In this briefing:

- UG Healthcare: Weak 2Q19 Driven by One-Off Issue, If 10% NPM Achieved in FY20 Trades at 4x FY20 P/E

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

1. UG Healthcare: Weak 2Q19 Driven by One-Off Issue, If 10% NPM Achieved in FY20 Trades at 4x FY20 P/E

UG Healthcare (UGHC SP) showed good topline growth (+15%) but very weak bottom-line performance (-73%) in the second quarter of FY19 (financial year ending June). Weak bottom-line results were caused by delays and cost overruns in opening its latest factory expansion.

While the latest results are a setback I remain a believer in the UG Healthcare story. The eventual goal of reaching 100M SGD in revenues and getting a 10% NPM remains unchanged by the end of FY2020. Should the target be achieved the company trades at 4x 2020 P/E. Competitors in Malaysia trade at mid-teens multiples (or higher) so UG should deserve a significant re-rating the coming two years. Fundamentally, nothing has changed to alter my bear case (0.24 SGD), base case (0.39 SGD) or blue-sky scenario (0.62 SGD) analysis. Liquidity remains an issue at less than 25K SGD/day.

2. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

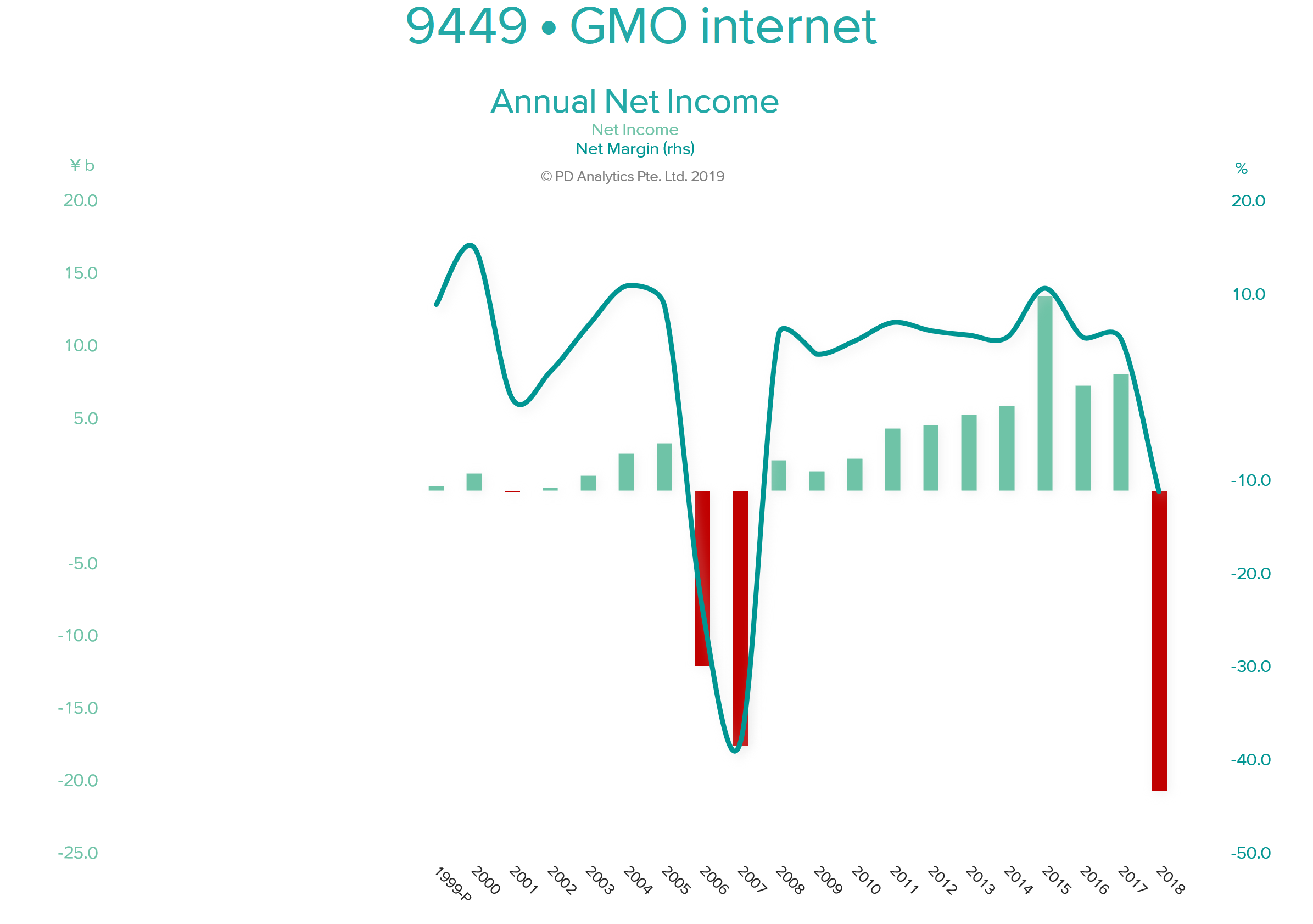

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.