In this briefing:

- GER Upcoming EVENTS Calendar

- M1 Offer Despatched – Dynamics Still Iffy

- DNO/Faroe – And That’s A Wrap

- Would a Sale of Founder’s Holdco NXC Corp Trigger a Tender Offer for Nexon (3659 JP)?

- StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

1. GER Upcoming EVENTS Calendar

We have received requests to provide a calendar of upcoming catalysts for near-term M&A, stubs and erstwhile event-driven names. Below is a list of catalysts over the near-term for such names as below. If you are interested in importing this directly into Outlook or have any further requests, please let us know.

Kind regards, Rickin Arun and Venkat

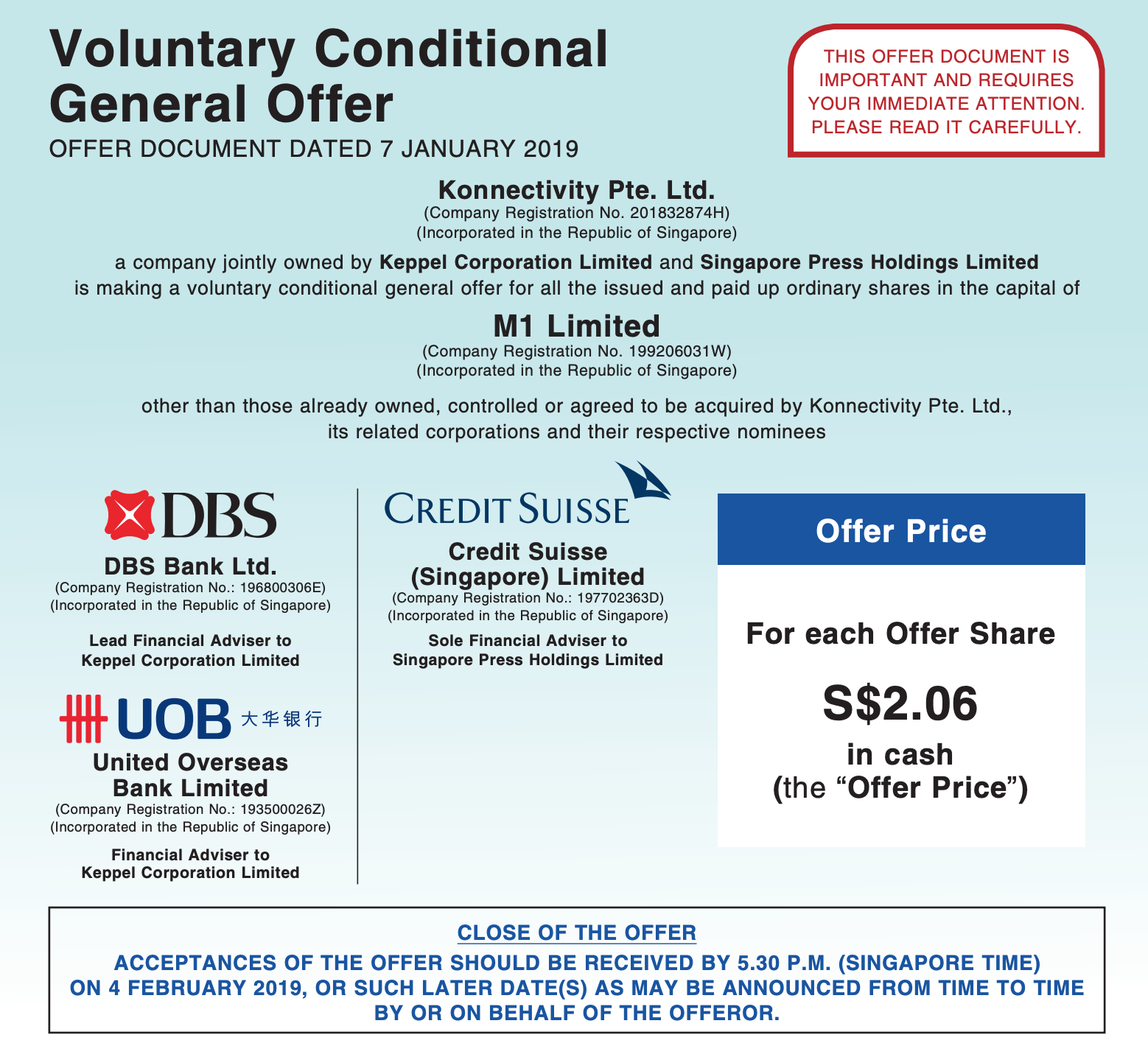

2. M1 Offer Despatched – Dynamics Still Iffy

On January 7th after the close of trading, Konnectivity Pte. Ltd officially announced the launch of its Offer to by M1 Ltd (M1 SP).

The closing date, as clear there, is 4 February.

After three-plus months of speculation that Axiata Group (AXIATA MK) was unhappy with the price and might make a counter-offer, no offer has been forthcoming.

