In this briefing:

- Metropolis Healthcare IPO: Stands Apart in Pricing Power, Revenue Growth and Margins

- ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

- ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

- China East Education (中国东方教育) Pre-IPO – The Company Known for Its Culinary School

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

1. Metropolis Healthcare IPO: Stands Apart in Pricing Power, Revenue Growth and Margins

- Metropolis Health Services Limited (MHL IN) is the 3rd largest pathology chain in India and caters to the Rs600bn market growing at 15% Cagr. It is strongest in the lucrative Mumbai and Chennai markets.

- Though India’s pathology market has seen intense price competition and price discounting, Metropolis managed to grow revenue/patient much ahead of peers

- Its revenue/patient is 20% higher than its nearest competitor and the gap has been widening over FY16-18

- It is the only major pathology chain to have accelerated revenue growth over FY16-18 despite the lowest A&P spend

- It managed to grow Gross Margin 330bps and hold Ebitda margins over FY16-18. Major competitors like Dr Lal Pathlabs (DLPL IN) (-340bps) and SRL (-520bps) saw sharp contraction in Ebitda margins.

- On the flip side, its patient growth has lagged its retail network growth by a wide margin. Its cash conversion cycle is much longer than DLAL’s. It is also the most vulnerable to any government regulated price caps on testing in the future owing to its premium pricing.

- Lastly, it doesn’t need any fresh money and the entire IPO is an offer for sale by the promoters and Carlyle Group.

2. ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)‘s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway’s IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi’s high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO’s trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

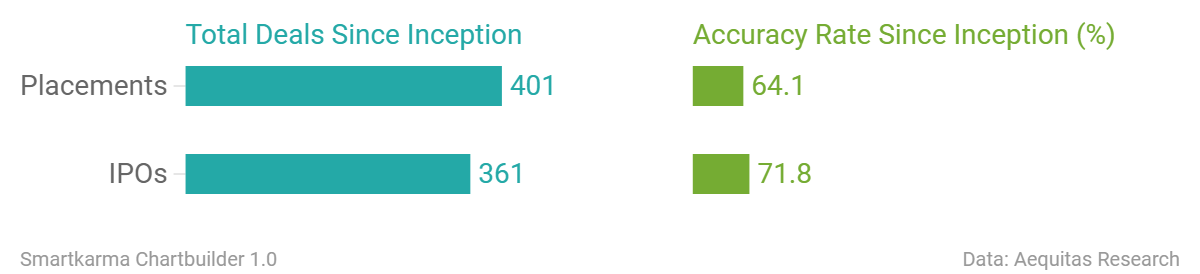

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

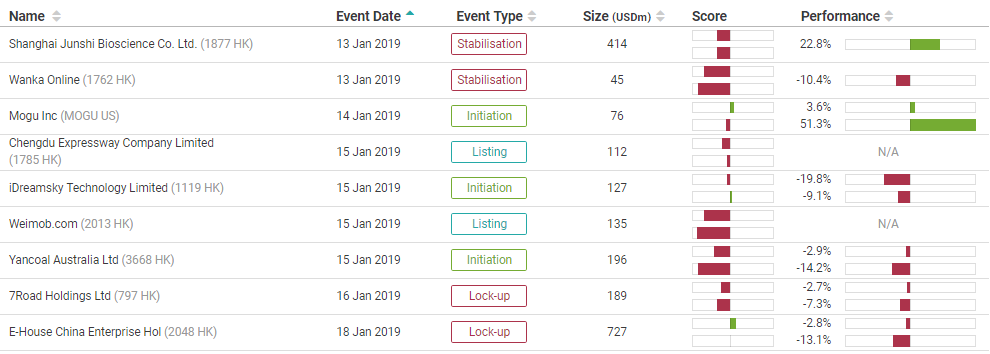

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China’s Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community’s this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda’s Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

3. ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

Over 2017-18, the Australian Securities & Investments Commission (ASIC) undertook a review of allocation in equity raising transactions. The review involved large and mid-sized licensees (brokers), Issuers, International investors and other international regulators. The results of the review were published by ASIC in Dec 2018. This insight highlights some of the key findings.

It’s good to see that some of the standard practices of banks allocating more to existing clients and participants of earlier deals have at least been acknowledged. Even though some institutional investors have outright labelled the allocation process as a “black box”, ASIC doesn’t seem to want to do much about it.

The area where ASIC is more concerned is the messaging to investors which highlights the different definitions of “well-covered” across banks. Although, the banks seem to have mislead the regulator on interpretation of “real-demand” with ECM bankers saying that all orders are taken at face-value. That raises a whole new level of questions on the messaging around demand for the deal.

4. China East Education (中国东方教育) Pre-IPO – The Company Known for Its Culinary School

China Xinhua Education (2779 HK) listed in Q1 of 2018 and we wrote in our insight that the founder had vocational schools that have been separated from China Xinhua that seemed to be his prized asset. Fast forward to December 2018, the prized asset has finally filed its draft prospectus under the entity China East Education (CEE HK) and it is looking to raise US$400m in its IPO.

In this insight, we will analyze the company’s financial and operating performance, compare it to listed education companies, and provide some questions we have for management.

5. Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

Futu Holdings Ltd (FHL US) plans to raise around US$300m in its US IPO. The company is backed by Tencent Holdings (700 HK) , Matrix Partners and Sequoia, who together own over 45% of the company.

The founding team comes mostly from Tencent, which might explain Tencent’s large stake in the company. Growth for the company has been stupendous despite the jittery markets, with margin financing adding to the top-line growth.

While its low costs will help it to steal clients from the more traditional brokers, other new low-cost brokers seem to be offering similar services at comparable rates. In addition, the company is not licensed or regulated by any entities in China, despite the majority of its client base being Chinese nationals. Furthermore, the company plans to expand into newer overseas market where it doesn’t seem to have much of a cost advantage.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.