In this briefing:

- Korea National Pension Fund & Voting Rights of Outsourced Korean Equity Investments

- PCI Ltd – All Over Before It Starts

- Softbank: Reduced Yield Competitiveness, End of Passive Buying and Softbank Group’s Hunger for Cash

- Hankook Tire Worldwide Stub Reverse Trade: Massive Price Divergence Is Created Today

- (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

1. Korea National Pension Fund & Voting Rights of Outsourced Korean Equity Investments

In this report, we discuss some of the major changes in regulation and recent important news related to the Korea National Pension Fund Service (NPS), including changes to the voting rights of outsourced Korean equity investments by NPS as well as how it may deal with the Hanjin Kal Corp (180640 KS) corporate governance issues.

It was reported yesterday that the NPS will allow 57 trillion won ($51 billion) of Korean equity investments which are currently managed indirectly by numerous outsourced asset management companies to have their own respective voting rights. The Financial Services Commission (FSC) announced yesterday that an amendment to the enforcement ordinance of the Capital Market Act was passed allowing NPS’s indirectly managed Korean equity investments’ voting rights to be exercised by the outsourced asset managers rather than by NPS itself passed the Cabinet meeting.

What are the major implication? As a result of this move, this will act as a key positive catalyst spurring on greater corporate activism since NPS’s outsourced fund managers will have greater freedom to make more aggressive decisions to improve shareholder value of Korean companies. In addition, it also reduces the overall responsibility of carrying out the Stewardship Code changes to not just on NPS but on the rest of the major asset management companies in Korea.

2. PCI Ltd – All Over Before It Starts

After gaining 22.5% over seven trading days back in mid-September, Pci Ltd (PCI SP) responded to an SGX query over this price action that “it has been approached by a third party in connection with a potential transaction in relation to the securities of the Company. The discussions are on-going …“.

All was revealed on 4th January 2019, when PCI announced that Pagani Holding (a SPV indirectly owned by Platinum Equity Advisors) had made a S$1.33/share cash offer for the company by way of a scheme.

Chuan Hup Holdings (CH SP), which holds 76.7% in PCI, has given an irrevocable undertaking to vote its stake in favour of the scheme resolution, and to reject or vote against any competing offers. PCI’s executive chairman, Peh Kwee Chim, is Chuan Hup’s majority owner.

The price presents a ~18% premium to the last close, but a 49% premium to the “undisturbed” price back in early September and a 60% premium over the 12-month VWAP. The Offer values PCI at US$195mn.

With the 75%-for scheme condition satisfied and a lifetime-high takeover price, this is a done deal, and is duly reflected in the gross/annualised spread of 2.3%/6.8%, assuming mid-May completion.

3. Softbank: Reduced Yield Competitiveness, End of Passive Buying and Softbank Group’s Hunger for Cash

We are once again turning negative on Softbank Corp (9434 JP) as the stock price is now 18% above the ¥1,200 level which we mentioned looked cheap, outperforming Topix by 20% and the Nikkei by 21%.

Softbank Corp: When Does It Become a Buy?

In our view this IPO was oversold and probably to numerous weak hands who may now be looking at the large price drops that Softbank Group has occasionally suffered. We would hazard a guess that many of the individuals looking to flip the shares may still not have sold, however, if the stock dips below ¥1,200 we believe risk-reward would tilt positive until the passive buying is complete. Our view on this large drop is mostly that Softbank over-reached in terms of the size of the sale and the valuation.

The business, while subject to various headwinds should still be highly cash generative and at the current price is on just under 13x EV/OP. That’s not particularly cheap but nor is it ridiculously expensive if you believe OP will not drop (we believe it will). With a bit more of a discount and once the initial selling pressure from flippers dies down we believe the yield and passive buying should help the stock find a temporary floor. We do not view this as an attractive long-term holding in any way shape or form, but as a short-term trade the potential to make a 5-10% return on the back of a bounce following panic selling by retail supported by the yield and passive buying seems reasonably good.

Prior to that, we had flagged that retail demand for the IPO could be fragile in Softbank IPO: Signs Point to Risk of Early IPO Price Break and while there was a stronger sell-off than we expected immediately post listing, we would hazard a guess that there could still be an overhang close to the IPO price as there could be significant latent sell volume from retailers hoping to break-even and if that opportunity opens up in a weak market we believe many could choose to sell despite the rebound.

