In this briefing:

- Celgene Acquisition by Bristol-Myers Squibb: A Call to Arbs

- Metropolis Healthcare IPO: Stands Apart in Pricing Power, Revenue Growth and Margins

- HK Connect Discovery Weekly: CR Beer, Great Wall Motors, and Kingsoft (2019-01-07)

- (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

- Healius (HLS AU): Bid Rejection Provides Option Value

1. Celgene Acquisition by Bristol-Myers Squibb: A Call to Arbs

On January 3, 2019, Bristol Myers Squibb Co (BMY US) and Celgene Corp (CELG US) announced a definitive agreement for BMY to acquire Celgene in a $74 billion cash and stock deal. The headline price of $102.43 per Celgene share plus one CVR (contingent value right) is a 53.7% premium to CELG’s closing price of $66.64 on January 2, 2019, before assigning any value to the CVR.

The logic behind the transaction is to create a biopharma powerhouse with leading franchises in oncology, immunology and inflammation (autoimmune diseases), and cardiovascular medicine. After completion, BMY will have six expected launches in the next 12-24 months representing over $15 billion in revenue potential, and an early pipeline that includes 50 high potential assets. In addition to amassing a powerhouse biopharma portfolio, the combination is expected to yield annual cost synergies of $2.5 billion by 2022.

Terms of the deal call for each CELG share to be converted into one BMY share and $50 cash, plus one tradeable CVR worth $9 if specific FDA approvals are received for three drugs by certain dates. The 1.0 BMY exchange ratio is fixed. Upon completion of the deal BMY shareholders will own about 69% of the combined company with former CELG shareholders owning the other 31%.

The deal is conditioned on approvals by both CELG and BMY shareholders as well as regulatory approvals that include the U.S. and the EU. Financing is not a condition. The companies expect the complete the deal in the third calendar quarter of 2019.

2. Metropolis Healthcare IPO: Stands Apart in Pricing Power, Revenue Growth and Margins

- Metropolis Health Services Limited (MHL IN) is the 3rd largest pathology chain in India and caters to the Rs600bn market growing at 15% Cagr. It is strongest in the lucrative Mumbai and Chennai markets.

- Though India’s pathology market has seen intense price competition and price discounting, Metropolis managed to grow revenue/patient much ahead of peers

- Its revenue/patient is 20% higher than its nearest competitor and the gap has been widening over FY16-18

- It is the only major pathology chain to have accelerated revenue growth over FY16-18 despite the lowest A&P spend

- It managed to grow Gross Margin 330bps and hold Ebitda margins over FY16-18. Major competitors like Dr Lal Pathlabs (DLPL IN) (-340bps) and SRL (-520bps) saw sharp contraction in Ebitda margins.

- On the flip side, its patient growth has lagged its retail network growth by a wide margin. Its cash conversion cycle is much longer than DLAL’s. It is also the most vulnerable to any government regulated price caps on testing in the future owing to its premium pricing.

- Lastly, it doesn’t need any fresh money and the entire IPO is an offer for sale by the promoters and Carlyle Group.

3. HK Connect Discovery Weekly: CR Beer, Great Wall Motors, and Kingsoft (2019-01-07)

In our Discover HK Connect series, we aim to help our investors understand the flow of southbound trades via the Hong Kong Connect, as analyzed by our proprietary data engine. We will discuss the stocks that experienced the most inflow and outflow by mainlanders in the past seven days.

We split the stocks eligible for the Hong Kong Connect trade into three groups: those with a market capitalization of above USD 5 billion, those with a market capitalization between USD 1 billion and USD 5 billion, and those with a market capitalization between USD 500 million and USD 1 billion.

In the past week, there were only three and a half days trading on the Hong Kong Stock Exchange last week. Hence the flow numbers were not as significant as a typical 5 trading day week. Having said that, we find it interesting that the Chinese were buying China Resources Beer Holdin (291 HK), Great Wall Motor Company (H) (2333 HK). In addition, Yichang Hec Changjiang Pharm (1558 HK) is a rare health care stock that experienced inflow last week despite overall poor sector performance last week.

