In this briefing:

- Japan: Fortnightly Update: Past the Peak

- THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

- Last Week in Event SPACE: Softbank, Delta, U-Shin, CJ Hello, Glow, Sigma, Oslo Bors, Hang Lung

- Horiba (6856 JP): Long-Term Buy on Pullbacks

- Japan: Winter Results & Revisions Flash – Cycle Earnings Peak Was December 26th

1. Japan: Fortnightly Update: Past the Peak

PEAK CYCLE EARNINGS – In our Winter Results & Revisions Flash Insight of yesterday, we noted that Japanese listed corporate earnings, after nine consecutive ‘up’ quarters, peaked on December 26th, two days before the market reached a twenty-month low having declined 22.5% in the preceding three months. Forecast earnings peaked on November 7th and have led reported earnings to the downside since August last year.

ONE-YEAR LAG – Reported and forecast earnings are a lagging indicator and, in this instance, lagged by just under one year. Our preferred leading indicator, the Results & Revision Score which includes earnings momentum factors, peaked on 11th November 2017, 44 trading days ahead of the peak in the Market Composite. As of Friday’s close and with 99% of this quarters’ announcements made, the Results & Revisions Score is at a new 21-month. The score has now fallen by 70% and has halved since October 26th last year. We will cover the outlook in more detail in our upcoming quarterly Results and Revision review. However, the last two cycles (2009 and 2016) saw ‘trough’ scores of -9.6 and -2.1, respectively. There is ample room on the downside as export volumes continue to decline and the increase in the consumption tax in October tips Japan into a recession by year-end.

SIDEWAYS – The market has moved sideways through the reporting window rising 0.7% in Yen terms and falling 0.7% in US$ terms. The weakness in the currency has helped offset the slide in profits.

MARKET/SECTOR STRATEGY- We continue to recommend an underweight position in Japan in global portfolios and favour undervalued domestically-orientated companies in the Information Technology, Internet, Media, and Telecommunications sectors. We would avoid or short the financial sectors Banks, Non-Bank Finance and Multi-Industry (Japan Post). We would underweight the Auto and Other Consumer Products sectors as consumer spending contracts further in the US, Europe, China and in Japan later in the year.

In the DETAIL section below, we will review Sector performance over the last two weeks, and, in addition to our regular roundup of company results, revisions and stock performance over the previous two weeks, including brief comments on Subaru (7270 JP), Infomart (2492 JP), Lion (4912 JP), Nissan Chemical (4021 JP), Keyence (6861 JP), Suruga Bank (8358 JP), and Mercari (4385 JP).

2. THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

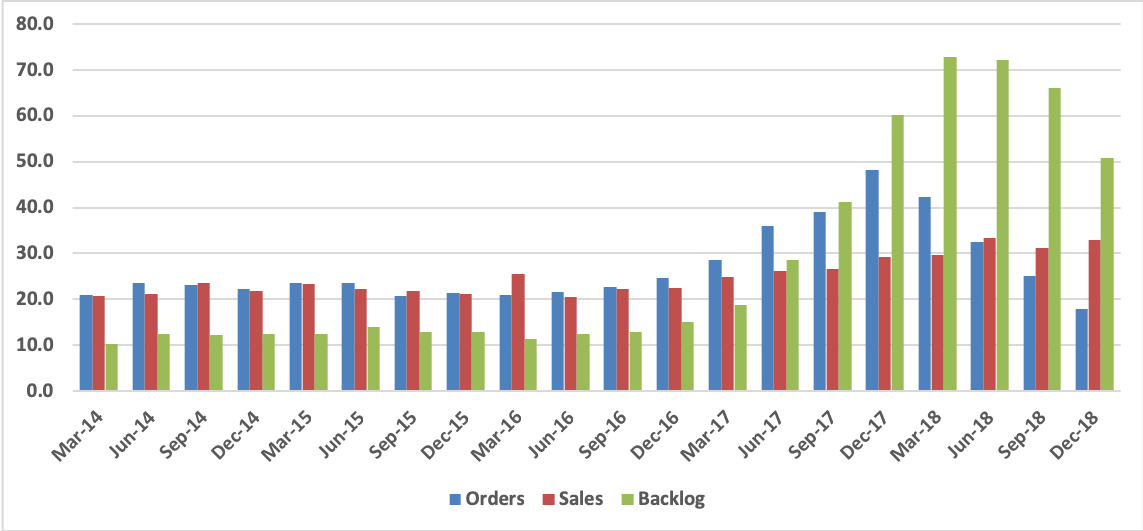

Sales and profits were above management’s guidance in FY Dec-18, with operating profit rising 36.9% on a 10.9% increase in sales. But new orders continuously declined and were down about two-thirds year-on-year in 4Q.

In view of the order flow, management is guiding for a 12% decline in sales and a 44% decline in operating profit in FY Dec-19, a forecast that is roughly in line with our own.

On the positive side, historical data indicates that new orders are at or near the bottom of the cycle. Anticipating a better investment climate after some resolution of the U.S.-China trade problem, we are forecasting an increase in sales and profits going into FY Dec-20.

The shares have rebounded by 41% since the beginning of January. At ¥2,720 (Friday, February 15, close), they are selling at 15.6x our estimate for FY Dec-19 and 13.8x our estimate for FY Dec-20E. These multiples look reasonably attractive in comparison with the company’s recent P/E range.

3. Last Week in Event SPACE: Softbank, Delta, U-Shin, CJ Hello, Glow, Sigma, Oslo Bors, Hang Lung

Last Week in Event SPACE …

- Softbank Group (9984 JP)‘s discount to NAV could narrow with Softbank looking to buy 10-13% of Real World Float.

- Excessive unknowns heading into Delta Electronics Thai (DELTA TB)‘s tender offer announcement.

- The price and process for the tender Offer for U Shin Ltd (6985 JP) is simply confounding.

- Taekwang Industrial (003240 KS)‘s 53.9% stake in Tbroad in the spotlight after LG Uplus Corp (032640 KS) takes a majority stake in Cj Hellovision (037560 KS).

- Global Power Synergy Company Ltd (GPSC TB)‘s rekindled Offer for Glow Energy Pcl (GLOW TB) should be priced similarly to its prior tilt.

- The fundamental drift and likelihood of a Sigma Healthcare (SIG AU) deal with API remain good.

- Has the contest for Oslo Bors VPS Holding ASA (OSLO NS) reached a Mexican standoff?

- Hang Lung (10 HK)‘s implied stub is at its widest since June 2013, outside a brief downward spike in in late April 2018.

- Plus CCASS movements and expected upcoming events for key M&A transactions.

(This insight covers specific insights & comments involving Stubs, Pairs, Arbitrage, share Classification and Events – or SPACE – in the past week)

EVENTS

Softbank Group (9984 JP) (Mkt Cap: $106bn; Liquidity: $795mn)

Softbank has announced a buyback of ¥600bn – its largest buyback ever. At ~¥10,500/share it is 57mm shares or 5.2% of shares out. At ¥12,000/share it is 50mm shares or 4.6%. The “official” float is about 68.7% or 750mm shares. However, by Travis’ estimate, only 44.5% of shares out or 488mm shares are Real World Float. 57mm shares out of 488mm shares is 11.7%. That is a non-negligible portion of float, and will mean significant reduction in foreign active management exposure to Softbank, or significant reduction in individual investor exposure to Softbank, or both.

- Travis Lundy wrote the buyback will have further impact on the stock price simply because of flow dynamics. It isn’t easy to buy 10% of float. And we should remember that the BOJ is still buying ¥100bn+ of Softbank shares per year as it continues to buy ¥6trln of ETFs per year. And given the stock will be in the top momentum ranks of large cap Japan, Travis expects momentum flows will join the party adding more inflow.

- For trading types, he thought Softbank was a buy, relatively and on an absolute basis. The Japan market is CHEAP on a current year and forecast year ahead, which suggests either the market is “wrong” or economic headwinds are picking up to a greater extent than pundits suggest.

