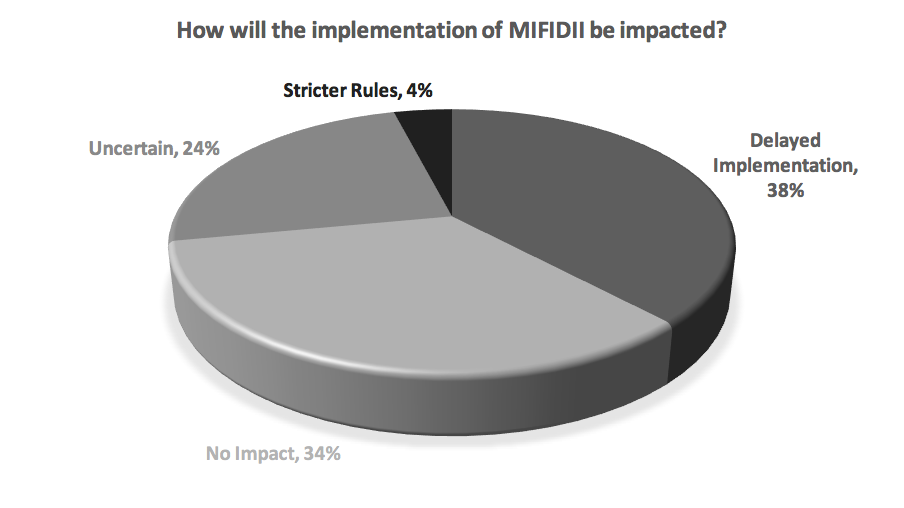

The impact of MIFIDII on investment research has been widely discussed in recent months by the financial press.

Some investment firms, including M&G, have recently announced that they will no longer charge clients for conducting broker research, opting instead to pay for research out of their own resources. This move could signal a revolutionary change in the way that investment research is bought and sold within Europe.

Other major players have said that they will continue to operate in much the same way as today, choosing only to implement those changes mandated by MIFIDII.

With little time to go before MIFIDII comes into effect, investors are eager to know whether the legislation will bring evolution or revolution to the investment research landscape.

The Shortcomings of the Current European Investment Research Landscape

Since the 2008 financial crisis shook the European financial markets, EU policymakers have sought to implement financial legislation that regulates the robustness of Europe’s financial markets.

Measures to introduce greater transparency into the European financial sector have been at the heart of the MIFIDII project. Once MIFIDII comes into effect in January 2018, asset managers will be required to separate research payments from execution costs. If the firm wishes for a client to pay for research, fund managers will be expected to report on the individual research providers paid from the account, the amount they receive over a given time period, and the services they provide.

This degree of transparency is unprecedented within Europe and is expected to inject much-needed innovation into the industry.

In 2012, the UK’s Financial Conduct Authority (FCA) estimated that £1.5bn of investors’ money – over and above charges that savers had previously agreed to pay to fund managers – was spent on investment research in the UK.

The FCA further estimates that European investment managers spent £3bn of clients’ money on dealing commissions in 2012 and that those same investment managers received £1.5bn back in the form of investment research.

“It may have cost investors £1.5bn, but it is commonly acknowledged that much of it is valueless and even some of the research providers will admit, off the record, that 90% of it is never read by anybody,” said Daniel Godfrey (former chief executive of the Investment Association) in a recent article by FT.com.

The investment research landscape within Europe is currently dominated by investment banks. Most research comes in the form of buy/sell/hold notes delivered by email.

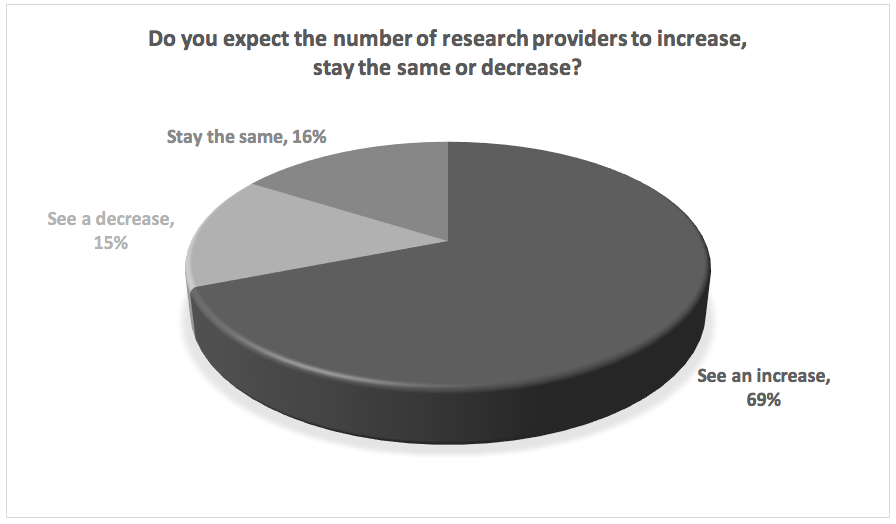

Many speculate that the firms best poised for growth in the new European regulatory landscape are not investment banks, but independent research providers.

Independents that provide focused, reliable and relevant insights at a reasonable rate are expected to be an appealing alternative for investors once MIFIDII comes into effect.

Investment banks who continue to charge a premium for research to sustain bureaucratic operational processes and overstaffed research teams will need to rethink their existing processes to remain competitive.

“With transparency comes responsibility for asset managers. Access to large volumes of bundled “research” of questionable quality will cease, and managers will need to carefully assess both the value add of the research they are paying for and the value for money of that research,” remarks Jon Foster, Co-Founder of Smartkarma.

“Valuable and differentiated research plays to the strengths of independent analysts. Value for money however is less obvious in a fragmented market place. By providing an efficient platform, Smartkarma brings true economies of scale across the industry whilst preserving the vibrancy of an independent community with different skills and opinion,” Foster adds.

For more on MIFIDII and our coverage of the rise of independent research providers in Europe, read our blog post here.