In this briefing:

- ZOZO – Buying a Stairway to Heaven

- Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

- Bleak Future for Indusind Bank

- Jamuna Bank: Clearing Electoral Uncertainties

- China Tower: More Details on Non Telco Growth Suggest Further Upside to Share Price

1. ZOZO – Buying a Stairway to Heaven

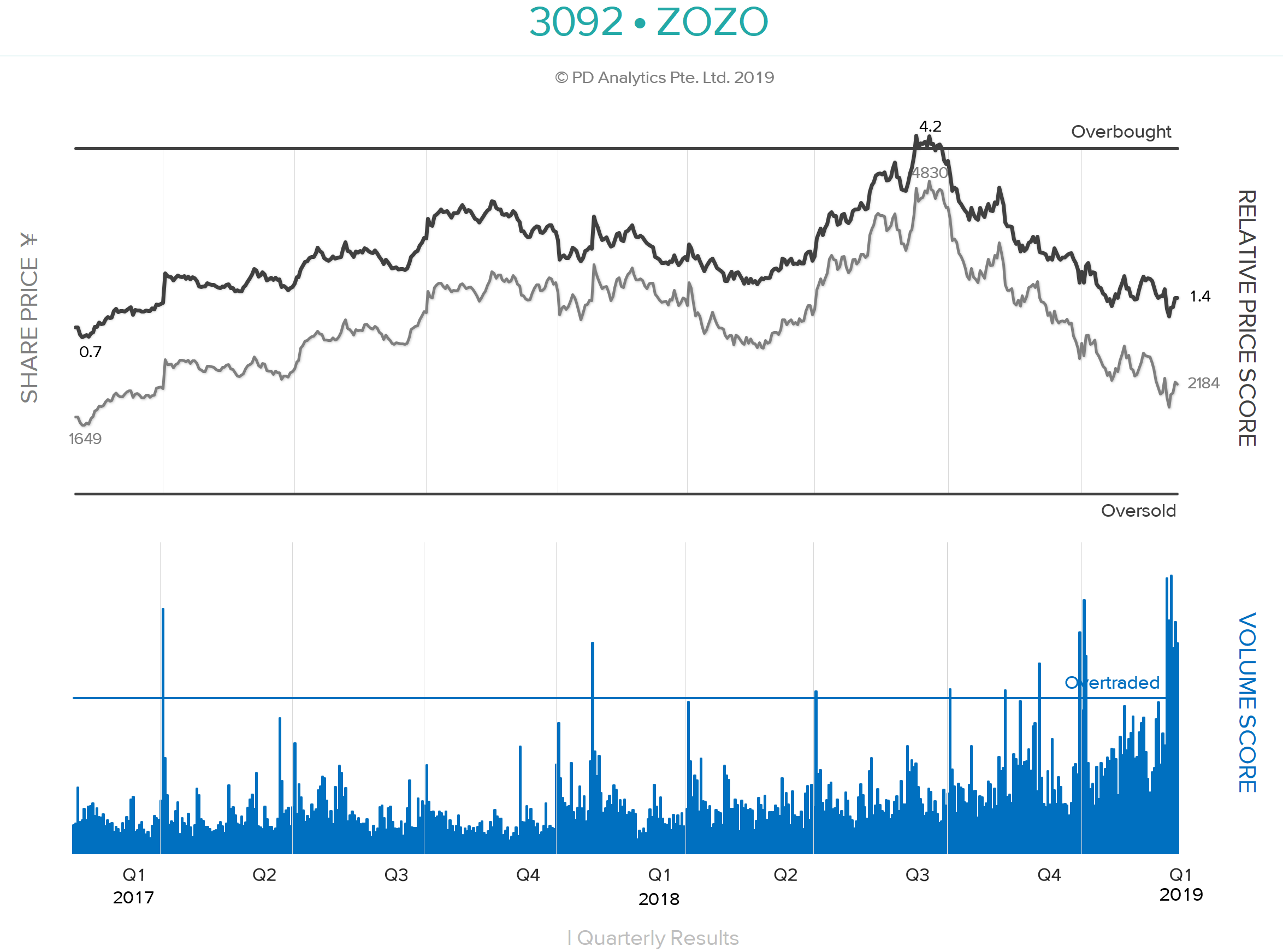

ONWARD AND OUT – ZOZO (3092 JP), formerly Start Today, has been the sixth-most-traded large capitalisation stock over the last ten trading days after Benefit One (2412 JP), Rizap (2928 JP), Takeda Pharmaceutical (4502 JP), Hoshizaki (6465 JP), and Workman Co Ltd (7564 JP). According to Nikkei XTECH, on 25th December apparel maker Onward (8016 JP) suspended selling of its products on ZOZOTOWN and will leave the platform altogether. Although Onward products are estimated to account for less than 3% of total transactions on the site, there are concerns that other apparel makers will follow suit as a result of the emerging direct competition on the site from ZOZO’s private label. Since reaching our 4.0 ‘Overbought’ threshold on 9th July 2018, ZOZO shares have corrected by 57% – the worst performance of any large cap from that date – as concerns mounted over the private brand strategy and the behaviour of CEO Yusaku Maezawa. Since bottoming on 4th January, the shares have risen by 18% following positive comments from the CEO about sales over the New Year holiday period.