(link to Travis insight: Softbank Buyback More Than It Appears To Be)

M&A – ASIA-PAC

Delta Electronics Thai (DELTA TB) (Mkt Cap: $2.8bn; Liquidity: $2mn)

The pre-conditons have been fulfilled and Delta Electronics (2308 TT) will now move to a tender offer. But there exist a number of unknowns for the transaction, which could delay the Offer timetable.

- Although the initial wording in the August conditional voluntary tender offer announcement suggests the offer will be for ALL shares, there is talk there may be a maximum acceptance condition, therefore possible clawback for shareholders tendering. A rumoured 60% maximum translates to a minimum 50% pro-rata, potentially 67% if the family tenders 40% and the rest of holders tender half.

- It is not clear whether the FY18 dividend will be netted. DELTA has announced two sets of quarterly results since the initial Offer announcement and it would be unjust for DEISG to net off any dividend. It would likely suit the family to receive the dividend. The Offer is pitched at a 1.79% premium to the then-current price. If the dividend is netted, then the Offer price will, in fact, be at a discount to last close as of announcement. DELTA will announce its full-year dividend tomorrow (18th February) and the terms of the deal may also be announced the same day. The AGM to ratify the dividend will take place around the 2 April.

- Currently trading at terms or a gross/annualised spread of 4.6/21%, if including a Bt3.30 FY18 dividend and mid-May payment. That looks overly tight in the face of timing delays and actual consideration to be paid if indeed it comes out to be a partial offer.

(link to my insight: Delta’s Less-Than-Straightforward Tender Offer)

U Shin Ltd (6985 JP) (Mkt Cap: $294mn; Liquidity: $2mn)

Three months ago, Minebea Mitsumi (6479 JP) announced it would launch a Tender Offer for U Shin and it would take just under three months until the approvals were received and it could officially start the Tender Offer process. The background to the Tender Offer was discussed in Minebea Mitsumi Launches Offer for U-SHIN in early November. Travis first conclusion in November was that this was the “riskiest” straight-out non-hostile TOB he had seen in a while. Minebea Mitsumi has now announced the launch of its Tender Offer, at the same price as originally planned (¥985/share).

- This deal is still perplexing to Travis. It’s easy enough from an industrial standpoint. Why not buy relatively cheap assets then see if you can cross-sell or assume some attrition? But for investors, he wonders why they put up with this. The process of reaching a “fair” valuation is, by definition, conflicted. It cannot NOT be conflicted. And just because some independent directors who don’t have skin in the game, and may have no clue about corporate valuation methodology, or fair market price, agree to a price that the acquiree’s managers, not wanting to lose their jobs, agree to doesn’t make this “fair.”

- The tender offer period is QUITE long. Most tender offers are 30 days in order to give time for people to tender or “offer sufficient time for a rival bidder.” This time Travis thinks it is longer so people can take their time and get bored and tender.

- Travis would sell shares now and use the balance sheet elsewhere until an activist shows his hand. If no activist, this deal is not an interesting one.

(link to Travis’ insight: Minebea-Mitsumi Underpriced Tender for U SHIN (6985 JP) Launched)

Cj Hellovision (037560 KS) (Mkt Cap: $720mn; Liquidity: $5mn)

After multiple news outlets reported that LG Uplus Corp (032640 KS) will finalise a transaction with the CJ Hello, a deal was done at ₩800bn (instead of ₩1tn speculated), and only 50%+1 share instead of the full 53.92% stake held by CJ ENM (035760 KS). The acquisition price of ₩20,659 is a 107% premium to last price and translates to a EV/EBITDA multiple of 6.6x.

- This is a straight stock acquisition deal. CJ Hello will be a subsidiary of LG Uplus and will continue to exist as a separate listed company. CJ ENM still owns nearly 4% CJH stake. SKT owns 8.61%.

- LG Group is publicly saying that they have no plan of an immediate merger, which means neither party requires shareholder approval. But the transaction is subject to local regulator approval – MSIT and Korea FTC. MSIT approval is not an issue. FTC rejected the SKT-CJH deal last time. This time, the FTC’s head Kim Sang-jo is hinting that this deal will go through.

