In this briefing:

- UG Healthcare: Weak 2Q19 Driven by One-Off Issue, If 10% NPM Achieved in FY20 Trades at 4x FY20 P/E

- GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

- Recruit Holdings Reports Strong 3Q Results; Remains Expensive

- Facebook Inc. – Is Consensus Overly Cautious?

- GMO Internet Reports Solid FY12/18 Despite Heavy Losses Incurred in Crypto Mining Business

1. UG Healthcare: Weak 2Q19 Driven by One-Off Issue, If 10% NPM Achieved in FY20 Trades at 4x FY20 P/E

UG Healthcare (UGHC SP) showed good topline growth (+15%) but very weak bottom-line performance (-73%) in the second quarter of FY19 (financial year ending June). Weak bottom-line results were caused by delays and cost overruns in opening its latest factory expansion.

While the latest results are a setback I remain a believer in the UG Healthcare story. The eventual goal of reaching 100M SGD in revenues and getting a 10% NPM remains unchanged by the end of FY2020. Should the target be achieved the company trades at 4x 2020 P/E. Competitors in Malaysia trade at mid-teens multiples (or higher) so UG should deserve a significant re-rating the coming two years. Fundamentally, nothing has changed to alter my bear case (0.24 SGD), base case (0.39 SGD) or blue-sky scenario (0.62 SGD) analysis. Liquidity remains an issue at less than 25K SGD/day.

2. GMO.internet FY2018 Results – The Shareholder’s [Re]Turn

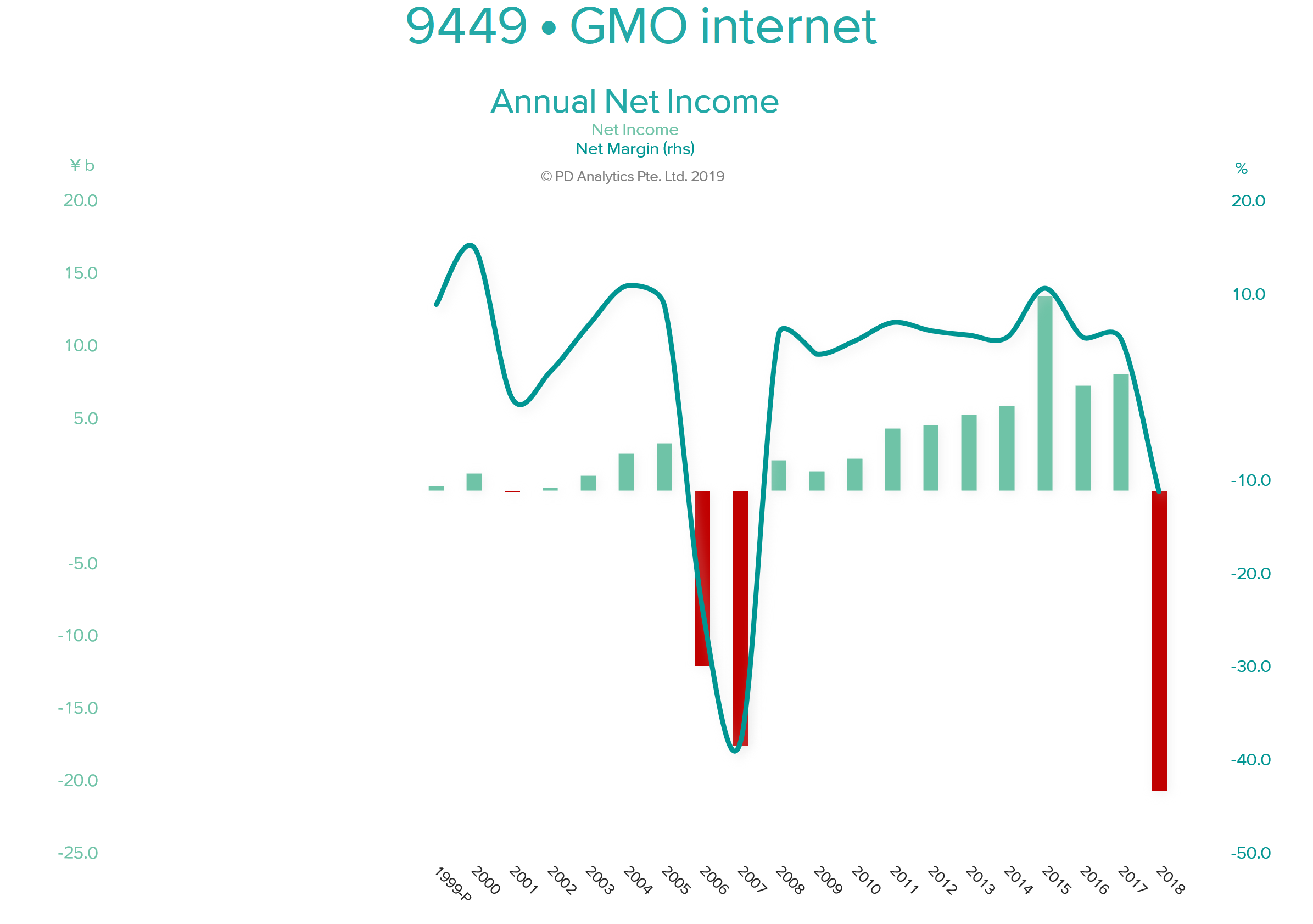

GMO internet (9449 JP) released 2018 full-year results in 12th February. 2018 was a turbulent year for the company as it ‘surfed’ the cryptocurrency wave. The subsequent downfall was swift and brutal. However, the company deserves some plaudits for cutting its (substantial) losses and attempting to move on (albeit somewhat half-heartedly). Unfortunately, GMO-i has ‘form’ in writing off large losses as shown above. The positive consequence of this saga is a renewed commitment to return value to shareholders with a stated aim of returning 50% of profits. Two-third of that goal is to be met by quarterly dividends, with the balance allocated to share repurchases in the following year.

