In this briefing:

- Silverlake Axis (SILV SP): 2Q19 Results Again Confirm New 3-Year Growth Cycle; HNA Overhang Removed

- Donaco International Ltd: A Tiny Cap, Low Price Entry Bet on the Bourgeoning Cambodia Gaming Market

- Musashino Bank (8336 JP): Braking Bad

- THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

1. Silverlake Axis (SILV SP): 2Q19 Results Again Confirm New 3-Year Growth Cycle; HNA Overhang Removed

Silverlake Axis (SILV SP) published 2Q19 results which again confirmed that the long-anticipated rise in revenues (+20% YoY) and profits (+99% YoY) has finally arrived. After three years of stagnation, this is the second quarter in a row that real earnings growth is visible.

YTD the share price of SILV has run by approximately 31% as we saw some larger volume spikes earlier this year which indicate that HNA is now finally off the register as a significant shareholder. Since HNA’s stake had dropped below 5% the new buyer has not had to step forward and disclose its identity.

Importantly, management believes the first half of FY19 was just the beginning of a new 3-year growth cycle and prospects are looking good for both FY2019 (ends June 2019) and FY2020 (ends June 2020). Dividends will continue but might be tempered depending on the number of acquisitions that are made.

Risk-Reward is not as attractive as early November but continues to look solid at these levels with a total return of 20% still achievable (assuming mid-point of historical P/E range) or a total return of 60% (assuming high-end of historical P/E range).

2. Donaco International Ltd: A Tiny Cap, Low Price Entry Bet on the Bourgeoning Cambodia Gaming Market

- The company’s flagship Star Vegas casino resort was victimized by an alleged diversion of VIP players by its contract management. Now under corporate control it is beginning to recover.

- Its US$124m breech of contract claim against the vendor was filed in there Singapore court system and sits at final appeal stage.

- Cambodia’s new gaming regulation law will stabilize and eliminate wild west dimension of Poipet casinos. This could lead to major earnings gains and increased investment going forward.

3. Musashino Bank (8336 JP): Braking Bad

Musashino Bank (8336 JP) was one of the last regional banks to announce 3Q FY3/2019 results, and they were a nasty surprise: a consolidated net loss for the nine months to 31 December 2018, caused by heavy reserving in Q3 (October-December 2018) against the bank’s exposure to the troubled Akebono Brake Industry Co (7238 JP) . While the bank has slashed its full-year net profit guidance from ¥11.1 billion to ¥4.5 billion, this would still require an heroic level of profits in Q4 which the bank has never before achieved. The share price has fallen over 31% in the last twelve months. Valuations at current levels are still high (FY3/2019 PER is 17.6x) and we consider the share price to be vulnerable to further weakness. Caveat emptor (May the buyer beware) !

4. THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

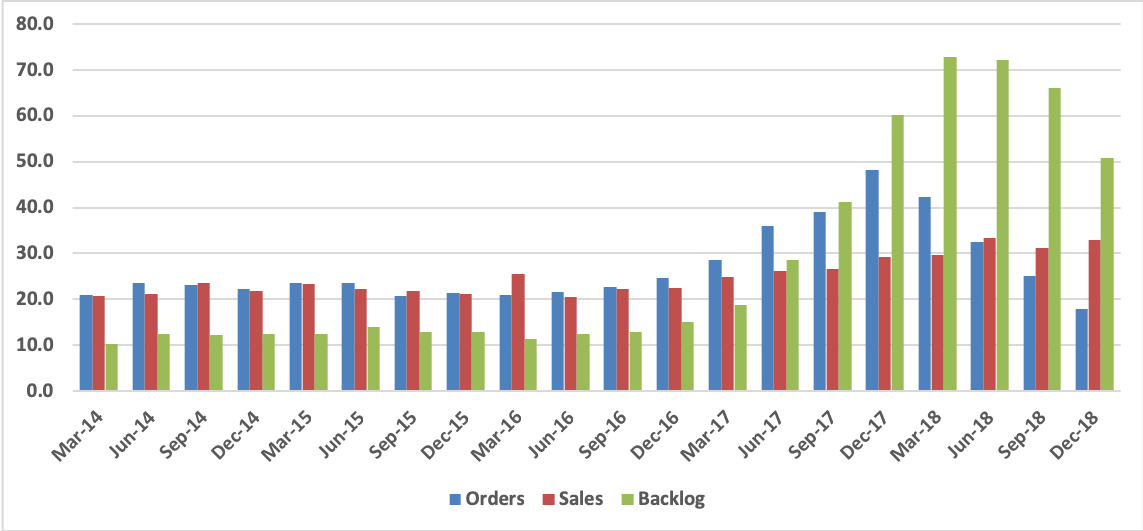

Sales and profits were above management’s guidance in FY Dec-18, with operating profit rising 36.9% on a 10.9% increase in sales. But new orders continuously declined and were down about two-thirds year-on-year in 4Q.

In view of the order flow, management is guiding for a 12% decline in sales and a 44% decline in operating profit in FY Dec-19, a forecast that is roughly in line with our own.

On the positive side, historical data indicates that new orders are at or near the bottom of the cycle. Anticipating a better investment climate after some resolution of the U.S.-China trade problem, we are forecasting an increase in sales and profits going into FY Dec-20.

The shares have rebounded by 41% since the beginning of January. At ¥2,720 (Friday, February 15, close), they are selling at 15.6x our estimate for FY Dec-19 and 13.8x our estimate for FY Dec-20E. These multiples look reasonably attractive in comparison with the company’s recent P/E range.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.