In this briefing:

- Extraordinary Fiscal and Monetary Policies Have Disrupted the Global Economy

- Visit Note

- A Golden Future?

- Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

- Uranium – About to Enter Its Own Nuclear Winter

1. Extraordinary Fiscal and Monetary Policies Have Disrupted the Global Economy

In their public presentations, central banks seem to be contemplating the use of neutral interest rates (r*) in addition to unemployment/inflation theories. R* has the advantage of appearing to be subject to mathematical precision, yet it’s unobservable, and so unfalsifiable. Thus, it permits central banks to present any policy conclusion they want without fear of verifiable contradiction. R* is the policy rate that would equate the future supply of and demand for loans. It rises and falls as an economy strengthens and weakens. Long-term observation during the non-inflationary gold standard, period indicated that r* in an average economy was 2% plus, which would become 4% plus with today’s 2% inflation target. The Fed may soon end this tightening cycle with the fed funds rate at or near 2¾%, which would be r* if the rate of lending and borrowing in America remained stable thereafter. Rising (falling) lending would indicate a higher (lower) r*.

2. Visit Note

We recently visited Prataap Snacks (DIAMOND IN) in Indore, Madhya Pradesh. Our objective of interaction was to get some clarifications on standalone financials of the company. As of FY 2018, standalone revenue was at 10,309 mn vs 10,377 mn for consolidated entity. Contrary to management’s suggestion to look at consolidated financials, we prefer to look at standalone financials, since the parent company contributes to 99% of Sales as 100% of the assets. Some of the issues that warrant attention are highlighted in this insight. Consensus financial data indicate an expectation of 44% growth in EPS for FY 2020. Our checks indicate an increasing competitive environment where both regional and national (MNC brands) are fighting for market share. The company is entering new product categories like sweet snacks. However, looking at growth expectations and cost structures discussed in this insight, investors would be better off looking for an alternative which is leaner.

3. A Golden Future?

The ability to have stable prices has great value.

According to Edward Gibbon, the decaying Roman Empire exhibited five hallmarks: 1) concern with displaying affluence instead of building wealth; 2) obsession with sex; 3) freakish and sensationalistic art; 4) widening disparity between the rich and the poor; and 5) increased demand to live off the state. Most DMs and many EMs display similar symptoms today because fiscal and monetary policies, the foundation of both ancient and modern societies, are identical: increasing welfare outlays by artificially inflating the money supply. The Roman Empire took more than four centuries to destroy what the Republic had built in the previous five centuries because clipping and debasing coins inflated currency supplies slowly. Entering debits and credits in the books of commercial and central banks is much more efficient.

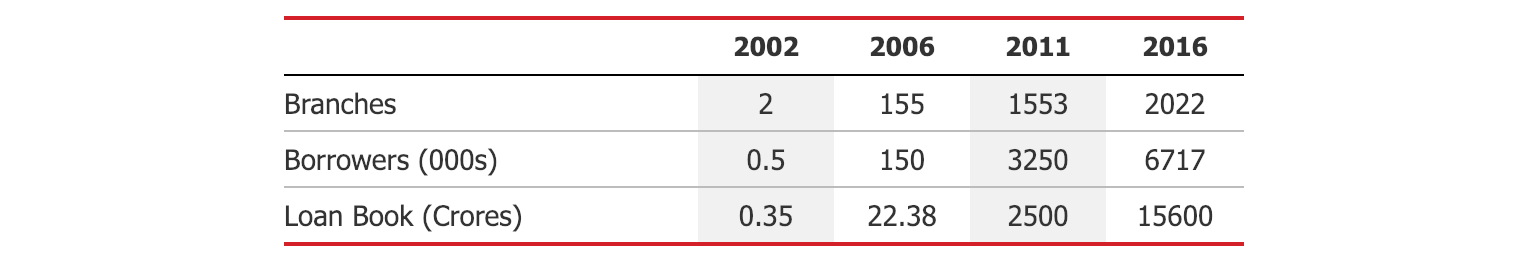

4. Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

Bandhan Bank (BANDHAN IN) (“BBL”) and Gruh Finance (GRHF IN) (“GRUH”) announced together on January 7th that their respective boards have considered and approved a Scheme of Amalgamation where Bandhan Bank will be the acquiring entity and GRUH Finance will become the acquired entity. All media sources suggest it was something of a surprise to GRUH personnel and management.