- LG Uplus’ acquisition of CJ Hellovision is likely to further accelerate the consolidation of the Korean cable TV/media sector. KT Corp (030200 KS) is now likely to aggressively try to acquire cable-operator D’Live. SK Telecom (017670 KS) has shown some interests in acquiring Tbroad cable company.

- Douglas Kim reckons Taekwang Industrial (003240 KS) 53.9% stake in Tbroad – also a possible target – may be worth ₩600bn or nearly 35% of its market cap.

links to:

Sanghyun Park‘s insight: ‘ insight: LG Uplus – CJ Hello Acquisition: Current Status & Trade Approach

Douglas’ insight: Korea M&A Spotlight: LGUplus to Acquire CJ Hellovision: What’s Next for Tbroad and D’Live?

Sanghyun’s follow-up insight: LG Uplus – CJ Hello Acquisition: Current Yield Is 10%, CJH Overhang Concerns Will Push It Up

Glow Energy Pcl (GLOW TB)(Mkt Cap: $4.2bn; Liquidity: $4mn)

Glow announced that the Energy Regulatory Commission (“ERC”) has resolved to approve the merger with GPSC, provided Glow sells its Glow SPP1 plant before or at the same time as the merger. A number of conditions were also attached to some of the remaining power plants. No price has been disclosed for the 69.11% stake in Glow, ex the SPP1 plant, but it will be in reference to the Bt94.892 Offer price previously announced, net of expenses with selling SPP1 and the reduced synergy thereon.

- Given SPP1 is an immaterial contributor (~5%) to Glow, in terms of revenue, it can be argued that GPSC may make only a minimal change to the Offer price. Still, even a 5% downward adjustment would equate to a price below where Glow is trading.

- The downside is ~8%, if using the closing price on the 11 October. Glow/GPSC/Engie want this deal to complete. I think the final Offer price will come in very close to that initially proposed. But I would not buy through Bt90, preferring to pick up shares at Bt89 or below. The merger is expected to be completed by next month, triggering a mandatory tender offer, which may take an additional 2 months or so to complete.

(link to my insight: GPSC To Proceed With Glow Takeover, But At What Price?)

Sigma Healthcare (SIG AU) (Mkt Cap: $409mn; Liquidity: $2mn)

Sigma Healthcare released a 2-page Market Update saying the four month Business Review had identified A$100mm of annual cost savings, confirmed the FY19 EBIT guidance of A$75mn, and confirmed the FY20 EBITDA guidance of $55-60mm. The business review sees 10% underlying EBITDA growth from FY20 to FY23 so that after cost savings are included, FY23 sees the same EBITDA as FY19 [i.e. almost A$90mm].

- On a standalone basis, at the end of FY22 looking towards FY23, at 8x EV/EBITDA, it looks like there is something like 60-80% upside. EBITDA might be worth even more than A$90mm in FY23 as long as the DCs can run at high capacity. And at mid-high teens PER that would be a pretty great result. They won’t get that 60-80% upside from now doing a deal with API, but they won’t have to wait for 4 years to get it either.

- Travis expects another A$0.15 of value would do it. He doesn’t think they need A$0.20. The shares bounced and traded around A$0.80-1.00 from mid summer 2017 to mid-summer 2018. But that is when EBIT was supposed to fall to A$90mm. And that was nearer-term. Now we have a forecast of EBITDA of A$90mm and that is 3+ years out.

- Travis thinks this could get done at 0.42-0.45 shares of API and A$0.23 of cash, given that would probably impact API shares a little bit, that would end up being a 10-15% bump vs original terms, but all told that would be pretty good – and almost a double from undisturbed.

(link to Travis’ insight: Sigma Healthcare Market Update: Strategic Review Expects More)

Kabu.Com Securities (8703 JP) (Mkt Cap: $1.7bn; Liquidity: $8mn)

KDDI Corp (9433 JP) announced its intention to conduct a Tender Offer for Kabu.com through a made-for-purpose SPC. The deal is not terribly different in scope than the one discussed in KDDI Deal for Kabu.com (8703 JP) Coming? about two weeks ago.

