In this briefing:

- Hansae Yes24 Holdings Stub Trade: Macy’s Lowered Guidance Will Revert Back 5Y High Holdco Discount

- Toshiba Buyback: Proceeding Apace, But That’s Slow

- GER Upcoming EVENTS Calendar

- M1 Offer Despatched – Dynamics Still Iffy

- DNO/Faroe – And That’s A Wrap

1. Hansae Yes24 Holdings Stub Trade: Macy’s Lowered Guidance Will Revert Back 5Y High Holdco Discount

- Hansae Yes24 Holdings Co, Ltd. (016450 KS) is a small cap holdco stock in Korea. Hansae Co Ltd (105630 KS) takes up half of Holdco NAV. Sub is Korea’s largest clothing OEM company. Holdco is currently at a 50% discount to NAV. This is the highest in 5 years. Discount was up nearly 10%p in the last 2 months.

- Sub is taking a hit today. The share is down 5.56% now. Holdco is down only 1.21%. Macy’s unpleasant guidance revision is pulling down Sub price. We are now a little above -1 σ on a 20D MA. Sub shares have rebounded lately with the expectation on improving margins in the US. But weak holiday sales numbers in the US would be more than enough to kiss off this expectation.

- I’d initiate a stub trade even though the duo has narrowed the gap today. It is still a long way to get reverted back to where they were two months ago.

2. Toshiba Buyback: Proceeding Apace, But That’s Slow

In November 2017, Toshiba Corp (6502 JP) bowed to the inevitable and issued shares in order to shore up shareholder equity ahead of the 31 March 2018 deadline where if the company had not announced a positive shareholder equity number, it would have been delisted according to the Enforcement Rules of the Tokyo Stock Exchange.

So it issued ¥600 billion of equity in an accelerated privately-negotiated placement to hedge funds. There was some jawboning later from domestic institutions who had not gotten the show on the deal, but they would do well to remember that when Toshiba was in dire straits earlier that year, and continued listing was not guaranteed because of accounting issues which were later overcome (before the equity issuance), it was the hedge funds who bought dozens of percent of the company – not domestic financial institutions. In any case, the equity was predictably needed, but as a way of making it clear that it would not be forever, the release accompanying the financing said the company would accelerate returns to shareholders once the sale of Toshiba Memory Corporation was complete.

That return of capital to shareholders was announced in June 2018 after the closing of the TMC transaction had been confirmed. Toshiba would buy back ¥700 billion of shares. At the time, that was up to 40% of shares outstanding, but the shares rose as the shares of companies with large buyback plans do, and it took until November to dot the “i”s and cross the “t”s on making sure that the cash in the bank account was deemed distributable capital surplus. On November 8th, a year after announcing the sale of equity, Toshiba announced the start of a Very Large Buyback. A few days later the company announced a large ToSTNeT-3 buyback, offering to buy back all ¥700 billion of shares the following morning at that day’s close. A week later the company had bought back ¥243 billion or more than 35% of the total buyback then announced further purchases would be made in the market.

That’s when the fun began.

For previous recent treatment on the Toshiba buyback, see the following:

Toshiba: King Street’s Buyback Proposals Lack Required Detail (5 Oct 2018)

Toshiba’s Buyback – How It Might Work (9 Nov 2018)

Toshiba’s ToSTNeT-3 Buyback: Unwinding? Another Game of 🐓? (12 Nov 2018)

Toshiba ToSTNeT-3: Round 2 (¥579bn To Go) (14 Nov 2018)

Toshiba ToSTNeT-3 Buyback Means 1/3 Done. Off To Buy In The Market Now! (21 Nov 2018)

Toshiba Buyback Update – Not Banging Down Doors To Get Stock Yet (3 Dec 2018)

3. GER Upcoming EVENTS Calendar

We have received requests to provide a calendar of upcoming catalysts for near-term M&A, stubs and erstwhile event-driven names. Below is a list of catalysts over the near-term for such names as below. If you are interested in importing this directly into Outlook or have any further requests, please let us know.