The exchange ratio has been set at 568 Bandhan Bank shares per 1000 GRUH Finance shares.

Following the announcement, the shares of Bandhan Bank and GRUH Finance have declined by 4.8% and 16.4% respectively. The deal is trading at a gross/annualised spread of 10%/13+% assuming a deal completion date in late September as of Tuesday’s close (but not assuming any dividends).

The deal is conditional on receiving approvals from the Reserve Bank of India (RBI), Competition Commission India (CCI), National Company Law Tribunal (NCLT) and other relevant regulatory authorities.

Data Point | Data in the Data Point |

The Deal | Scheme of Amalgamation |

Acquiring Entity | Bandhan Bank Ltd |

Acquired Entity | GRUH Finance Ltd |

Terms | Exchange ratio of 568 Bandhan Bank shares for every 1000 GRUH Finance shares |

Conditions | Receipt of Approvals from the Reserve Bank of India (RBI), Competition Commision India (CCI), National Company Law Tribunal (NCLT), Ahmedabad Bench and Kolkata Bench, Securities and Exchange Board of India BSE Limited, the National Stock Exchange of India Limited and other regulatory authorities as may be necessary. 75% Shareholder approval by each company’s shareholders will be required as well. Bandhan’s result is a foregone conclusion. GRUH’s is not. |

Dividends? | Not mentioned. |

Indicative Timeline

Date | Event |

|---|---|

7 Jan 2019 | Announcement Date |

30 Apr 2019 | RBI Approval |

8 May 2019 | CCI Approval |

30 Sep 2019 | Possible Close Date |

Note that Indian Schemes of Amalgamation also require 75% shareholder approval from all combining parties. The vote for Bandhan shareholders is a foregone conclusion as the promoter Bandhan Financial Holdings has 82.3%. The GRUH vote is not certain but HDFC has 57.8% of the 75% required.

This deal is really pricey, and some shareholders of Bandhan Bank who will get diluted have voted with their feet. It is a pretty great exit from GRUH for HDFC. While the prima facie evidence suggests that the deal was done to appease the RBI and get closer to the promoter shareholder limit required in October last year, the shareholder structure and CEO Ghosh’s own personal history suggests that neither the 40% rule nor the salary freeze are real hurdles (though the branch opening freeze may be something BBL wants to lift).

5. Uranium – About to Enter Its Own Nuclear Winter

- Quantifying nuclear statistics with substantial discrepancies

- LT contracts & speculative hoarding driving recent 40% spot price increase

- Primary/secondary Uranium supplies currently 112% of 2017 demand

- Uranium supply deficits extremely unlikely before 2022

- Global Uranium demand to fall 25-40% by 2050

- Primary Uranium sector LT SELL

We have independently audited global nuclear construction statistics in order to determine future Uranium demand. Although near-term statistics match those in the public domain, long-term demand determined via construction pipeline illustrates substantial discrepancies. Compiling planned plant construction, operational extensions, nameplate upgrades, versus decommissioning announcements/events, and in many cases, public policy inertia; has led us to believe that despite historical primary supply shortages, global nuclear demand peaked in 2006.

Since plateauing and despite strong Chinese growth, nuclear power generation has fallen <2% over the past two decades, a decline that is predicted to accelerate as a number of developed and developing nations pursue other energy options.

The macro-trend not replacing existing nuclear infrastructure means (dependent on assumptions), according to our calculations, global uranium demand will decrease between 20 to 40% by 2050.

As opposed to signifying a fundamental change in underlying demand, we believe that recent Uranium price increases are the result of producers closing primary operations, and substituting production with purchases on the spot market to meet long-term contract obligations. In addition, hedge funds are buying physical uranium in order to realise profits on potential future commodity price increases. Critically, we determine that primary and secondary supplies are more than sufficient to meet forecast demand over the next four to five years; before taking into account substantial existing global uranium stocks, some of which are able to re-enter the spot market at short notice.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.