In this briefing:

- More Volatility in the LNG Markets as JKM Drops Below TTF – Oil Majors Increase Exposure to US LNG

- What Next in the Inflation / Deflation Debate and What Does It Mean for Asset Prices?

- Monthly Geopolitical Comment: Markets Are Still Waiting for the Result of US-China Trade Talks

- RHT Health Trust – 40.7% Net Returns Since Jan. Is There Any Upside Left?

- Yinson Tenders a Lifeboat for Ezion

1. More Volatility in the LNG Markets as JKM Drops Below TTF – Oil Majors Increase Exposure to US LNG

The JKM has halved its value since December, continuing its steady decline and dropping below the TTF, the benchmark for European LNG prices. Asian LNG spot prices are now at their lowest level since May 2015. While a prolonged LNG price downturn could force many projects to be cancelled, the winners among the developers are starting to emerge, aggressively pushing ahead their projects closer to the final investment decision.

Both Tellurian Inc (TELL US) and NextDecade Corp (NEXT US) signed high-profile deals, respectively with Total Sa (FP FP) and Royal Dutch Shell (RDSA LN), that could significantly de-risk their proposed LNG projects and increase the probability to reach FID in 2019. In Russia, LNG newcomer Novatek PJSC (NVTK LI) agreed two long-term offtake deals with Repsol SA (REP SM) and Vitol thereby moving a step closer to FID its Arctic LNG 2 project.