After I wrote on the 2nd in M1 Offer Coming – Market Odds Suggest a Bump But… that the reward/risk did not look that great, shares drifted downward from the S$2.09-2.11 area and into the afternoon of the 7th, traded in the S$2.05-2.07 range, which was the first time in months the shares had traded at or below the prospective offer price.

Some 20mm+ shares (5.5% of the shares out other than the three major holders) traded between 3pm Singapore time on the 7th and a few minutes after the open the day after the announcement. Then part-way through the day, someone bought a large number of shares lifting the share price two spreads for a while. Since then, the shares have settled back down to the $2.07-2.08 range.

Depending on your opinion of the likelihood of a bump, your execution strategy will differ. It’s still not clear that a bump or counterbid will be forthcoming, but at S$2.07, the risks are better than they were higher.

3. DNO/Faroe – And That’s A Wrap

In my insight (DNO Closes In On Faroe) last week, I concluded a slight kiss to DNO ASA (DNO NO)‘s Offer for Faroe Petroleum (FPM LN), would get it over the line and this is exactly what transpired.

On January 8th, DNO referenced a statement made the previous day by the Norwegian Petroleum Directorate of a 30% reserves downgrade at Faroe’s Oda field from 47.2mn MMboe to 32.7 MMboe.

Shortly after that statement, on the same day, DNO capitalised on this negative newsflow and announced it had increased its (final) cash Offer to GBP 1.60/share, 5.3% above the initial Offer of GBP 1.52/share. DNO subsequently reported on January 9th that it had gained additional acceptances from shareholders representing ~8.65% of shares out, taking total acceptances to 52.44%. The offer will now become unconditional on January 11th (tomorrow) upon the settlement of these additional acceptances.

Despite open hostilities to the initial offer, Faroe’s board has now accepted the increased Offer and recommends shareholders tender.

Shares last closed at a price of GBP 1.61 and the final closing date is 1.00 p.m. (London time) on 23 January 2019.

4. Would a Sale of Founder’s Holdco NXC Corp Trigger a Tender Offer for Nexon (3659 JP)?

It was reported on January 3rd that Korean founder and heretofore effective controller of Nexon Co Ltd (3659 JP) Mr. Kim Jung-Ju and family, who exercise their ownership of Nexon through near 100% (98.64% according to Douglas Kim) control of NXC Corp (Korea) and NXC’s control of NXMH B.V.B.A (Belgium), planned to sell their stakes in NXC for up to 10 trillion won (US$8.9 billion).

Those two companies – NXC Corp (Korea) and NXMH (Belgium) – own 253.6mm shares and 167.2mm shares respectively, or direct and indirect ownership by NXC of just under a 48% stake in Nexon (3659 JP). Yoo Junghyun (Kim Jung-Ju’s wife) directly holds another 5.12mm shares at last look.

The speculation is that it might be sold to Tencent Holdings (700 HK) or another global buyer because it might be too big a mouthful to swallow for NCsoft Corp (036570 KS) and Netmarble Games (251270 KS), each of which have a market cap in the area of 10 trillion won themselves.

Nexon was founded in Korea in 1994 and moved its headquarters from Seoul to Tokyo in 2005, listing itself on the TSE in December 2011. The company is a well-known gamemaker (over 80 PC and online/mobile games), with famous games such as MapleStory, Dungeon & Fighter, and Counter Strike.

Douglas Kim has started the discussion of this situation in Korea M&A Spotlight: Nexon’s Founder Plans to Sell; Will Tencent Buy Nexon? and Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?.

The Korea Economic Daily said in its report on the 3rd of January that Deutsche Bank and Morgan Stanley had been selected as advisors to run a sale process, and a formal non-binding offer to potential bidders was expected next month. A Korea Herald article suggested that “potential buyers, according to industry speculation, include China’s Tencent, Korea’s Netmarble Games, China’s NetEase and Electronic Arts of the US.”

The Big Question

In the second piece, Douglas Kim questions whether Kim Jung-Ju would sell NXC (and NXMH) as reported by the local press, or whether NXC and NXMH would sell their stakes in Japan-listed Nexon, the implication being that if they sold the stake in Nexon, it would mean buyers would get a large stake in a single company, whereas there is a bunch of other stuff floating around in NXC and its subsidiaries.

The other question is whether Tencent or another buyer buying NXC would trigger a mandatory Tender Offer for the shares in Nexon in Japan. The letter of the law in the TOB Rules changed a bit over 10 years ago would indicate not, but there are questions (and precedents) here.

Discussion ensues.

5. StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

This week in StubWorld …

- With concerns over its tender offer for BGF Retail (282330 KS) now behind it, now may be the time for a BGF Co Ltd (027410 KS) setup.

- Kingboard Chemical (148 HK) gets a boost after buying properties from its major shareholder, however, the implied yield is uninspiring.

Preceding my comments on BGF and KBC are the weekly setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity threshold of US$1mn on a 90-day moving average, and a % market capitalisation threshold – the $ value of the holding/opco held, over the parent’s market capitalisation, expressed as a % – of at least 20%.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.