In this briefing:

- Hankook Tire Worldwide Stub Reverse Trade: Massive Price Divergence Is Created Today

- (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

- Healius (HLS AU): Bid Rejection Provides Option Value

- Poongsan Holdings Stub Trade: Current Status & Trade Approach

- The GER Weekly EVENTS Wrap: Healius, FamilyMart, Healthscope, Myob and Hitachi

1. Hankook Tire Worldwide Stub Reverse Trade: Massive Price Divergence Is Created Today

- Hankook Tire Worldwide (000240 KS) is another local single sub dependent holdco in Korea. Hankook Tire (161390 KS) accounts for nearly 90% of the sub holdings. Holdco is now at a 35% discount to NAV. This is substantially better than the local peer average.

- Sub is taking a harsh hit now mainly on concerns over 4Q results. It is currently down 7% today. In contrast, Holdco is holding steady. It is rather up 1%. This is creating a massive price divergence. As of now, they are close to +3 σ on a 20D MA.

- Holdco’s real world float is much less than 10% of total shares. This often serves to help Holdco stave off market volatility like today’s. But this much divergence is a rare one. Sub’s current PER on FY19e is at 7x. This is 20% less than its usual level. It should be that Sub is being oversold.

- I’d make a very short-term trade at this point. I’d go short Holdco and long Sub for a quick mean reversion.

2. (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

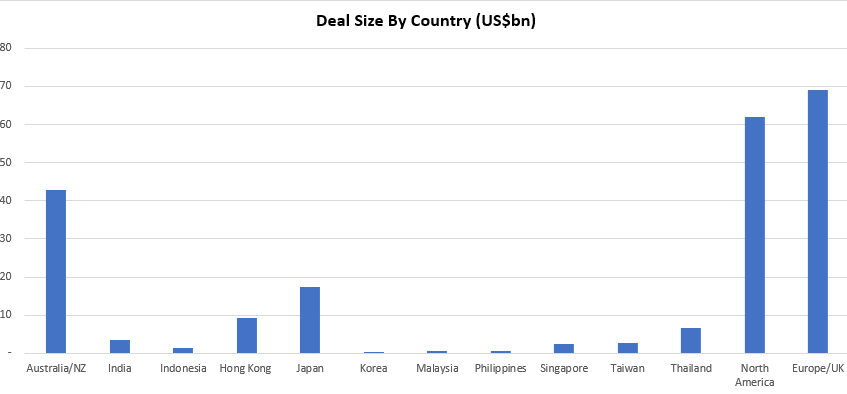

This insight briefly summarises the 93 M&A transactions, with a collective deal size of ~US$215bn, published on Smartkarma in 2018.

Transactions discussed were typically Asia-Pacific-centric or concerned an outbound transaction initiated from an Asia-Pacific-listed company. The majority of these deals involved a market cap/deal size in excess of US$100mn.

The mega deals of Takeda Pharmaceutical (4502 JP)/Shire PLC (SHP LN), Sprint Corp (S US)/T Mobile Us Inc (TMUS US) and Intl Business Machines (IBM US)/Red Hat Inc (RHT US) were first discussed in May, June and November respectively.

- The most generous country? The average premium for Australian and Hong Kong deals was almost identical at 38%.

- The stingiest? Singapore with 16%.

- The graveyard award? 49 deals were completed with 35 ongoing. Australia had four deals (out of a total of 29, the most for any country) that were abandoned for various reasons – such as CKI getting dinged by FIRB in its tilt for APA Group (APA AU). But in terms of outright fails, Hong Kong takes home that award following the failures in Pou Sheng Intl Holdings (3813 HK), Guoco Group Ltd (53 HK) and Spring Real Estate Investment Trust (1426 HK).

During the year a number of large, high profile transactions were completed that were also extensively analysed and discussed on Smartkarma. However, if the initial discussions between the two parties (acquirer & target) took place pre-2018, they are not included in the charts above. A selection of these include (in no particular order):

Broadcom Corp Cl A (BRCM US)/Qualcomm Inc (QCOM US)

Alps Electric (6770 JP)/Alpine Electronics (6816 JP)

Westfield Corp (WFD AU)/Unibail-Rodamco SE (UL FP)

Idemitsu Kosan (5019 JP)/Showa Shell Sekiyu Kk (5002 JP)

Orient Overseas International (316 HK)

3. Healius (HLS AU): Bid Rejection Provides Option Value

Healius (HLS AU), formerly known as Primary Health Care (PRY AU), is a leading Australian owner of GP clinics and pathology centres. Healius just took four days to reject Jangho Group Co Ltd A (601886 CH)’s 3 January 2018 proposal of A$3.25 cash per share as it “is opportunistic and fundamentally undervalues Healius.”

We believe that rejection of Jangho’s proposal provides shareholders with option value. If Healius’ growth initiatives generate value, we believe that the shares will be worth more than Jangho’s proposal. If Healius’ growth initiatives stall and the shares slide, we believe that Jangho will once again table a proposal.

4. Poongsan Holdings Stub Trade: Current Status & Trade Approach

- Poongsan Holdings (005810 KS) is another clear-cut target of stub trade in Korea. Poongsan Corp (103140 KS) is responsible for nearly 80% of the sub holdings. Holdco is currently at a 53% discount to NAV. Holdco discount has narrowed. But it is still substantially higher than the local average of 40%.

- Sub is having a run today. It went as high as 6% today. Currently, it is up 4%. Holdco is up 2%. They are now close to -1 σ on a 20D MA. Poongsan business is highly exposed to copper price and US ammunition demand. It still appears that Poongsan is suffering from a weaker copper price and falling demand of ammunition in US.

- I’d make a trade on a short-term horizon. I’d capitalize on a divergence on a 20D MA. I’d wait a bit until later today when there is a little greater price divergence on the duo. I’d make a stub trade when the price ratio on a 20D MA once again enters < -1 σ territory.

5. The GER Weekly EVENTS Wrap: Healius, FamilyMart, Healthscope, Myob and Hitachi

Happy New Year! Below is a recap of the key event-driven research produced by the Global Equity Research team. This week we dig into the potential low-ball bid for Healius (HLS AU) , we update our view on the messy deal between Familymart Uny Holdings (8028 JP) and Don Quijote Holdings (7532 JP) as the deal shifts to earnings dislocation. In addition, we question the economics of a material bump for Healthscope Ltd (HSO AU), assess the reduced bid (and great call by Arun) on MYOB Group Ltd (MYO AU) and finally dig into the potentially risky acquisition by Hitachi Ltd (6501 JP) of ABB Ltd (ABBN VX)‘s power grids.

The rest of our event-driven research can be found below

Best of luck for the new week – Rickin, Venkat and Arun

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.