In this briefing:

- Chinese Telcos: 5G Launches in 2019. Buy the 5G Beneficiary (China Tower).

- Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

- ZOZO – Buying a Stairway to Heaven

- Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

- Bleak Future for Indusind Bank

1. Chinese Telcos: 5G Launches in 2019. Buy the 5G Beneficiary (China Tower).

We highlighted in a recent note Chris Hoare‘s positive outlook for China Tower (788 HK). Our view takes into account the 5G build-out commencing this year, improved capex efficiency from using “social resources”, the rapid growth in non-tower businesses that lie outside the Master Services Agreement (MSA), and the valuation benefit from what looks like surprisingly investor friendly management.

This note focuses on four key issues facing the Chinese telcos in 2019:

- 5G capex (March) (this is by far the most important),

- Regulatory newsflow (February/ March),

- Operating trend improvements (August), and

- Emerging business opportunities driving future growth (August).

We remain positive on the telcos which trade at low multiples. China Unicom (762 HK) continues to trade at a discount, yet is most exposed to the positive story emerging at China Tower. We switch our top pick among the telcos from China Mobile (941 HK) back to China Unicom as a result. Alastair Jones thinks China Telecom’s (728 HK) premium multiple is at risk if management execution on the cost base doesn’t improve. It is our least preferred telco at this stage. Overall, we expect China Tower to outperform all telcos and it is our top pick. The upgrade to China Tower flows through the telcos (valuation and costs) and our new target prices are as follows: China Unicom to HK$14.4, China Telecom to HK$5.4 and China Mobile to HK$96.

2. Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

Accordia Golf Trust (AGT SP) has not been a great success story since its IPO in August 2014. The stock went to market at a unit price of 0.97 SGD and was recently traded at 0.53 SGD. If we include the dividends received since the IPO (0.2387 SGD) the ‘real‘ adjusted price is still only 0.76 SGD.

In the past we have attended several management meetings and the 2017 company AGM but were disappointed on multiple occasions by management that either 1) did not care, 2) did not know how or 3) was held back by other corporate Japanese factors from creating shareholder value.

Over the last six months several new developments are potentially creating a cocktail that could finally create sustained value for AGT unitholders:

- Appointment of new CFO who assures investors no repeat of “membership deposit debacle”

- New five-year funding secured from two lenders

- MBK Partners buys ORIX Golf Management

- Value investor Hibiki Path Advisors buys 6.2% of the company

- Clear focus on acquisitions and using its balance sheet strength

With its 2019 financial year ending in March, investors can be hopeful that its dividend in FY20 can grow to a minimum of 5 SGD cents suggesting a yield of 9.5%. If management injects assets a higher DPU is possible.

