In this briefing:

- HDC Holdings Stub Trade: Current Status & Trade Approach

- M1 Ltd (M1 SP): Take the Offer, Axiata Unlikely to Start a Bidding War

- Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

- Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?

- A Pricey Deal in Hindsight, Walmart? India Reviews Policy – Amazon, Walmart May Need to Rejig Model

1. HDC Holdings Stub Trade: Current Status & Trade Approach

- HDC Holdings (012630 KS) and HDC-OP (294870 KS) price gap is now at a nearly record high. Holdco discount is now 60% to NAV. On a 20D MA, Holdco and Sub are currently below -1 σ.

- I initiated a stub trade on the duo on Dec 11. It paid off on a short term horizon until the duo reached within -0.5~0 σ on a 20D MA. Yield peaked at 4.6% on Dec 14. If you approached with a longer term horizon, things wouldn’t have been as enjoyable.

- The only possibly explainable factor for the recent price divergence is HDC I-Controls’ need to dump a 1.78% Holdco stake. 1.78% overhang risk is not enough to sustain this much divergence and current 60% Holdco discount.

- The duo has again entered < -1 σ territory at yesterday’s closing prices. I’d first make another short-term stub trade. I’d hold onto the position until they reach within -0.5~0 σ on a 20D MA with a loss cut at -5%. But a little longer term approach to hunt for a higher yield wouldn’t be a bad idea at this point.

2. M1 Ltd (M1 SP): Take the Offer, Axiata Unlikely to Start a Bidding War

M1 Ltd (M1 SP), the third largest telecom operator in Singapore, is subject to a bid. On 7 January 2019, Konnectivity launched a voluntary conditional offer (VGO) at S$2.06 cash per share. Konnectivity is jointly owned by Keppel Corp Ltd (KEP SP) and Singapore Press Holdings (SPH SP).

M1’s shares are trading a touch above the VGO price of S$2.06 per share as the market is betting that Axiata Group (AXIATA MK) may ride in with its competing offer. However, we believe that shareholders should accept the offer as Axiata is unlikely to engage in a bidding war due to several factors.

3. Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

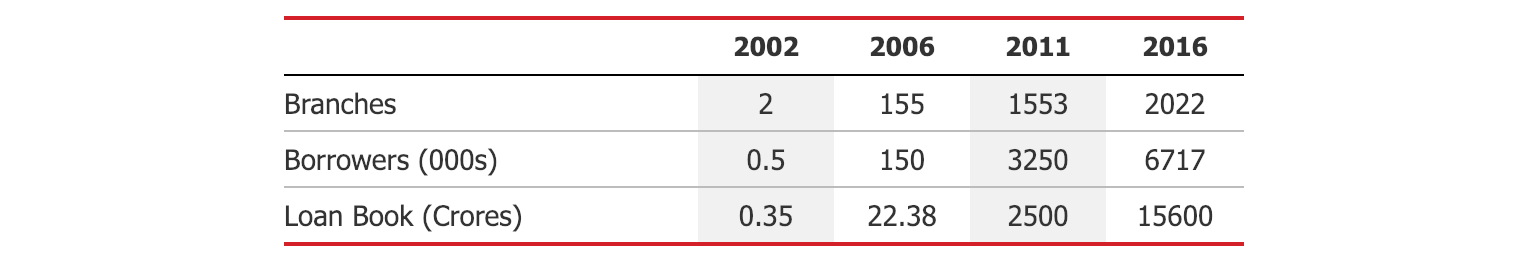

Bandhan Bank (BANDHAN IN) (“BBL”) and Gruh Finance (GRHF IN) (“GRUH”) announced together on January 7th that their respective boards have considered and approved a Scheme of Amalgamation where Bandhan Bank will be the acquiring entity and GRUH Finance will become the acquired entity. All media sources suggest it was something of a surprise to GRUH personnel and management.

The exchange ratio has been set at 568 Bandhan Bank shares per 1000 GRUH Finance shares.

Following the announcement, the shares of Bandhan Bank and GRUH Finance have declined by 4.8% and 16.4% respectively. The deal is trading at a gross/annualised spread of 10%/13+% assuming a deal completion date in late September as of Tuesday’s close (but not assuming any dividends).

The deal is conditional on receiving approvals from the Reserve Bank of India (RBI), Competition Commission India (CCI), National Company Law Tribunal (NCLT) and other relevant regulatory authorities.