Kind regards, Rickin Arun and Venkat

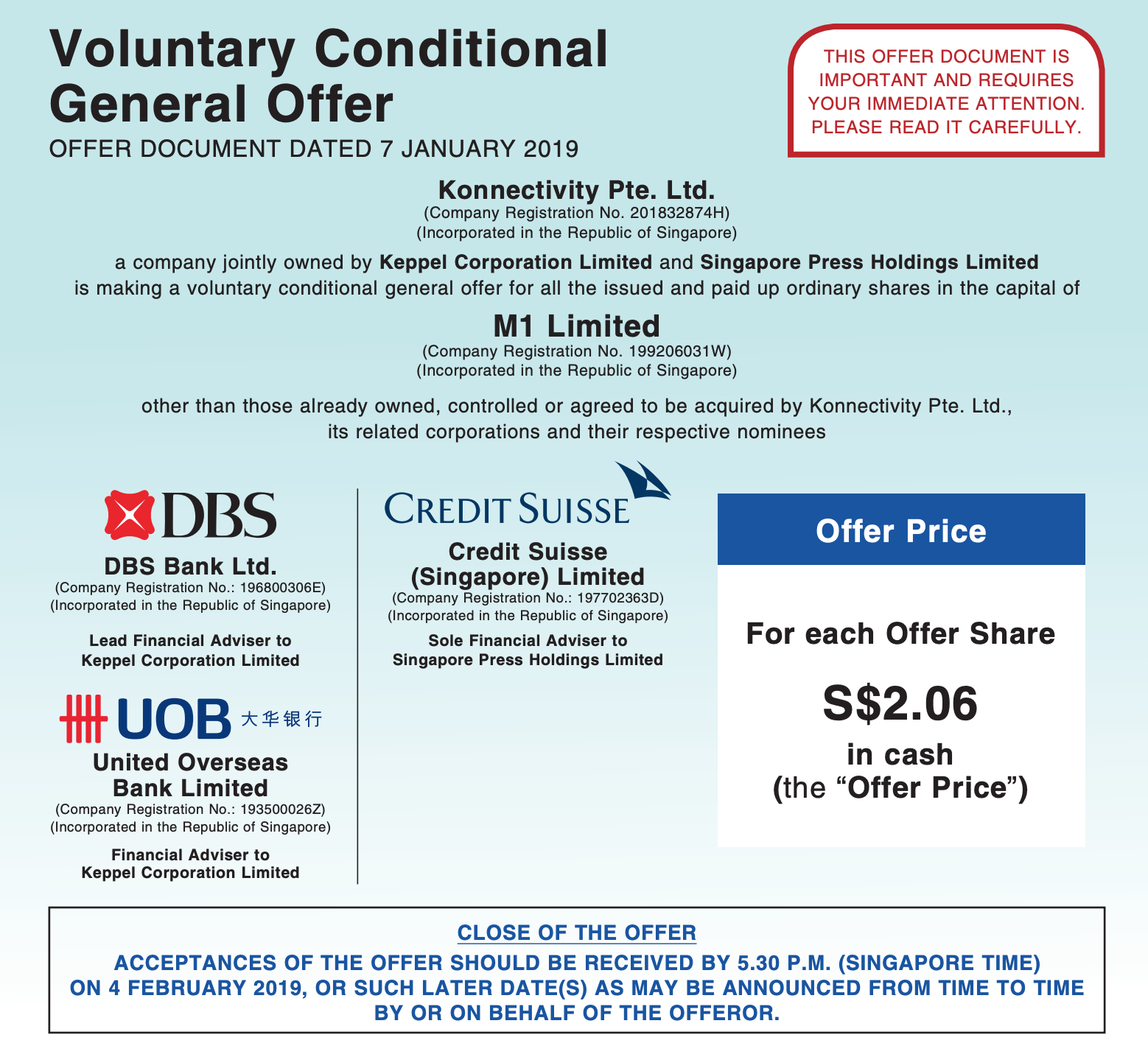

4. M1 Offer Despatched – Dynamics Still Iffy

On January 7th after the close of trading, Konnectivity Pte. Ltd officially announced the launch of its Offer to by M1 Ltd (M1 SP).

The closing date, as clear there, is 4 February.

After three-plus months of speculation that Axiata Group (AXIATA MK) was unhappy with the price and might make a counter-offer, no offer has been forthcoming.

After I wrote on the 2nd in M1 Offer Coming – Market Odds Suggest a Bump But… that the reward/risk did not look that great, shares drifted downward from the S$2.09-2.11 area and into the afternoon of the 7th, traded in the S$2.05-2.07 range, which was the first time in months the shares had traded at or below the prospective offer price.

Some 20mm+ shares (5.5% of the shares out other than the three major holders) traded between 3pm Singapore time on the 7th and a few minutes after the open the day after the announcement. Then part-way through the day, someone bought a large number of shares lifting the share price two spreads for a while. Since then, the shares have settled back down to the $2.07-2.08 range.

Depending on your opinion of the likelihood of a bump, your execution strategy will differ. It’s still not clear that a bump or counterbid will be forthcoming, but at S$2.07, the risks are better than they were higher.

5. DNO/Faroe – And That’s A Wrap

In my insight (DNO Closes In On Faroe) last week, I concluded a slight kiss to DNO ASA (DNO NO)‘s Offer for Faroe Petroleum (FPM LN), would get it over the line and this is exactly what transpired.

On January 8th, DNO referenced a statement made the previous day by the Norwegian Petroleum Directorate of a 30% reserves downgrade at Faroe’s Oda field from 47.2mn MMboe to 32.7 MMboe.

Shortly after that statement, on the same day, DNO capitalised on this negative newsflow and announced it had increased its (final) cash Offer to GBP 1.60/share, 5.3% above the initial Offer of GBP 1.52/share. DNO subsequently reported on January 9th that it had gained additional acceptances from shareholders representing ~8.65% of shares out, taking total acceptances to 52.44%. The offer will now become unconditional on January 11th (tomorrow) upon the settlement of these additional acceptances.

Despite open hostilities to the initial offer, Faroe’s board has now accepted the increased Offer and recommends shareholders tender.

Shares last closed at a price of GBP 1.61 and the final closing date is 1.00 p.m. (London time) on 23 January 2019.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.