4. (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

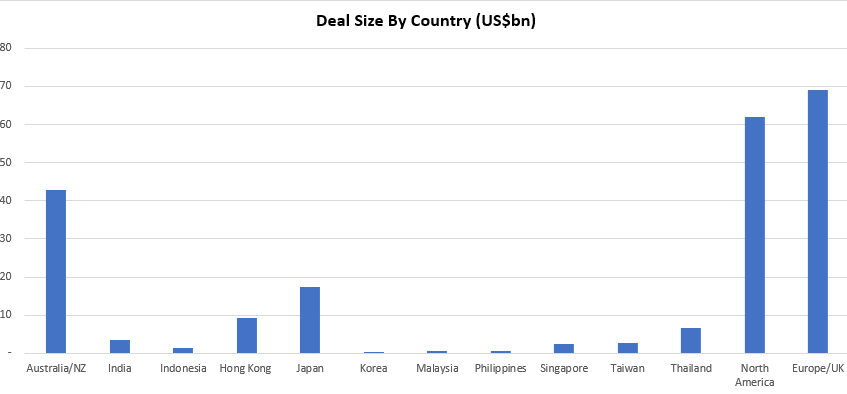

This insight briefly summarises the 93 M&A transactions, with a collective deal size of ~US$215bn, published on Smartkarma in 2018.

Transactions discussed were typically Asia-Pacific-centric or concerned an outbound transaction initiated from an Asia-Pacific-listed company. The majority of these deals involved a market cap/deal size in excess of US$100mn.

The mega deals of Takeda Pharmaceutical (4502 JP)/Shire PLC (SHP LN), Sprint Corp (S US)/T Mobile Us Inc (TMUS US) and Intl Business Machines (IBM US)/Red Hat Inc (RHT US) were first discussed in May, June and November respectively.

- The most generous country? The average premium for Australian and Hong Kong deals was almost identical at 38%.

- The stingiest? Singapore with 16%.

- The graveyard award? 49 deals were completed with 35 ongoing. Australia had four deals (out of a total of 29, the most for any country) that were abandoned for various reasons – such as CKI getting dinged by FIRB in its tilt for APA Group (APA AU). But in terms of outright fails, Hong Kong takes home that award following the failures in Pou Sheng Intl Holdings (3813 HK), Guoco Group Ltd (53 HK) and Spring Real Estate Investment Trust (1426 HK).

During the year a number of large, high profile transactions were completed that were also extensively analysed and discussed on Smartkarma. However, if the initial discussions between the two parties (acquirer & target) took place pre-2018, they are not included in the charts above. A selection of these include (in no particular order):

Broadcom Corp Cl A (BRCM US)/Qualcomm Inc (QCOM US)

Alps Electric (6770 JP)/Alpine Electronics (6816 JP)

Westfield Corp (WFD AU)/Unibail-Rodamco SE (UL FP)

Idemitsu Kosan (5019 JP)/Showa Shell Sekiyu Kk (5002 JP)

Orient Overseas International (316 HK)

5. Healius (HLS AU): Bid Rejection Provides Option Value

Healius (HLS AU), formerly known as Primary Health Care (PRY AU), is a leading Australian owner of GP clinics and pathology centres. Healius just took four days to reject Jangho Group Co Ltd A (601886 CH)’s 3 January 2018 proposal of A$3.25 cash per share as it “is opportunistic and fundamentally undervalues Healius.”

We believe that rejection of Jangho’s proposal provides shareholders with option value. If Healius’ growth initiatives generate value, we believe that the shares will be worth more than Jangho’s proposal. If Healius’ growth initiatives stall and the shares slide, we believe that Jangho will once again table a proposal.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.