Data Point | Data in the Data Point |

The Deal | Scheme of Amalgamation |

Acquiring Entity | Bandhan Bank Ltd |

Acquired Entity | GRUH Finance Ltd |

Terms | Exchange ratio of 568 Bandhan Bank shares for every 1000 GRUH Finance shares |

Conditions | Receipt of Approvals from the Reserve Bank of India (RBI), Competition Commision India (CCI), National Company Law Tribunal (NCLT), Ahmedabad Bench and Kolkata Bench, Securities and Exchange Board of India BSE Limited, the National Stock Exchange of India Limited and other regulatory authorities as may be necessary. 75% Shareholder approval by each company’s shareholders will be required as well. Bandhan’s result is a foregone conclusion. GRUH’s is not. |

Dividends? | Not mentioned. |

Indicative Timeline

Date | Event |

|---|---|

7 Jan 2019 | Announcement Date |

30 Apr 2019 | RBI Approval |

8 May 2019 | CCI Approval |

30 Sep 2019 | Possible Close Date |

Note that Indian Schemes of Amalgamation also require 75% shareholder approval from all combining parties. The vote for Bandhan shareholders is a foregone conclusion as the promoter Bandhan Financial Holdings has 82.3%. The GRUH vote is not certain but HDFC has 57.8% of the 75% required.

This deal is really pricey, and some shareholders of Bandhan Bank who will get diluted have voted with their feet. It is a pretty great exit from GRUH for HDFC. While the prima facie evidence suggests that the deal was done to appease the RBI and get closer to the promoter shareholder limit required in October last year, the shareholder structure and CEO Ghosh’s own personal history suggests that neither the 40% rule nor the salary freeze are real hurdles (though the branch opening freeze may be something BBL wants to lift).

4. Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?

According to a local media outlet called Chosun Daily, it stated that one of the bankers in the deal (Deutsche Bank), already sent teaser letters of this deal to Tencent Holdings (700 HK) and KKR and in the teaser letter, it mentioned about potentially selling nearly 47% of Nexon Co Ltd (3659 JP) (Japan).

The question about whether or not Kim Jung-Joo decides to sell NXC Corp (Korea) or Nexon Co Ltd (3659 JP) (Japan) has important consequences not just for him and his family but also to the minority shareholders of Nexon Co Ltd (3659 JP). If Kim Jung-Joo decides to sell NXC Corp (Korea), there may not be much upside for the minority shareholders of Nexon Co Ltd (3659 JP) since current regulations do not require the buyers to pay potentially additional control premium to the minority shareholders as well.

However, if Kim Jung-Joo decides to sell Nexon Co Ltd (3659 JP) (Japan), there may be an opportunity for the minority shareholders to gain from an additional control premium. We think that this is one of the reasons why Nexon Co Ltd (3659 JP) shares are up 13% YTD as some of the investors may think that there could be a higher probability that Kim Jung-Joo ends up selling Nexon Co Ltd (3659 JP) (Japan), instead of NXC Corp (Korea).

5. A Pricey Deal in Hindsight, Walmart? India Reviews Policy – Amazon, Walmart May Need to Rejig Model

Would Wal Mart Stores (WMT US) have paid USD16 bn last year for Flipkart, a leading online Indian retailer, if the recent clarification on India’s policy on FDI in e-commerce were in place back then? Foreign owned online retailers in India ( Amazon.com Inc (AMZN US) , Wal Mart Stores (WMT US) and Alibaba Group Holding (BABA US) ) will need to rejig their operating models and may face prospects of slower growth and even more distant breakeven targets, if the Indian Government is indeed determined to enforce its policy that e-commerce ‘Marketplaces’ operate only as platforms for third party vendors. Unsurprisingly, Amazon.com Inc (AMZN US) and Wal Mart Stores (WMT US) have reportedly teamed up to lobby the government on these regulations.

The Indian Government had posted a one-page circular on Dec 26th giving further clarifications to its existing policy on foreign owned e-commerce entities. The detailing of policy specifics seems to be an attempt to enforce the existing policy restrictions on foreign owned online retailers; compliance has so far been sketchy. India do not allow majority foreign ownership in multi brand retail stores and online retailers are allowed to operate only as ‘Marketplaces’ and not as B2C entities. With national elections due in next few months, the Government cannot ignore demands from domestic lobby groups to reign in free play by deep pocketed foreign operators that have been hurting local retailers.

In the detailed note below, we present (1) an overview of the regulatory framework and restrictions under which online retailers operate in India (2) the updated policy and its impact on operating models of Amazon and Walmart in India (3) expectations for India’s e-commerce players. Also, there is a likely gainer from all these – a listed Indian player aspiring to trump global majors in India’s online retail turf.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.