In this briefing:

- Asia’s External Balances Signal Safety for Investors

- Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

- Vedanta Resources PLC: Holding Firm Despite Rising Net Debt

- Another US LNG Project Goes Ahead: Positive for the Contractors; Negative for Others Looking to FID

- NextDecade’s Oil-Linked Contract Offering Signals More Hurdles Ahead for US LNG Project Developers

1. Asia’s External Balances Signal Safety for Investors

Asian currencies are, in general, well supported by economic fundamentals in the form of external surpluses and interest rate differentials. Indeed, most Asian currencies display an appreciating bias, contrary to perceptions in 2018 when all of them lost ground to the US dollar. Over the last year the underlying external strength has been reflected in Asian currency appreciation against the US dollar.

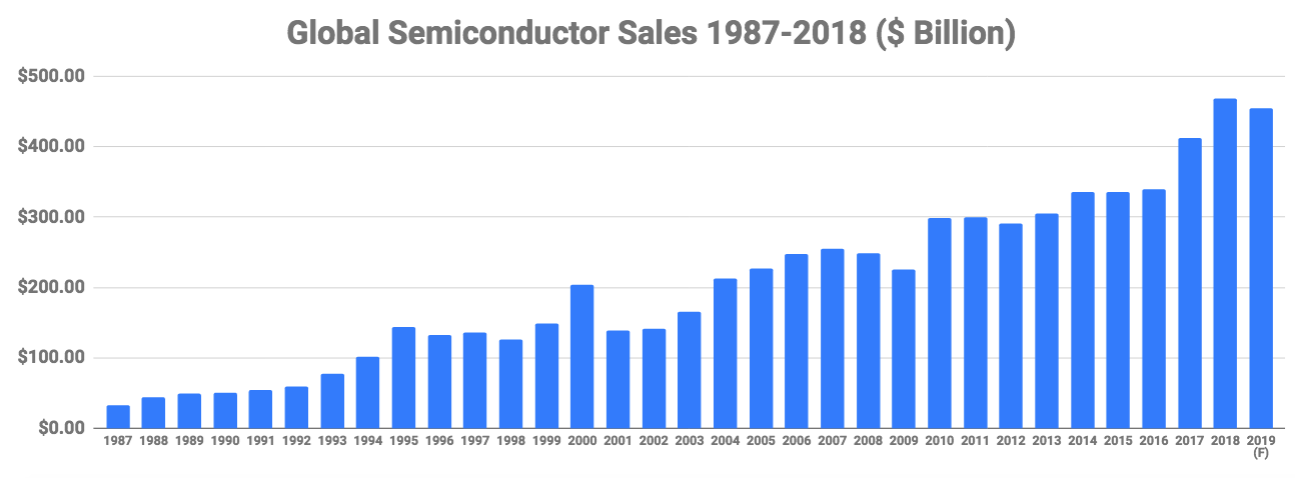

2. Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

According to SEMI, North American (NA) WFE sales for January 2019 fell to $1.9 billion, down ~10% sequentially and ~20% YoY. This was an abrupt reversal of the recovery trend implied by the December 2018 sales of $2.1 billion and is the biggest monthly sales YoY decline since June 2013.

Just as declining monthly WFE sales preceded the current semiconductor downturn by some six months, the continuation of December’s MoM WFE decline reversal trend was a prerequisite for a second half recovery in the broader semiconductor sector. With that trend well and truly broken, we now anticipate a more delayed, gradual and prolonged recovery, one which is now unlikely to materialise until late third, early fourth quarter 2019.

3. Vedanta Resources PLC: Holding Firm Despite Rising Net Debt

Vedanta Resources (VED LN) (Vedanta)’s net debt of USD6.4bn for six months ended 30 September 2018 results in a net debt/EBITDA ratio of 3.2x compared to 2.4x a year earlier. We are worried about the company’s rising debt amidst new court orders in India barring it from reopening its subsidiary’s controversial copper plant in the southern state of Tamil Nadu. Vedanta’s subsidiary Vedanta Ltd (VEDL IN) (VL) has also witnessed a sharp decline in its stock price over the past three months due to uncertainty over the plant. Vedanta’s 1HFY19 revenues of USD7.1bn saw a 4% increase compared to the same period last year as a result of higher aluminium sales as well as rising commodity prices. Vedanta’s EBITDA for 1HFY19 stood at USD1.7bn, a 1% increase compared to the same period the year before, driven by the higher oil prices as well as better operating efficiencies. Average production metrics increased across the board, including higher production of oil, aluminium, and steel.

We reiterate our OVERWEIGHT recommendation for the VEDLN complex (21s, 23s and 24s) on its attractive yields versus Indian quasi-sovereign peers and the company’s consistent operating performance.

4. Another US LNG Project Goes Ahead: Positive for the Contractors; Negative for Others Looking to FID

US private LNG company Venture Global is starting construction on its 10 million ton per annum (mtpa) US LNG export facility in Louisiana after gaining approval from the US Federal Energy Regulatory Commission (FERC). This is positive for the LNG contractor market and we discuss the companies involved in the project.

This follows final investment decision taken on Golden Pass (Exxon and Qatar Proceed with US$10bn Golden Pass LNG Terminal: Positive for Chiyoda and MDR US) and supports our thesis of a large wave of new projects that will be sanctioned in the coming months (A Huge Wave of New LNG Projects Coming in the Next 18 Months: Positive for The E&C Companies). This was viewed as a relatively speculative project and with aggressively low cost and timing estimates.

5. NextDecade’s Oil-Linked Contract Offering Signals More Hurdles Ahead for US LNG Project Developers

NextDecade Corp (NEXT US) recently announced that it started offering long-term contracts indexed to the crude Brent in order to attract more LNG buyers. This follows the agreement reached by Tellurian Inc (TELL US) with Vitol back in December to index a long term contract with the Asian LNG price benchmark JKM. While typically US LNG projects are indexed to the Henry Hub, declining crude oil and LNG prices seem to have diminished the appeal of the Henry Hub pricing compared to the oil indexation. This insight takes a look at the latest trends in the LNG markets to assess which companies are taking the lead in the race to bring to FID in 2019 their proposed LNG projects.

Exhibit 1: NextDecade adds Brent indexation to its commercial offering

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.