2. What Next in the Inflation / Deflation Debate and What Does It Mean for Asset Prices?

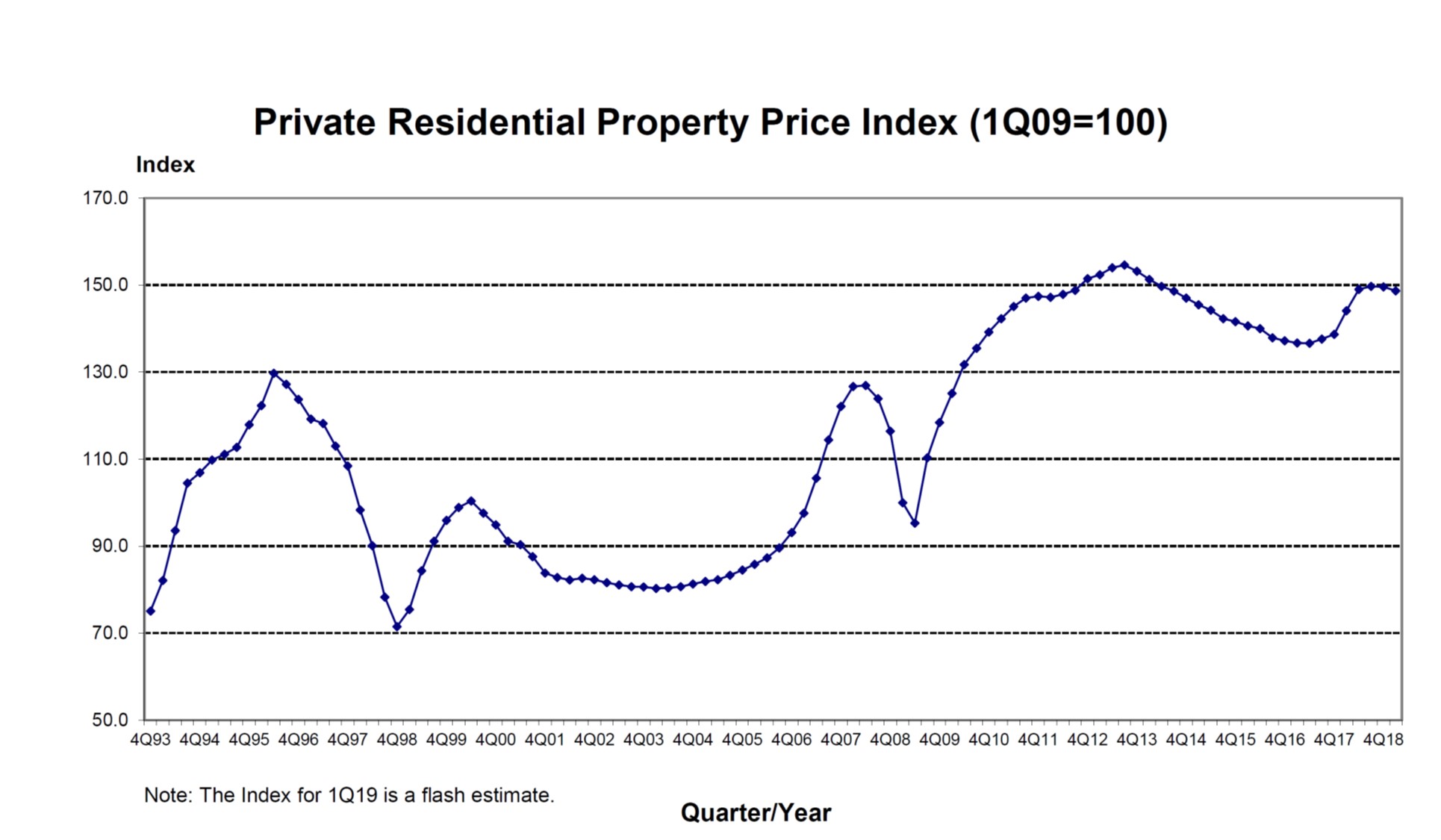

Despite some signs of stabilization in China’s factory gauges the primary trend is still weakness and it might be rash for investors to read too much into the recent data given the apparent weakness in the Eurozone and the moderation form a high level of growth in the United States. Quantitative tightening is on hold in the United States but a sharp “U-turn” to easing has not happened yet and is politically embarrassing. As inflation falls real rates are rising. Housing markets are showing signs of price weakness. Investors need to watch for signs of credit quality decay that could be an indicator of the next period of severe financial distress.

3. Monthly Geopolitical Comment: Markets Are Still Waiting for the Result of US-China Trade Talks

The future of the US and China relationship remains the most significant geopolitical and economic issue watched by the markets. While the markets prefer to focus on the positives, the eventual outcome of the talks may yet prove disappointing. Meanwhile, a rift is emerging among EU members who have diverging attitudes to cooperation with China. Authorities in Turkey have again spooked investors with their ham-fisted approach to markets. In Ukraine, comedian Zelensky has won in the first round of the presidential poll. In India, sabre-rattling continues ahead of parliamentary elections despite the de-escalation of tensions with neighbouring Pakistan.

4. RHT Health Trust – 40.7% Net Returns Since Jan. Is There Any Upside Left?

Since my last insight on RHT Health Trust (RHT SP) on 29th Jan 2019 – RHT Health Trust – Cash on Sale , investors who bought into RHT Health Trust at S$0.029 per unit would have netted a return on investment of 40.7% if they sell out today, including the cash distribution that they have received in 1st March.

Since last insight in January, RHT reported major changes to its Board of Directors and Management. The strong background of the new BOD and CEO in investment banking and REIT management will be valuable to RHT as it progresses to transform itself and acquire new business/assets to inject into the Trust.

Key investment thesis remains unchanged. RHT Health Trust is an event-driven play and the catalyst will be the announcement of an RTO deal to inject new assets/business into the Trust. This will be the key driver to further upside in RHT.

Proposed investment strategy at this stage is to hold on to the investment in RHT and look for opportunities to add if RHT trades lower. Target entry price is S$0.016 per unit, which translates to a NAV discount of 27.3%.

5. Yinson Tenders a Lifeboat for Ezion

Long-suffering lifeboat market play Ezion Holdings (EZI SP) has received a bail-out from Malaysia’s Yinson Holdings (YNS MK).

Yinson’s proposal is two-fold:

- A conditional debt conversion agreement to capitalise all of the “relevant debt” of US$916mn via the allotment and issue of up to approximately 22,573,570,909 new ordinary shares of Ezion at an issue price of S$0.055/share (27.9% premium to last close).

- A conditional option agreement for the proposed grant by Ezion of 3,360,495,867 non-listed and transferable share options to Yinson at the exercise price of S$0.0605 per option Share.

This shareholder structure will take the following shape, with Yinson holding 85.9% of shares out after the conversion and 87.5% after both the conversion and the exercise of the share options.

Current | After | After Conversion | ||||

| Current shares out | 3,728 | 100% | 3,728 | 14% | 3,728 | 13% |

| Debt conversion | 0% | 22,574 | 86% | 22,574 | 76% | |

| Option shares | 0% | 0% | 3,360 | 11% | ||

| Total shares (mn) | 3,728 | 26,302 | 29,662 | |||

However … as per the more detailed Bursa announcement:

It is the intention of YEPL (wholly-owned sub of Yinson) to acquire up to US$916mn of the Relevant Debts for a consideration to be agreed with the Designated Lenders. Tentatively, YHB (Yinson) expected its cash outlay shall be in the region of USD200mn and some EHL (Ezion) Shares that will give YEPL a shareholding of not less than 70% in EHL at the point of the completion of the Proposed Debt conversion and Subscription. In any event, assuming all convertible securities of EHL are converted, YHB expects its eventual shareholding in EHL shall be a controlling stake of at least 51%.

Ezion is also in negotiation with the major secured lenders to restructure its existing debts which would result in the conversion of certain debts to redeemable convertible preferences shares to be issued by Ezion.

As this is effectively a hybrid takeover, there exist a number of conditions required to complete this proposal. Of importance is the waiver from the Securities Industry Council of Singapore for Yinson not to make a mandatory general offer for Ezion under Rule 14.1 of the Takeover Code, as the share subscription takes Yinson’s stake >30%.