- The Tender Offer is to purchase a minimum of 45,758,400 shares at ¥559/share, which is a 5.67% premium to last close and a 46.3% premium to the undisturbed price of 23 January 2019. Obtaining the minimum would get the combination of KDDI and MUFJ Securities (which currently holds 52.96% of the shares outstanding, and will not tender) to 66.67% which would allow the combination to do a Two Step Squeezeout, which KDDI states in the document that it intends to do.

- Anti-trust and regulatory approvals are required (Travis can’t imagine any issues), and KDDI expects that the Tender Offer will commence in late April. This looks pretty easy as a deal, with few impediments. A rival bid is unlikely – KDDI has a headstart with the shares of MUFG Bank which have committed to the deal.

- This is going to be boring. One can make markets, carry it, or allocate capital to something more interesting. However Kabu.com’s ¥6/share dividend for end March 2019 WILL BE PAID according to a press release by Kabu.com today after the close. That means there will be a down-shift in price on the ex-date of the dividend at end-March.

(link to Travis’ insight: KDDI Tender Offer for Kabu.com (8703 JP) Decided)

Denso Corp (6902 JP) (Mkt Cap: $33.4bn; Liquidity: $73mn)

Via subsidiary NSITEXE, Inc, Denso has acquired a stake in Californian start-up quadric.io. NSITEXE was established to develop high performance, next generation semiconductor devices for automated driving solutions. quadric’s edge processing units compliment this technology push.

(link to LightStream Research‘s insight: Stake in Quadric.io Following Renesas; Denso Attempts to Keep Chip Makers Close to Achieve AD Aims)

Xingfa Aluminium (98 HK) (Mkt Cap: $306mn; Liquidity: $0.1mn)

Xingfa announced its major shareholder, Guangxin Aluminium (a wholly-owned Guangdong SASAC vehicle), has acquired 5,000 shares, lifting its stake to 30.001%, triggering a mandatory general offer. The offer price is $5.60, a premium of just 2.94% to last close.

- Guangxin, together with certain management of Xingfa, attempted to take Xingfa private at $3.70/share back in 1H17. That scheme failed comprehensively, which was a good outcome for minorities as FY17 net income increased 28%. 1H18 profit was also a 25% improvement over the corresponding period.

- The offer price is in line with where Xingfa traded last October and is 23% below the recent peak back in mid-June 2018. It is also 37% below where China Lesso Group Holdings (2128 HK) acquired its 26.3% stake in April last year.

- There has to be some behind the scenes play for Xingfa’s shares, and this potentially centres on China Lesso. While a look at CCASS shows Liao Yuqing (an ED in Xingfa) intriguingly moving his entire 48.2mn (11.5% of shares out) outside of CCASS in early December 2018.

(link to my insight: Guangxin Reloads A Peculiar Low-Ball Offer For Xingfa Aluminium)

M&A – Europe/UK

Oslo Bors VPS Holding ASA (OSLO NS) (Mkt Cap: $803mn; Liquidity: $1mn)

OSLO NS is the target of competing tender offers from Euronext NV (ENX FP)andNasdaq Inc (NDAQ US). Euronext owns 5.3% and has irrevocables for 45.2% of OSLO NS shares, for 50.5% total. It launched an Offer to acquire all shares at NOK 145, and just raised that to NOK 158 on February 11, 2019. Nasdaq has irrevocables for 35.2% of OSLO NS shares and has launched an Offer to acquire all OSLO NS shares at NOK 152 per share. Nasdaq’s Offer received the unanimous recommendation of Oslo Børs VPS’s Board when it was announced. The IFA opined that NOK 152 per share is above the top end of what shareholders could expect.

- Nasdaq’s undertakings are irrevocable and binding, including in the event of a higher offer. The pre-acceptances further include an obligation on the part of the pre-accepting shareholders not to accept the Euronext Offer. Irrevocables for both bidders have an end date of 31 December 2019, after which they are no longer binding.

