In this briefing:

- M1 Offer Despatched – Dynamics Still Iffy

- ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

- StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

- HDC Holdings Stub Trade: Current Status & Trade Approach

- M1 Ltd (M1 SP): Take the Offer, Axiata Unlikely to Start a Bidding War

1. M1 Offer Despatched – Dynamics Still Iffy

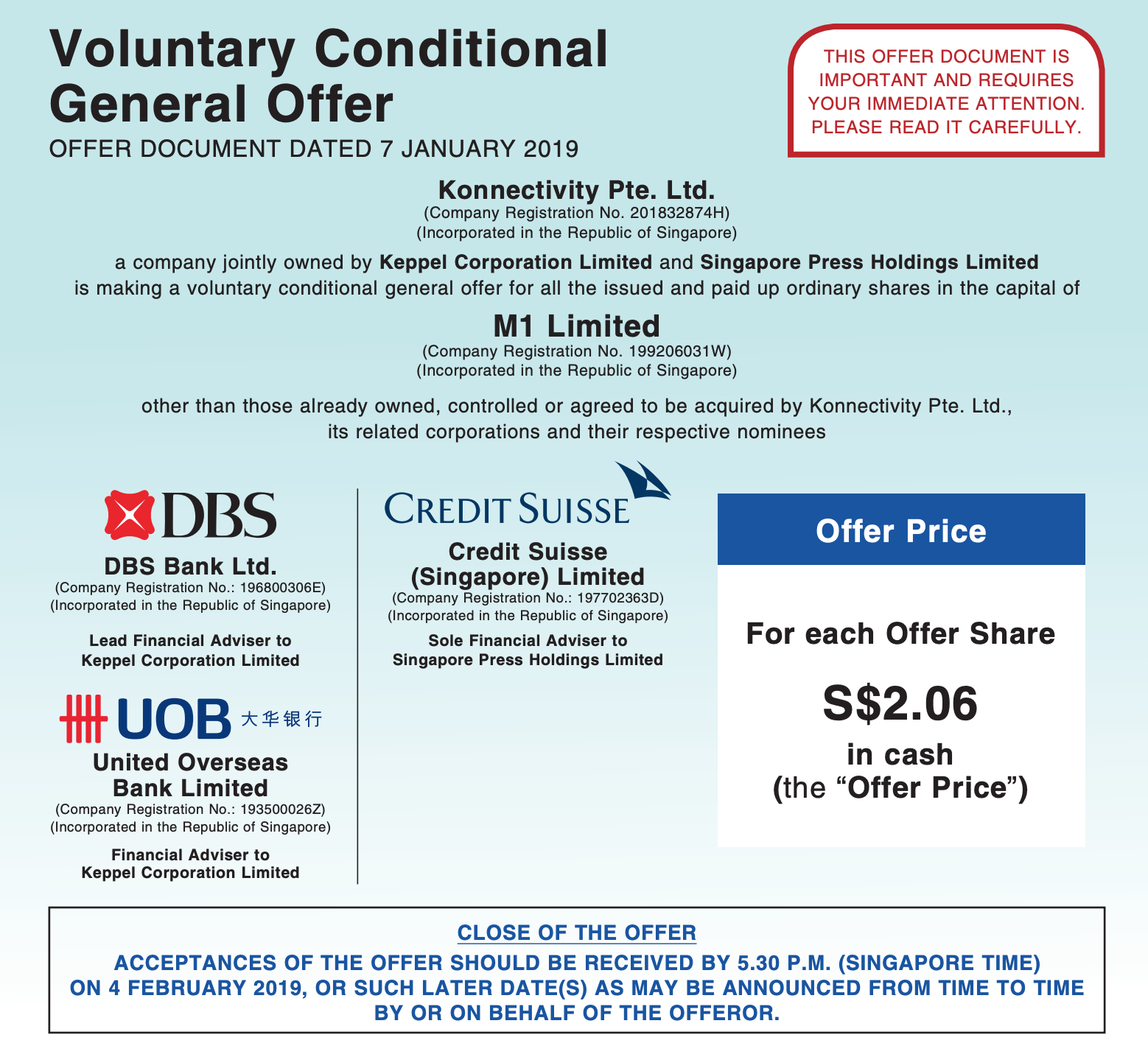

On January 7th after the close of trading, Konnectivity Pte. Ltd officially announced the launch of its Offer to by M1 Ltd (M1 SP).

