In this briefing:

- ECM Weekly (30 March 2019) – ESR, Yunji, Ruhnn, Jinxin Fertility, Metropolis Health, Viva Biotech

- Metropolis IPO: Priced to Leave Limited Upside

- Metropolis Healthcare IPO – Fairly Valued, at Best

- Viva Biotech (维亚生物) IPO: Warning Signs from 2018 Numbers (Part 2)

- LYFT: Wouldn’t It Be Ironic if This Was an IPO to Rent but Not Own?

1. ECM Weekly (30 March 2019) – ESR, Yunji, Ruhnn, Jinxin Fertility, Metropolis Health, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

CanSino Biologics Inc (6185 HK)‘s debut in Hong Kong this week was spectacular. It closed almost 60% above its IPO price on the first day. In Ke Yan, CFA, FRM‘s trading update note, he pointed out that valuation is trading close to fair value and that the near term driver will be the progress of the NMPA review and commercialization of MCV2. On the other hand, Koolearn (1797 HK)‘s IPO was not as fortunate. The company got listed on the same day but struggled to hold onto its IPO price even though it was oversubscribed.

For upcoming IPOs, Dongzheng Automotive Finance (2718 HK) will finally be listing next week on the 3rd of April after re-launching its IPO at a much lower fixed price of HK$3.06 per share. Sun Car Insurance(1879 HK), however, pulled its IPO even though reports mentioned that books were covered. We are also hearing that Shenwan Hongyuan Hk (218 HK) will be pre-marketing its IPO next week while CIMC Vehicle will be seeking approval soon.

India’s IPO market is starting to warm up after long lull period as Metropolis Health Services Limited (MHL IN) and Polycab India (POLY IN) are launching their IPOs next week. Sumeet Singh had already shared his thoughts on valuation for Metropolis Healthcare and his early thoughts on Polycab in:

- Metropolis Healthcare IPO – Fairly Valued, at Best

- Polycab India Limited Pre-IPO – Market Leader with Steady Growth but with a Few Unanswered Question

Meanwhile, in the U.S, Ruhnn Holding Ltd (RUHN US) launched its IPO to raise about US$125m and we heard that books have already been covered. Lyft Inc (LYFT US)‘s strong debut even after it priced above its original IPO price range should bode well would likely mean that there will be more tech unicorns looking to list in the coming few months.

In Malaysia, we also heard that Leong Hup International (LEHUP MK) will be pre-marketing next week while in Indonesia, Map Actif will open its books for US$200 – 400m IPO next week as well.

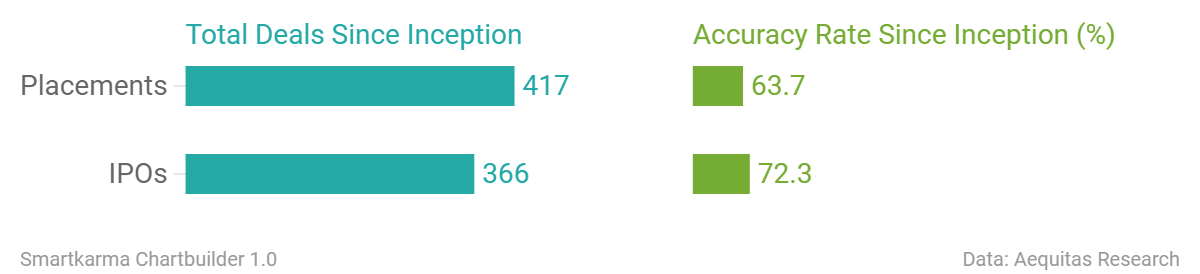

Accuracy Rate:

Our overall accuracy rate is 72.4% for IPOs and 63.9% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- Haitong UniTrust International Leasing (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- As IPO flood recedes, Asia bankers bet on follow-on capital raising

- Bitmain forced to delay Hong Kong IPO amid crypto-mining decline

This week Analysis on Upcoming IPO

- Viva Biotech (维亚生物) IPO: Warning Signs from 2018 Numbers (Part 2)