- Nasdaq, which is conditional on a 90% acceptance level, seems to have the weaker hand since its acceptance threshold condition won’t be met unless Euronext folds its cards and walks away; while Euronext (with a 50.01% acceptance condition) can keep its 50.5% “stake” as long as it gets regulatory approval. Therefore, Nasdaq would need to waive its 90% acceptance condition in order to stay in the game.

The Norwegian Ministry of Finance MoF may resolve this by approving both bidders, provided they reach a super majority acceptance threshold of two-thirds or 90% of shares outstanding (but not less). In this scenario, either party will have enough to block the other from reaching the threshold while the irrevocables are binding.

If the MoF says both parties have approval if they get to whatever super majority the MoF decides or is statutorily permitted to impose, and puts a deadline on getting there of some date after the irrevocable lock-up expiration (say, January 31, 2020), then the formerly locked-up shares are free to go to whichever bidder they chose.

(link to John’s insight: Oslo Børs, Euronext and Nasdaq – Shootout at the NOK Corral)

STUBS & HOLDCOS

Hang Lung (10 HK) / Hang Lung Properties (101 HK)

I estimate HLG’s discount to NAV at 41% compared to its one-year average of 38%. The implied stub is right at the 2STD extreme and excluding a brief dip in late April 2018, is at the lowest level since June 2013.

- What assets HLG does directly own at the stub level are intertwined with HLP’s own investments. There is therefore, very little to distinguish between the two companies. In addition, HLG has gradually offloaded its HK properties – to HLP no less – further increasing its exposure to China and blurring the lines between HLP and HLG’s business exposure.

- HLG has also been increasing its stake in HLP since June 2011, from 48.96% to 57.62% as at 31 Dec 2018. It’s a pretty astute trade to sell a property at book to HLP, then “buy” it back indirectly via increasing its stake in HLP, which trades at 0.6x P/B.

- There is no significant catalyst for the NAV discount to narrow. And liquidity does play a role, although HLG’s volume has narrowed the gap to HLP’s in recent years. Nevertheless, a ~40% discount to NAV is extreme for a straightforward, passive, single stock holdco structure.

(link to my insight: StubWorld: Hang Lung’s Implied Stub At Extreme Levels)

Intouch Holdings (INTUCH TB) / Advanced Info Service (ADVANC TB)

Athaporn Arayasantiparb, CFA discussed his one-on-one with Intouch. Of interest is his discussions on the stub assets specifically InVent, a venture capital arm and considered the market leader in growth stage funding. In 2018, InVent invested Bt30m into ytm thailand, an end-to-end digital marketing and feedback platform, which used the proceeds to buy offline digital access; Bt40m into Choco CRM, a CRM and POS (point of sales) platform for SME; and Bt40m into E Studio, a B2C lifestyle portal.

- Other investments discussed by Athaporn, at the stub level, include Wongnai and HSN. Wongnai is an online foodie guide and one of their largest investments to date, boasted 8m active users, 120m page views, 200,000 patron restaurants, and 10m pictures posted so far. Revenue grew 60% in 2018 to Bt250mn, and is expected to grow at 50%. HSN is an online shopping venture between Intuch and Hyundai, which managed to breakeven on a net basis.

- The overall value of these investments, and the estimated 11 other start-up companies under InVent, is very much a “finger in the air” calculation. They may exceed the value of Intouch’s 41.1% stake in Thaicom Pcl (THCOM TB), but that still would be just 1% of NAV.

- I estimate Intouch’s discount to NAV at ~21% (vs. the one-year average of 27%), having significantly narrowed in response to rumours of a purported sale of Thaicom (discussed in StubWorld: Intouch Gains On Possible Sale of Thaicom). At the time, I thought Intouch had run its course, noting Intouch had denied any definitive approach/agreement.

- New Street Research also met with AIS and remains cautious on this telco in the current slowing environment ahead of delayed elections.

links to:

Athaporn’s insight: Catch-Up Session with Intuch Group

New Street’s insight: AIS Growth Has Been Slowing as DTAC Returns to the Scene. 2019 Outlook Uncertain.