3. ZOZO – Buying a Stairway to Heaven

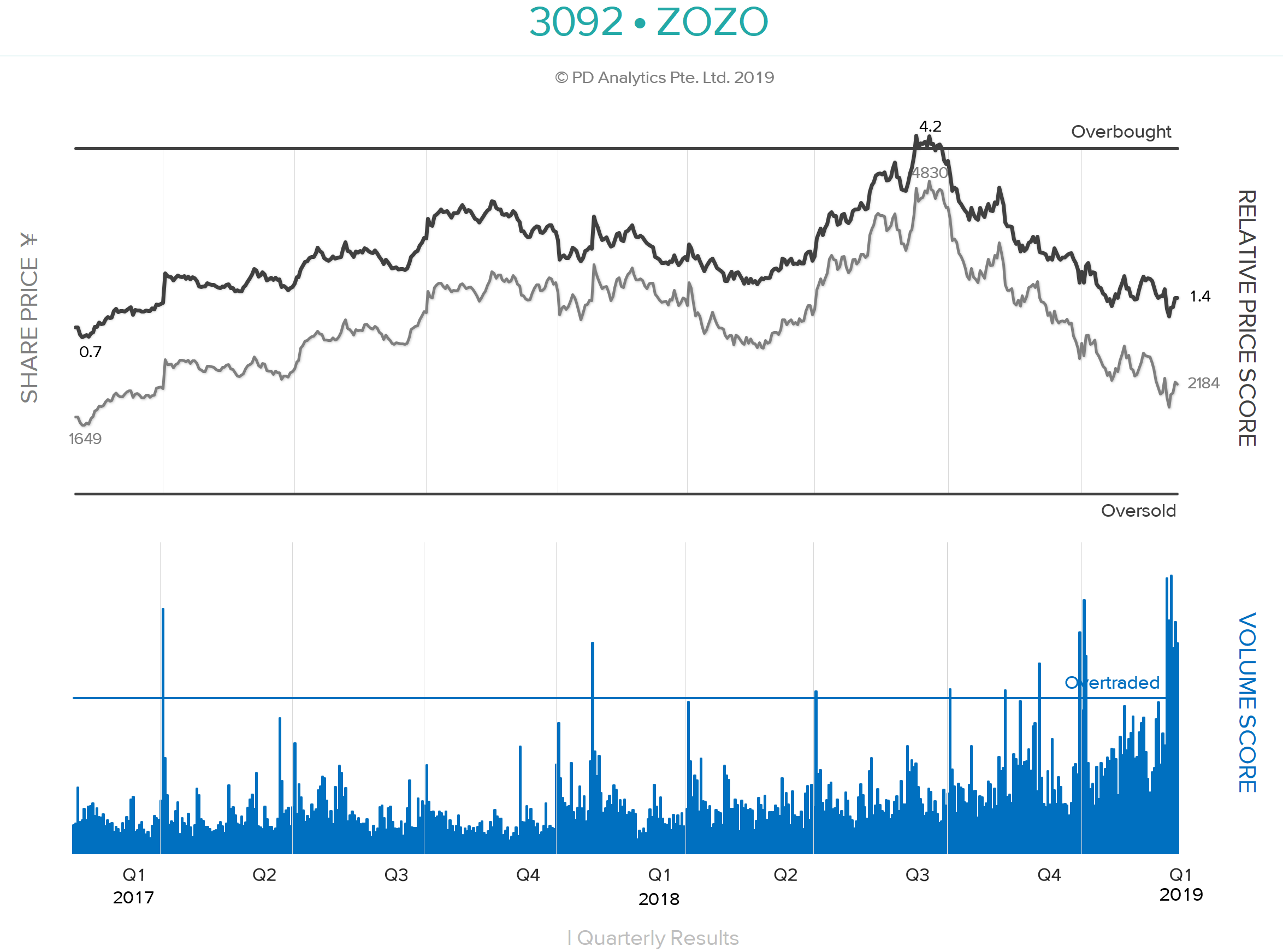

ONWARD AND OUT – ZOZO (3092 JP), formerly Start Today, has been the sixth-most-traded large capitalisation stock over the last ten trading days after Benefit One (2412 JP), Rizap (2928 JP), Takeda Pharmaceutical (4502 JP), Hoshizaki (6465 JP), and Workman Co Ltd (7564 JP). According to Nikkei XTECH, on 25th December apparel maker Onward (8016 JP) suspended selling of its products on ZOZOTOWN and will leave the platform altogether. Although Onward products are estimated to account for less than 3% of total transactions on the site, there are concerns that other apparel makers will follow suit as a result of the emerging direct competition on the site from ZOZO’s private label. Since reaching our 4.0 ‘Overbought’ threshold on 9th July 2018, ZOZO shares have corrected by 57% – the worst performance of any large cap from that date – as concerns mounted over the private brand strategy and the behaviour of CEO Yusaku Maezawa. Since bottoming on 4th January, the shares have risen by 18% following positive comments from the CEO about sales over the New Year holiday period.

PRIVATE-LABEL STRETCH GOALS– The ‘teething problems’ of ZOZO entering the private-label apparel business have been well-documented by Michael Causton in a recent Insight on Smartkarma. Michael rightly questions the feasibility of the company scaling a ¥200b apparel business within the next three years while targeting an additional incremental ¥400b in e-commerce revenue, particularly as it has taken ZOZO twenty years to reach the first ¥100b in annual revenues. In the DETAIL section below, we shall examine ZOZO’s current and possible future financial condition as it strives to become one of the top-ten global fashion retailers.

‘ZOSO’ & THE STAIRWAY TO HEAVEN – In addition to some notable purchases of modern art at record-breaking prices, CEO Maezawa also last year booked himself on Space X’s first flight to the moon. With apologies, the lyrics of the peerless song from Led Zeppelin’s untitled fourth album – known by fans as ‘Zoso’ after the symbol designed by Jimmy Page for the inner sleeve – come to mind:-

There’s a lad(y) who’s sure

All that glitters is gold

And (s)he’s buying a stairway to heaven

When(s)he gets there (s)he knows

If the stores are all closed

With a word (s)he can get what (s)he came for.

4. Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

Shares of E Mart Inc (139480 KS) are down 40% from their highs in March 2018 and we think this decline has been excessive. We believe the stock has bottomed and we expect a 20-30% upside on this stock over the next six months to one year (current share price is 193,500 won). At end of 3Q18, the company had 157 Emart hypermarkets and Traders warehouse supermarkets, of which 90% of their assets were owned by the company and 10% were leased. The company has the highest number of hypermarkets and warehouse supermarkets in Korea. The following are the major catalysts that could boost Emart shares by 20-30%+ in the next 6-12 months.

- Renewed focus on the company’s real estate value

- Upcoming IPO of Homeplus REIT in 2019

- Push back against a steep increase in minimum wages

- Success of Pierrot Shopping and a gradual reduction of unprofitable hypermarkets

5. Bleak Future for Indusind Bank

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank will eventually need to provide only 40-50% of this exposure and the bank has currently provided only 26.5%. The bank’s guidance on this appears to be as optimistic as its initial appraisal when it disbursed the loan, without any apparent scrutiny of the company’s financials. Shareholders in the bank need to be more realistic and factor a 100% write-off on the unsecured IL&FS exposure and need to examine all the bank’s loans more carefully for similar high-risk lending. The glory days of this once fancied stock are over and a bleak future beckons.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.