Conditions of the Debt Conversion/Proposed Subscription and Share Options | |

| For the Debt Conversion & Subscription | |

| Conditions | Satisfactory due diligence by Yinson. |

| Waiver from SIC not to make a MGO. | |

| Independent shareholders of Ezion approving the whitewash waiver. Simple majority vote. | |

| The approval by Ezion shareholders for the allotment and issue of the subscription shares. Simple majority vote. | |

| Other | The long stop date is 6 months from the conditional debt conversion agreement (31 March 2019). |

| For the Share Options | |

| Conditions | The approval by Ezion shareholders for the option shares. Simple majority vote. |

| Other | The long stop date is 6 months from the conditional option agreement (31 March 2019). |

| The exercise period is five years from the issuance of the options. | |

| Gross proceeds will be S$203mn assuming full exercise. To be applied to business expansion or new business opportunities | |

| Inter-conditionality | The grant of options is conditional upon and shall take place simultaneously with the debt conversion and subscription |

On Ezion

Ezion develops, owns, and charters offshore assets to support offshore energy markets, via three key segments:

- Lifeboats/liftboats – these are self-propelled rigs involved in the production and maintenance of the O&G and windfarm industry. This segment accounted for 57.9% of revenue in FY18.

- Jack-up rigs – engaged in non-self propelled rigs involved in the production and maintenance of the O&G and windfarm industry. The segment accounted for 34.1% of revenue in FY18.

- And offshore support logistic services, accounting for 7.5% of revenue in FYT18.

Ezion is primarily Asian focused with revenue split between Singapore, India, and the rest of Asia as to 8%, 5.3% and 54%. The Middle East and Africa account for 15.6% and 15.2% respectively.

Fundamentals

US$mn | FY16 | FY17 | FY18 |

| Revenues | |||

| Liftboats | 127 | 96 | 69 |

| Jack-Up Rigs | 158 | 76 | 41 |

| Offshore Support Logistic Services | 33 | 20 | 9 |

| Others | 1 | 1 | 1 |

| Total Revenue | 318 | 193 | 119 |

| EBITDA | |||

| Liftboats | 77 | 68 | 21 |

| Jack-Up Rigs | 112 | 60 | 16 |

| Offshore Support Logistic Services | 22 | 16 | (1) |

| Others | 1 | 1 | 1 |

| Total EBITDA | 212 | 144 | 37 |

| NPBT | |||

| Liftboats | 62 | (16) | (54) |

| Jack-Up Rigs | (54) | (745) | (297) |

| Offshore Support Logistic Services | (13) | (156) | (53) |

| Others | 1 | 1 | 7 |

| Unallocated Expenses | (24) | (82) | 94 |

| Total NPBT | (29) | (999) | (303) |

| Assets | |||

| Liftboats | 811 | 772 | 807 |

| Jack-Up Rigs | 1,382 | 556 | 226 |

| Offshore Support Logistic Services | 415 | 315 | 119 |

| Others | 79 | 81 | 32 |

| Unallocated Assets | 165 | 70 | 108 |

| Total assets | 2,851 | 1,794 | 1,291 |

| Total equity | 1,315 | 305 | (255) |

| Net debt | 1,282 | 1,358 | 1,358 |

- Revenue declined by US$125mn in FY17 due to a reduction in charter rates and delays in re-deployment of the Ezion’s liftboats due to working capital constraints. The loss before tax was exacerbated by impairment losses totalling US$897mn.

- Revenue declined by US$74mn in FY17 due to a drop in the utilisation rates of liftboats and jack-up rigs. FY18 also saw an increase in impairments loses of US$84.5mn, while loses in associate and jointly controlled entities increased to US$39mn in FY18 from US$16mn in FY17.

Effect on NTA from the conversion/options

Assuming the subscription and options were completed on 31 December 2018, the effects of the Ezion’s NTL/NTA per share would be as follows:

Before subscription | After subscription | |

(NTL)/NTA (US$mn) | (254.7) | 811.2 |

(NTL)/NTA per share (US$) | (0.0687) | 0.0274 |

Peer Comparisons

Trading Comps | Mkt Cap (SGDm) | PER | PBV | EV/EBITDA |

Yinson Holdings Berhad | 1,647 | 21.7x | 1.5x | 9.1x |

ASL Marine Holdings Ltd. | 33 | NM | 0.1x | 15.3x |

Dyna-Mac Holdings Limited | 105 | 69.6x | 1.0x | 10.5x |

Mermaid Maritime Public Company | 113 | NM | 0.3x | -10.3x |

Nam Cheong Limited | 57 | 0.1x | NM | 11.1x |

China Oilfield Services Limited | 7,230 | 1067.0x | 1.0x | 11.2x |

Aban Offshore Limited | 67 | NM | 17.7x | 27.2x |

Max | 7,230 | 1067.0x | 17.7x | 27.2x |

Median | 105 | 45.7x | 1.0x | 11.1x |

Min | 33 | 0.1x | 0.1x | -10.3x |

Mean | 1,322 | 289.6x | 3.6x | 10.6x |

Ezion Holdings Limited | Market Cap (SGDm) | PER | PBV | EV/EBITDA |

Current Price SGD 0.04 | 160 | NM | NM | -5.8x |

Substantial Shareholders of Ezion

Shares (mn) | % | |

Chan Fooi Peng | 184.7 | 5.0 |

Chew Thiam Peng (CEO) | 190.3 | 5.1 |

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.