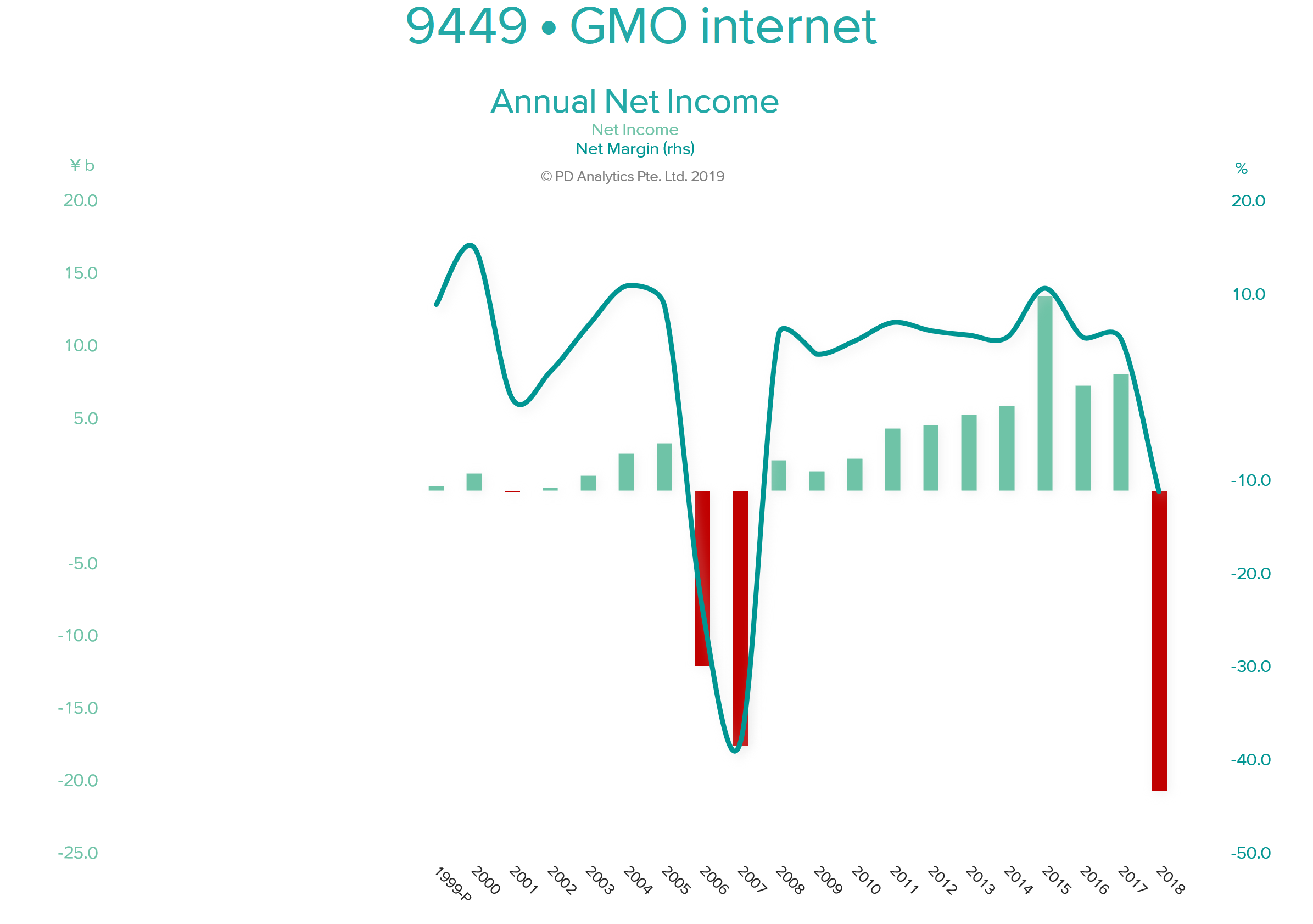

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

2. Recruit Holdings Reports Strong 3Q Results; Remains Expensive

Recruit Holdings (6098 JP) reported its 3Q FY03/19 financial results on Wednesday (13th February). Recruit’s revenue and EBITDA were up 6.0% YoY and 11.1% YoY respectively in 3Q FY03/19. This was mostly due to 1) consolidation of the results of Glassdoor Inc. (the company which operates the employment information website glassdoor.com), 2) steady growth in Japanese staffing operations and 3) growth in beauty and real estate app users during the quarter, partially offset by slowdown in global recruitment activity.

Despite its strong 3Q results and steady topline and bottom line growth over the forecast period, at a FY2 EV/EBITDA multiple of 16.0x, Recruit doesn’t look particularly attractive to us. Recruit’s internet advertising business and employment business peers, Yahoo Japan (4689 JP) and Persol Holdings (2181 JP) are trading at FY2 EV/EBITDAs of 6.8x and 7.5x respectively.

| FY03/18 | FY03/19E | FY03/20E |

Consolidated Revenue (JPYbn) | 2,171 | 2,327 | 2,478 |

YoY Growth % | 11.9% | 7.2% | 6.5% |

Consolidated EBITDA (JPYbn) | 258 | 288 | 312 |

EBITDA Margin % | 11.9% | 12.4% | 12.6% |

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.