We would point to the news today regarding Softbank Group lowering its planned investment in WeWork from $16bn to just $2bn due to investors in the Vision Fund balking. As perhaps the most aggressive tech investor of the last few years, Softbank stepping back is not a good sign overall and raises questions about the viability of the valuations that other companies in its investment portfolio, namely Uber, are targeting for their upcoming IPOs. With news sources suggesting that Softbank Group is also looking to offload its Nvidia Corp (NVDA US) stake, the tide appears to have truly turned for tech in general and the chronically unprofitable platform companies such as Uber and WeWork in particular.

This raises the governance risks we initially highlighted regarding the use of Softbank Corp for funding the overall Softbank Group. As such, despite a final round of passive buying for Topix buying at the end of the month, the stock price looks vulnerable here.

4. Hankook Tire Worldwide Stub Reverse Trade: Massive Price Divergence Is Created Today

- Hankook Tire Worldwide (000240 KS) is another local single sub dependent holdco in Korea. Hankook Tire (161390 KS) accounts for nearly 90% of the sub holdings. Holdco is now at a 35% discount to NAV. This is substantially better than the local peer average.

- Sub is taking a harsh hit now mainly on concerns over 4Q results. It is currently down 7% today. In contrast, Holdco is holding steady. It is rather up 1%. This is creating a massive price divergence. As of now, they are close to +3 σ on a 20D MA.

- Holdco’s real world float is much less than 10% of total shares. This often serves to help Holdco stave off market volatility like today’s. But this much divergence is a rare one. Sub’s current PER on FY19e is at 7x. This is 20% less than its usual level. It should be that Sub is being oversold.

- I’d make a very short-term trade at this point. I’d go short Holdco and long Sub for a quick mean reversion.

5. (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

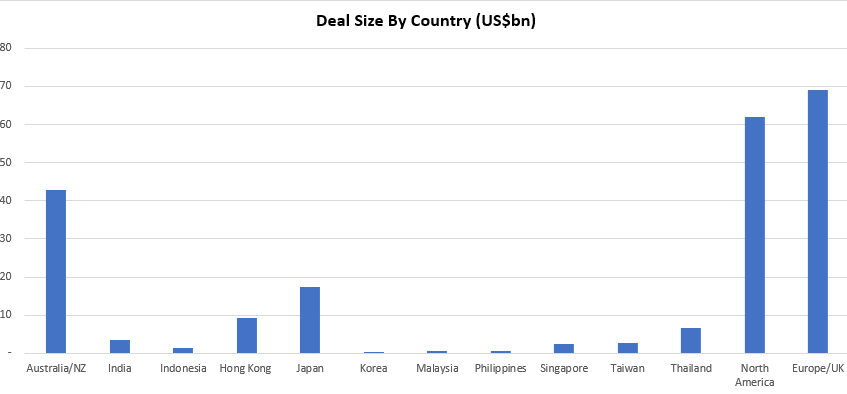

This insight briefly summarises the 93 M&A transactions, with a collective deal size of ~US$215bn, published on Smartkarma in 2018.

Transactions discussed were typically Asia-Pacific-centric or concerned an outbound transaction initiated from an Asia-Pacific-listed company. The majority of these deals involved a market cap/deal size in excess of US$100mn.

The mega deals of Takeda Pharmaceutical (4502 JP)/Shire PLC (SHP LN), Sprint Corp (S US)/T Mobile Us Inc (TMUS US) and Intl Business Machines (IBM US)/Red Hat Inc (RHT US) were first discussed in May, June and November respectively.

- The most generous country? The average premium for Australian and Hong Kong deals was almost identical at 38%.

- The stingiest? Singapore with 16%.

- The graveyard award? 49 deals were completed with 35 ongoing. Australia had four deals (out of a total of 29, the most for any country) that were abandoned for various reasons – such as CKI getting dinged by FIRB in its tilt for APA Group (APA AU). But in terms of outright fails, Hong Kong takes home that award following the failures in Pou Sheng Intl Holdings (3813 HK), Guoco Group Ltd (53 HK) and Spring Real Estate Investment Trust (1426 HK).

During the year a number of large, high profile transactions were completed that were also extensively analysed and discussed on Smartkarma. However, if the initial discussions between the two parties (acquirer & target) took place pre-2018, they are not included in the charts above. A selection of these include (in no particular order):

Broadcom Corp Cl A (BRCM US)/Qualcomm Inc (QCOM US)

Alps Electric (6770 JP)/Alpine Electronics (6816 JP)

Westfield Corp (WFD AU)/Unibail-Rodamco SE (UL FP)

Idemitsu Kosan (5019 JP)/Showa Shell Sekiyu Kk (5002 JP)

Orient Overseas International (316 HK)

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.