Briefly …

- Sanghyun recommended going long Poongsan Corp (103140 KS) and short Poongsan Holdings (005810 KS) as the Poongsan Holdco/Sub duo is now at +277% of σ on a 20D MA. Using his numbers, I back out a discount to NAV of 52.8%, bang in line with its 12-month average of 51.3%. The parent is also very illiquid, while Corp trades around US$2mn/day. (link to Sanghyun’s insight: Poongsan Holdings Reverse Stub Trade: Current Status & Trade Approach)

- Sanghyun also recommended a Nong Shim Holdings Co (072710 KS) setup mid-week with the Holdco/Sub duo at 253% of σ. Using his numbers, I back out a discount to NAV of 47% compared with its 12-month average of 42%. As with Poongsan, the parent is also very illiquid, while Nongshim Co Ltd (004370 KS) trades around US$4mn/day. (link to Sanghyun’s insight: Nongshim Holdco/Sub Trade: Current Status & Trade Approach)

OTHER M&A UPDATES

- Sand Grove’s holding in Ophir Energy (OPHR LN) is now 17.28% according to a recent filing.

- Kian Joo Can Factory (KJC MK) is subject to a conditional mandatory takeover at RM3.10/share, a 52.7% premium to last close.

CCASS

My ongoing series flags large moves (~10%) in CCASS holdings over the past week or so, moves which are often outside normal market transactions. These may be indicative of share pledges. Or potential takeovers. Or simply help understand volume swings.

Often these moves can easily be explained – the placement of new shares, rights issue, movements subsequent to a takeover, amongst others. For those mentioned below, I could not find an obvious reason for the CCASS move.

Name | % chg | Into | Out of | Comment |

18.76% | China Sec | Sun Sec | Shares suspended since Oct-17 | |

10.19% | Oceanwide | China Prospect | ||

15.88% | KGI | Outside CCASS | ||

UPCOMING M&A EVENTS

Country | Target | Deal | Event | E/C | |

| Aus | GrainCorp | Scheme | 20-Feb | Annual General Meeting | C |

| Aus | Greencross | Scheme | 27-Feb | Scheme Implementation | C |

| Aus | Propertylink | Off Mkt | 28-Feb | Close of offer | C |

| Aus | Sigma | Scheme | February | Binding Offer to be Announced | E |

| Aus | Eclipx Group | Scheme | February | First Court Hearing | E |

| Aus | MYOB Group | Scheme | 11-Mar | First Court Hearing Date | C |

| Aus | Healthscope | Scheme | April/May | Despatch of Explanatory Booklet | E |

| HK | Harbin Electric | Scheme | 22-Feb | Despatch of Composite Document | C |

| HK | Hopewell | Scheme | 28-Feb | Despatch of Scheme Document | C |

| India | Bharat Financial | Scheme | 28-Feb | Transaction close date | C |

| India | GlaxoSmithKline | Scheme | 9-Apr | Target Shareholder Decision Date | E |

| Japan | Pioneer | Off Mkt | 1-Mar | Issuance of the new shares and common stock to be delisted on the Tokyo Stock Exchange | C |

| Japan | Showa Shell | Scheme | 1-Apr | Close of offer | E |

| NZ | Trade Me Group | Scheme | 19-Feb | Application for initial orders filed | C |

| Singapore | Courts Asia | Scheme | 15-Mar | Offer Close Date | C |

| Singapore | M1 Limited | Off Mkt | 18-Feb | Closing date of offer | C |

| Singapore | PCI Limited | Scheme | February | Release of Scheme Booklet | E |

| Thailand | Delta | Off Mkt | 18-Feb | Submit Tender Offer Form | C |

| Finland | Amer Sports | Off Mkt | 28-Feb | Offer Period Expires | C |

| Norway | Oslo Børs VPS | Off Mkt | 4-Mar | Nasdaq Offer Close Date | C |

| Switzerland | Panalpina | Off Mkt | 27-Feb | Binding offer to be announced | E |

| US | Red Hat, Inc. | Scheme | March/April | Deal lodged for approval with EU Regulators | C |

4. Horiba (6856 JP): Long-Term Buy on Pullbacks

Horiba’s share price has rebounded on FY Dec-18 results that were above management’s most recent guidance and better than we had expected. Consolidated operating profit was up 7.5% on a 7.8% increase in sales, and net profit up 37.0% following extraordinary gains (vs. losses the previous year) and a lower effective tax rate.