The closing date, as clear there, is 4 February.

After three-plus months of speculation that Axiata Group (AXIATA MK) was unhappy with the price and might make a counter-offer, no offer has been forthcoming.

After I wrote on the 2nd in M1 Offer Coming – Market Odds Suggest a Bump But… that the reward/risk did not look that great, shares drifted downward from the S$2.09-2.11 area and into the afternoon of the 7th, traded in the S$2.05-2.07 range, which was the first time in months the shares had traded at or below the prospective offer price.

Some 20mm+ shares (5.5% of the shares out other than the three major holders) traded between 3pm Singapore time on the 7th and a few minutes after the open the day after the announcement. Then part-way through the day, someone bought a large number of shares lifting the share price two spreads for a while. Since then, the shares have settled back down to the $2.07-2.08 range.

Depending on your opinion of the likelihood of a bump, your execution strategy will differ. It’s still not clear that a bump or counterbid will be forthcoming, but at S$2.07, the risks are better than they were higher.

2. ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

Over 2017-18, the Australian Securities & Investments Commission (ASIC) undertook a review of allocation in equity raising transactions. The review involved large and mid-sized licensees (brokers), Issuers, International investors and other international regulators. The results of the review were published by ASIC in Dec 2018. This insight highlights some of the key findings.

It’s good to see that some of the standard practices of banks allocating more to existing clients and participants of earlier deals have at least been acknowledged. Even though some institutional investors have outright labelled the allocation process as a “black box”, ASIC doesn’t seem to want to do much about it.

The area where ASIC is more concerned is the messaging to investors which highlights the different definitions of “well-covered” across banks. Although, the banks seem to have mislead the regulator on interpretation of “real-demand” with ECM bankers saying that all orders are taken at face-value. That raises a whole new level of questions on the messaging around demand for the deal.

3. StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

This week in StubWorld …

- With concerns over its tender offer for BGF Retail (282330 KS) now behind it, now may be the time for a BGF Co Ltd (027410 KS) setup.

- Kingboard Chemical (148 HK) gets a boost after buying properties from its major shareholder, however, the implied yield is uninspiring.

Preceding my comments on BGF and KBC are the weekly setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity threshold of US$1mn on a 90-day moving average, and a % market capitalisation threshold – the $ value of the holding/opco held, over the parent’s market capitalisation, expressed as a % – of at least 20%.

4. HDC Holdings Stub Trade: Current Status & Trade Approach

- HDC Holdings (012630 KS) and HDC-OP (294870 KS) price gap is now at a nearly record high. Holdco discount is now 60% to NAV. On a 20D MA, Holdco and Sub are currently below -1 σ.

- I initiated a stub trade on the duo on Dec 11. It paid off on a short term horizon until the duo reached within -0.5~0 σ on a 20D MA. Yield peaked at 4.6% on Dec 14. If you approached with a longer term horizon, things wouldn’t have been as enjoyable.

- The only possibly explainable factor for the recent price divergence is HDC I-Controls’ need to dump a 1.78% Holdco stake. 1.78% overhang risk is not enough to sustain this much divergence and current 60% Holdco discount.

- The duo has again entered < -1 σ territory at yesterday’s closing prices. I’d first make another short-term stub trade. I’d hold onto the position until they reach within -0.5~0 σ on a 20D MA with a loss cut at -5%. But a little longer term approach to hunt for a higher yield wouldn’t be a bad idea at this point.

5. M1 Ltd (M1 SP): Take the Offer, Axiata Unlikely to Start a Bidding War

M1 Ltd (M1 SP), the third largest telecom operator in Singapore, is subject to a bid. On 7 January 2019, Konnectivity launched a voluntary conditional offer (VGO) at S$2.06 cash per share. Konnectivity is jointly owned by Keppel Corp Ltd (KEP SP) and Singapore Press Holdings (SPH SP).

M1’s shares are trading a touch above the VGO price of S$2.06 per share as the market is betting that Axiata Group (AXIATA MK) may ride in with its competing offer. However, we believe that shareholders should accept the offer as Axiata is unlikely to engage in a bidding war due to several factors.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.