In this briefing:

- MYOB (MYO AU): Shareholders Are Caught Between a Rock and a Hard Place

- New Pride Rights Offer: Tempting but Tricky

- LG Chem Share Class: Another Pref to Watch as Div Yield Gap at 4Y High

- Daelim Industrial Share Class: One of Prefs to Arb Trade on Div Payout Record Date

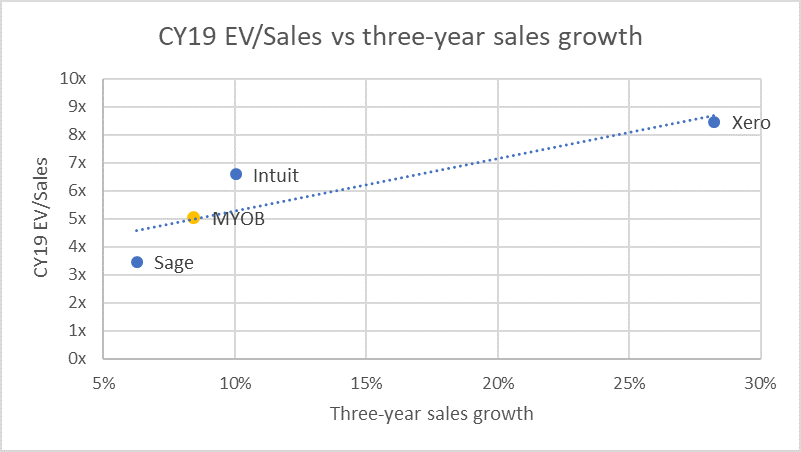

1. MYOB (MYO AU): Shareholders Are Caught Between a Rock and a Hard Place

On 24 December, MYOB Group Ltd (MYO AU) announced that it entered into a scheme implementation agreement under which KKR will acquire MYOB at $3.40 per share, which is 10% lower than 2 November offer price of A$3.77. MYOB claims its decision to recommend KKR’s lower offer was based on current market uncertainty, long-term nature of its strategic growth plans and the go-shop provisions of the deal.

We believe that KKR’s revised offer is opportunistic, but MYOB’s shareholders are caught between a rock and a hard place. Shareholders can take a short-term view and grudgingly accept the revised offer. Alternatively, shareholders can take a long-term view by rejecting the offer and hope MYOB’s strategic growth plans and a market recovery can reverse the inevitable share price collapse.

2. New Pride Rights Offer: Tempting but Tricky

- New Pride Corp (900100 KS) announced a ₩36.2bil rights offer. This is a public offering, so there won’t be subscription rights to trade. Pricing will be done as 3-day VWAP on Jan 9~11 at a 30% discount.

- Supposedly, we can have ample opportunity to arb trade. This may be what the company is hoping. Simply, we wait until Jan 16~17 (subscription period) and see the spread. At this much discount, there must be a huge spread opening.

- Proration risk can be much more annoying than a usual stockholder offering. In the previous public offering event by New Pride, subscription rate went as high as 370 to 1. It should be way much lower this time. But still this is risky enough.

3. LG Chem Share Class: Another Pref to Watch as Div Yield Gap at 4Y High

- LG Chem Ltd (051910 KS) 1P is now at a 44.20% discount to Common. Div would be the same as last year of ₩6,000 despite lower earnings. Payout would be 28%. Div yield for Common will be 1.68%, and 3.03% for 1P. Div yield difference stands at 1.35%p. This is a record high at least since 2014.

- 1P’s discount to Common is hovering at the highest level in 2 years. On a 20D MA, it is close to +1 σ. It may not be tempting enough for those seeking high yields. Otherwise, this’d be worth giving it a shot. Liquidity shouldn’t be an issue. Short recovering risk on Common also appears to be limited.

4. Daelim Industrial Share Class: One of Prefs to Arb Trade on Div Payout Record Date

- Daelim Industrial (000210 KS) is one of the main targets of local activist movement. This makes a setting for higher dividends. Common div yield to 1.58% and Pref to 4.18%. Difference is 2.59%p. This is the widest gap in many years.

- Pref is currently at a 60.89% discount to Common. Among those > ₩100bil MC prefs, it is the second highest discounted pref, only behind CJ Cheiljedang 1P (097955 KS). Local street expects at least ₩1,600 div per share. This should be a conservative estimate. On a 20D MA, Pref is above +1 σ.

- Dec 26 is record date of dividend payout. I expect a price catchup movement tomorrow in favor of Pref. I’d go long Pref and short Common as early in the morning as possible.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.