4Q results were weak, primarily due to the downturn in semiconductor capital spending, but this was no surprise. Total consolidated operating profit was down 10.3% year-on-year on a 2.3% increase in sales in the three months to December, while operating profit on Semiconductor Instruments & Systems (primarily mass flow controllers) was down 32.8% on a 15.8% decrease in sales.

Looking ahead, management is guiding for year-on-year declines in both sales and profits in the six months to June, again due to weak demand for semiconductor equipment, followed by a sharp rebound in 2H and low single-digit growth FY Dec-19 as a whole. Judging from the semiconductor equipment order flow, it appears that a weak 1H will be hard to avoid, while there is as yet no sign pointing to recovery. Nevertheless, we have raised our own sales and profit estimates for this fiscal year and next based on the absolute levels of orders and sales.

Automotive Test Systems and the company’s other businesses should continue to grow, supported by the acquisition of FuelCon AG of Germany (an industry leader in battery and fuel cell validation) and Manta Instruments of the U.S. (which makes nanoparticle tracking analysis systems). The issue, then, is how soon and how rapidly semiconductor related investments will recover. We suspect later and more slowly than management hopes, but in any case the downturn appears to have been discounted.

At ¥5,980 (Friday, February 15, closing price), Horiba has rebounded by 44% from its January 4 low of ¥4,155, but is still 38% below its ¥9,590 all-time high reached last May. It is now selling at 13.6x our EPS estimate for this fiscal year and 12.3x our estimate for FY Dec-20. These and other projected valuations are on the low side of their 5-year historical ranges. Once the recent bounce has been consolidated, there should be another buying opportunity for longer term investors.

5. Japan: Winter Results & Revisions Flash – Cycle Earnings Peak Was December 26th

WORST Q SINCE AUTUMN 2016 – Since our last Results Flash in November – Japan: Autumn Results & Revisions Flash – Flatlining + Weakest Quarter in Two Years – the operating and net profits of Japanese listed companies have peaked and declined by 2.0% and 7.5%, respectively while forecasts for the same have fallen by 1.7% and 4.1%. The stock market’s initial reaction to the peaking of earnings for this cycle was a sharp 15.5% decline which climaxed on Christmas Day. A softer tone from the US Federal Reserve and a weaker Yen have helped restore a degree of confidence and the recent 12.1% rally has taken aggregate market capitalisation back to early-December. As a result of the downturn in profits, trailing and forecast earnings multiples have reverted to August 2018 levels and can no longer be considered a bargain. For the restoration of a ‘normal’ market multiple (16.7x), either share prices have to rise by 18% (all else equal) or net income has to decline by a further 16%. Our money is on the latter being the more likely outcome.

Source: Japan Analytics

ROLLING TTMs – Our series of rolling trailing-twelve-month (TTM) quarterly aggregates of all listed companies confirm the profit peak. Revenues are still increasing by 5-6% a year, and by 1-2% a quarter, however, the rate of increase is slowing and the implied growth rate for the current quarter is just 0.5%. Operating Income declined by 1.9% qoq in the quarter just declared and will be flat this quarter, although, as few companies revise full-year forecasts with Q3 earnings results, this forecast should be considered optimistic. Operating margins are forecast to be 33bps lower than in TTM-3. TTM Net Income fell by 8% qoq, although yoy growth is still a positive 3%. The 1.6% forecast growth for this quarter implies that the most recent quarter had an excessive level of write-offs. We are not so sanguine.

SECTOR BREAKDOWNS – In the DETAIL section below we shall examine the trends in earnings results and forecasts for the 30 sectors that make up our Market Composite.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.