In this briefing:

- Memory Chips and the Elasticity Myth

- PRM: Thai Largest Tanker Fleets Assured of Consistent Growth

- IPO Stalker: SISB’s Growth Plans

- RRG Global Macro Weekly – Election Volatility Expected in India, Indonesia and Thailand

- SYNEX: New Smartphone Launches Help Drive Earnings Momentum in 2019

1. Memory Chips and the Elasticity Myth

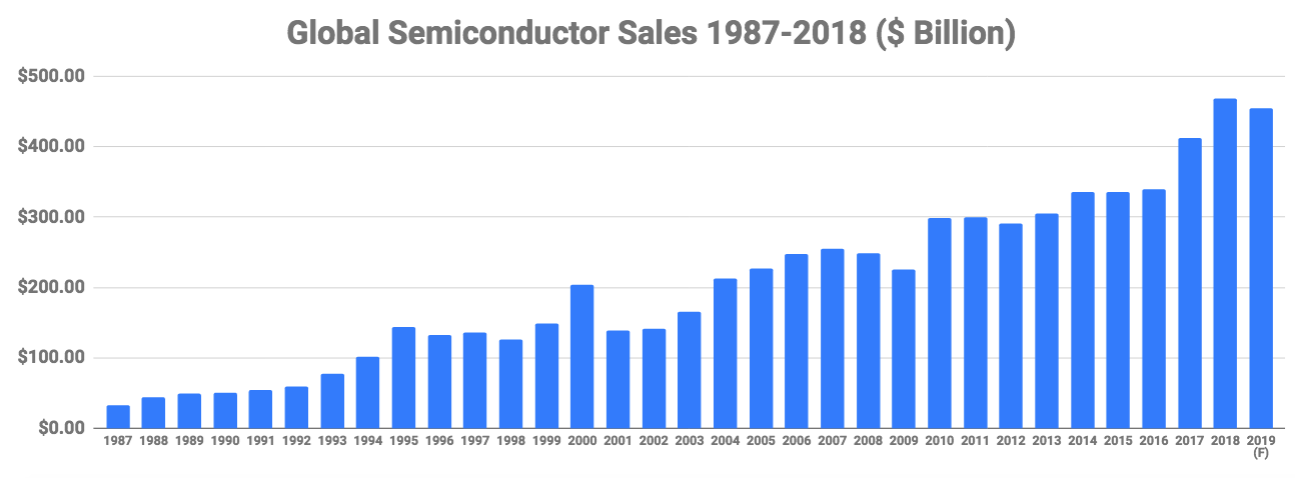

During recent earnings calls memory chip makers have postulated that the market will return to higher margins once price elasticity causes demand to increase. This popular myth needs to be treated with great skepticism since, as this Insight will reveal, short-term price elasticity has a negligible impact upon memory chip sales if it has any impact at all.

2. PRM: Thai Largest Tanker Fleets Assured of Consistent Growth

We initiate coverage of PRM with a BUY rating, based on a target price of Bt7.70, derived from a PEG ratio of 0.9x, which is the average for the Asia ex-japan transportation sector, implying 22.0x PE’19E.

The story:

- Secured revenue from domestic trading business

- IMO 2020 implementation to propel floating storage demand

- Recovery in T/C rate should prompt international trading turnaround

Risks: Lower-than-expected domestic oil consumption and trading activities in ASEAN, foreign currency and fuel cost fluctuations

3. IPO Stalker: SISB’s Growth Plans

SISB has been one of the best investments in our portfolio, rising 26% since we jumped in shortly after the IPO. Founder Kelvin Koh reiterated the strengths in his prospectus (English-Chinese language, affordability, own brand) and backs it up with:

- positive stats and trends. 7.8% CAGR in international students, growth in high net worth Thais (11.4% CAGR) and expat population (6.9% CAGR) all of which are supportive of the business.

- expansion plans both abroad and domestic. A Bt70m investment in the Thonburi site as well as talks to potentially set up new campuses in China and/or CLMV region.

- Financials. An almost sixfold jump in earnings from Bt18m in 2017 to Bt103.5m in 2018 primarily due to its high operating leverage and now debt-free status after the IPO.

- favorable operating environment. High availability of Caucasian teachers in Thailand and growing Chinese expat community due to China’s increasing environment.

4. RRG Global Macro Weekly – Election Volatility Expected in India, Indonesia and Thailand

- Volatility set to rise as Thailand, Indonesia and India all Face ElectionsRussia: Michael Calvey, a US citizen and one of Russia’s most prominent foreign investors, has been detained.

- Indonesia: Incumbent President and his challenger from the military are trying to outdo each other in spending largesse targeting rural poor ahead of the May election.

- South Africa: Recent inflation readings have been the lowest in a long time on lower fuel expenses. Expected to stay low.

5. SYNEX: New Smartphone Launches Help Drive Earnings Momentum in 2019

SYNEX’s 4Q18 net profit was at Bt190m (+16%YoY, +18QoQ), in-line with our expectation

- Record-high level of sales at Bt10.38bn is the major contributor to impressive 4Q18 performance. Meanwhile , gross margin drops below 4% in the first time due to changing product mix towards more on device segment

- SYNEX post 2018 net profit of Bt721m (+15%YoY) driven by 18% increase in revenue

- We maintain our positive view toward FY19-20E earnings outlook driven by (1) number of flagship smartphone model launches and new brands for low budget users, Neffos, and, (2) higher sales contribution from high-margins product such as gaming desktops and post-sales services.

We maintain our BUY rating with a new target price of Bt16.80 (previous target price at Bt15.0) derived from 17xPE’2019E, which is the average of the World information and technology sector

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.