Having royally ‘screwed up’ with ‘cryptocurrencies’, and trying the patience of remaining shareholders yet again, this policy is to be commended, particularly if more attention is paid to generating the wherewithal to meet the 50% without raiding the listed subsidiaries’ ‘piggy bank’. Apart from the excitement that this move has generated and the year-long support this buying programme will provide to the share price, our two valuation models, find little in the way of further upside potential.

We remain sceptical of investing in GMO-i over the long-term and prefer GMO Payment Gateway (3769 JP) – the best business in the GMO-i ‘stable’ – but consider GMO-PG’s stock overvalued at 57x EV/OP.

3. Recruit Holdings Reports Strong 3Q Results; Remains Expensive

Recruit Holdings (6098 JP) reported its 3Q FY03/19 financial results on Wednesday (13th February). Recruit’s revenue and EBITDA were up 6.0% YoY and 11.1% YoY respectively in 3Q FY03/19. This was mostly due to 1) consolidation of the results of Glassdoor Inc. (the company which operates the employment information website glassdoor.com), 2) steady growth in Japanese staffing operations and 3) growth in beauty and real estate app users during the quarter, partially offset by slowdown in global recruitment activity.

Despite its strong 3Q results and steady topline and bottom line growth over the forecast period, at a FY2 EV/EBITDA multiple of 16.0x, Recruit doesn’t look particularly attractive to us. Recruit’s internet advertising business and employment business peers, Yahoo Japan (4689 JP) and Persol Holdings (2181 JP) are trading at FY2 EV/EBITDAs of 6.8x and 7.5x respectively.

| FY03/18 | FY03/19E | FY03/20E |

Consolidated Revenue (JPYbn) | 2,171 | 2,327 | 2,478 |

YoY Growth % | 11.9% | 7.2% | 6.5% |

Consolidated EBITDA (JPYbn) | 258 | 288 | 312 |

EBITDA Margin % | 11.9% | 12.4% | 12.6% |

4. Facebook Inc. – Is Consensus Overly Cautious?

Facebook Inc A (FB US) is a bellwether stock for the equity markets. Although the market capitalisation is approaching $475 billion, the Company is still considered a growth stock. In our view, 2019 could be a pivotal year for the Company after a lack lustre 2018, when FB, although volatile, underperformed the NASDAQ. We believe that investors are underestimating revenue growth for 2019 and that FB is likely to surprise to the upside in Q1-19.

5. GMO Internet Reports Solid FY12/18 Despite Heavy Losses Incurred in Crypto Mining Business

GMO Internet, Inc. (9449 JP) announced its consolidated financial results for its full-year FY12/18 yesterday (12th February). Despite heavy losses incurred in the cryptocurrency mining business in FY12/18, GMO managed to achieve a solid year with 20% YoY growth in top-line alongside a 23.5% YoY growth in operating profits. Excluding the crypto losses, the operating profit increased 35.7% YoY, with an OPM of 13.2% compared to 11.4% reported a year ago. For the full-year, the company has reported a net loss of JPY20.7bn as opposed to a net profit of JPY8bn in FY12/17, blaming the crypto losses for the decline. For FY12/18, the management has proposed a dividend of JPY29.5 per share (compared to JPY23 paid in FY12/17) in spite of reporting net losses for the fiscal year. Further, the company has also allocated JPY1.36bn (equivalent to 0.7% of outstanding shares at the current price) for share repurchases in FY2019.

JPY (bn) | FY12/17 | FY12/18 | YoY Change | FY12/18 Excluding Crypto | FY12/18 Excl. Crypto Vs. FY12/17 | Consensus | Company Vs. Consensus |

Revenue | 154.3 | 185.2 | 20.1% | 180.9 | 17.3% | 183.3 | 1.0% |

Operating Profit | 17.6 | 21.8 | 23.5% | 23.9 | 35.7% | 22.8 | -4.5% |

OPM | 11.4% | 11.8% |

| 13.2% | 12.4% |

| |

Net Profit | 8.0 | -20.7 | -357.9% | 8.4 | 4.1% |

|

|

GMO is currently trading at JPY1,741 per share which we believe is undervalued compared to its combined equity stake in 8 listed subsidiaries. The company share price has lost more than 40% since it peaked in June last year due to the negativity surrounding its cryptocurrency and mining segment. However, we believe further downside is limited as the company has closed down a majority of its mining related business which weighs very little on the consolidated performance of the company. Further, the company’s key businesses, Internet Infrastructure, Online Advertising & Media and Internet Finance generate solid recurring revenues, which should help the company achieve strong growth. Following its earnings announcement, the share price gained 5.6% from the previous days close.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.