- Metropolis Healthcare IPO – Fairly Valued, at Best

- Jinxin Fertility (锦欣生殖) Pre-IPO: Strong Foothold in Sichuan but Weak Sentiment for Sector

- Ruhnn (如涵) Pre-IPO Review- Significant Concentration Risk

- Yunji (云集) Pre-IPO Review – Poor Disclosure on Data

- ESR Cayman Pre-IPO- First Stab at Valuation

- Leong Hup Pre-IPO – Hard to Pinpoint What’s Going to Be the Revenue Driver Going Forward

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

- SNK Corp (950180 KS)

2. Metropolis IPO: Priced to Leave Limited Upside

We like Metropolis Health Services Limited (MHL IN) ’ track record of growing revenue/patient despite competition, premium pricing and strong margin defence. Margins have however, come under some pressure in 9MFY19. Its patient growth lags that of Dr Lal Pathlabs (DLPL IN)’s despite rapid network expansion. It is also at the highest risk from any government instituted pricing cap on pathology tests owing to (1) high share of institutional business and (2) premium pricing. Also, 51.6% of promoter stake will be pledged with lenders after the IPO. At the upper end of its price band, Metropolis is valued at 20.9x FY20F EV/EBITDA and 33.3x FY20F PE- at ~15% discount to Dr Lal. We see EPS compounding at 12% Cagr over FY18-21, lower than the 16% EPS Cagr of Dr Lal’s. We feel valuation leaves limited upside.

3. Metropolis Healthcare IPO – Fairly Valued, at Best

Metropolis Health Services Limited (MHL IN) (MHL) plans to raise around US$175m in its Indian IPO via a sell down of shares by the promoter and private equity owners. MHL is one of the largest diagnostic chains in the country.

In my previous insight, Metropolis Healthcare Pre-IPO Quick Take – Steady Performance but Growth Lagged Network Expansion, I analyzed MHL’s recent financial performance and compared it with its listed peers, Dr Lal Pathlabs (DLPL IN) and Thyrocare Technologies (THYROCAR IN).

In this insight, I’ll run the deal through our IPO framework and comment on valuation.

4. Viva Biotech (维亚生物) IPO: Warning Signs from 2018 Numbers (Part 2)

Viva Biotechnology, a China-based drug discovery company, is seeking to raise USD 200m to list on the Hong Kong Stock Exchange. It has recently obtained approval for listing by the Hong Kong Stock Exchange. In our previous insight (link here), we discussed the company’s fundamentals, its unique business model, its shareholders, and our thoughts on its valuation.

In this insight, we look at its latest prospectus and review our valuation for Viva Biotech.

5. LYFT: Wouldn’t It Be Ironic if This Was an IPO to Rent but Not Own?

Lyft Inc (LYFT US) announced an increase in its IPO price range from $62-68 to $70-72 after previous reports had indicated that the IPO became oversubscribed very early.

There has been significant coverage of the name on Smartkarma but a disappointing lack of obvious puns:

Lyft IPO: Key Takeaways from In-Depth Interviews with Drivers by Johannes Salim, CFA

Lyft IPO: Valuation Analysis (Prudent Investment or Quasi-Gambling?) and Lyft IPO Preview by Douglas Kim

Lyft IPO Preview: Maybe We’ll Just Walk? by Rickin Thakrar

LYFT Pre-IPO – Drivers and Shared Rides Hold the Key But the Numbers Are Missing by Sumeet Singh

We would highlight Johannes’ interview piece as being well worth a read to understand the driver perspective, as well as Sumeet’s piece and the comments sections for discussions of business model strengths and weaknesses.

Ultimately, this issue isn’t going to be bought for its cheapness and we would guess that it will be successful (initially) due to pent up demand and relatively strong broad stock market performance over the last few months. Below, however, we examine NY transportation data to point out what we feel are misconceptions about the overall value proposition of the ride sharing industry.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.