PRIVATE-LABEL STRETCH GOALS– The ‘teething problems’ of ZOZO entering the private-label apparel business have been well-documented by Michael Causton in a recent Insight on Smartkarma. Michael rightly questions the feasibility of the company scaling a ¥200b apparel business within the next three years while targeting an additional incremental ¥400b in e-commerce revenue, particularly as it has taken ZOZO twenty years to reach the first ¥100b in annual revenues. In the DETAIL section below, we shall examine ZOZO’s current and possible future financial condition as it strives to become one of the top-ten global fashion retailers.

‘ZOSO’ & THE STAIRWAY TO HEAVEN – In addition to some notable purchases of modern art at record-breaking prices, CEO Maezawa also last year booked himself on Space X’s first flight to the moon. With apologies, the lyrics of the peerless song from Led Zeppelin’s untitled fourth album – known by fans as ‘Zoso’ after the symbol designed by Jimmy Page for the inner sleeve – come to mind:-

There’s a lad(y) who’s sure

All that glitters is gold

And (s)he’s buying a stairway to heaven

When(s)he gets there (s)he knows

If the stores are all closed

With a word (s)he can get what (s)he came for.

2. Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

Shares of E Mart Inc (139480 KS) are down 40% from their highs in March 2018 and we think this decline has been excessive. We believe the stock has bottomed and we expect a 20-30% upside on this stock over the next six months to one year (current share price is 193,500 won). At end of 3Q18, the company had 157 Emart hypermarkets and Traders warehouse supermarkets, of which 90% of their assets were owned by the company and 10% were leased. The company has the highest number of hypermarkets and warehouse supermarkets in Korea. The following are the major catalysts that could boost Emart shares by 20-30%+ in the next 6-12 months.

- Renewed focus on the company’s real estate value

- Upcoming IPO of Homeplus REIT in 2019

- Push back against a steep increase in minimum wages

- Success of Pierrot Shopping and a gradual reduction of unprofitable hypermarkets

3. Bleak Future for Indusind Bank

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank will eventually need to provide only 40-50% of this exposure and the bank has currently provided only 26.5%. The bank’s guidance on this appears to be as optimistic as its initial appraisal when it disbursed the loan, without any apparent scrutiny of the company’s financials. Shareholders in the bank need to be more realistic and factor a 100% write-off on the unsecured IL&FS exposure and need to examine all the bank’s loans more carefully for similar high-risk lending. The glory days of this once fancied stock are over and a bleak future beckons.

4. Jamuna Bank: Clearing Electoral Uncertainties

The Jamuna Bank Ltd (JAMUNABA BD) narrative is underpinned by a quintile 1 global PH Score™ and a low franchise valuation as well as a high Earnings Yield by global standards.

Established by a group of local entrepreneurs in 2001, experienced in trade, commerce, and industry, Jamuna Bank Ltd is the only Bengali named 3rd generation private commercial bank. JBL. has exhibited vibrant growth over 18 years. The Credit Rating Agency of Bangladesh classifies JBL as AA2 [very strong capacity and very high quality] for Long Term and ST-2 for Short Term.

JBL offers both conventional and Islamic banking. The Bank provides diverse services, encompassing trade, commerce, and manufacturing. The traditional focus has been on the corporate sector (especially textiles and manufacturing services) though SME lending and retail are fast-expanding. JBL is engaged with entrepreneurs in setting up enterprise ventures and BMRE of existing industrial units. Operations are centred on Dhaka and Chittagong though Rajshahi is an important market too.

All 122 branches are running with real-time online capacity while the bank has 243 ATMs, sharing with other partner banks and consortium throughout Bangladesh. In addition, JBL is a Primary Dealer of government. securities.

While the economy is in a relatively stable state, the Banking Sector presents a highly mixed picture. Funding and liquidity are adequate in the Banking System in general. At the main listed entities, ROA and ROE stand at around 1% and 12%. Capitalisation targets are moving in the right direction though there is a shortfall at a number of lenders. The sector is weighed down by SOCB asset quality and poor governance which needs to be addressed as it exerts a distortionary impact across the system. SOCB NPL Ratio stands at around 30% and is probably worse than this versus around 10% for the system in general. The system stressed Loan/Investment Ratio is probably double this level. Worryingly, private sector bank defaults are rising at a fast clip as LDRs climb at the same time.

Shares of JBL stand on an Earnings Yield of 17.7%, a P/B of 0.94x, and a FV at 9%, below EM and global medians. A quintile 1 PH Score™ of 7.9 captures value-quality attributes. Combining franchise valuation and PH Score™, Jamuna Bank stands in the top decile of opportunity globally. Recent strong share performance is not unrelated to the clearing of electoral uncertainty. And there seems a real tailwind behind these shares of late.

5. China Tower: More Details on Non Telco Growth Suggest Further Upside to Share Price

After initially being very skeptical of the China Tower (788 HK) IPO given it is essentially a price take to its three largest shareholders, we changed our view in early December to a more positive outlook. What changed our view has been series of calls and meetings with the company that suggested a more shareholder friendly approach than expected and a real opportunity to reduce capex substantially through the use of “social resources” (e.g. electricity grid, local government sites). These can be used to deliver co-locations without building towers and poles and imply much lower capital intensity at a time when revenue growth will be accelerating as 5G is rolled out. Management has also given more detail on non-Tower business prospects which can generate higher returns (not under the Master Services Agreement). While small now (2% of revenue) they are growing rapidly. With lower capex than initially guided and a more shareholder friendly management (i.e. higher dividends are possible) we reduce the SOE discount and raise our forecasts (again). We remain at BUY with a new target price of HK$2.20

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.