In this briefing:

- ESR Cayman Pre-IPO – Earnings and Segment Analysis

- PagerDuty IPO Preview

- China Risun (中国旭阳) – Quick Post-IPO Trading Update

- GDS Holdings (GDS US): Placing a Good Opportunity to Gain Exposure to a High Growth Story

- ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

1. ESR Cayman Pre-IPO – Earnings and Segment Analysis

ESR Cayman (ESR HK) aims to raise up to US$1.5bn in its planned Hong Kong listing, as per media reports. The company is backed by Warburg Pincus and counts APG, the Netherlands’ largest pension provider, as one of its main investors.

In my earlier insight, I touched upon the company’s business model and provided an overview of its operations, ESR Cayman Pre-IPO – A Giant in the Making.

In this insight, I’ll talk more about the financials and the drivers for each of the three segments.

2. PagerDuty IPO Preview

PagerDuty Inc (PD US) is a US based software company which is ready to complete its IPO in the next several weeks. Founded in 2009, PagerDuty helps companies to respond quickly when their websites go down. PagerDuty’s software helps companies to respond to items such as customer complaints and helps companies to spot problems. The company is known for capitalizing on its AI (Artificial Intelligence) models to quickly solve problems of why websites go down.

The company has an excellent, diversified base of more than 10,000 customers in 90 countries including IBM, The World Bank, Airbnb, Netflix, GE, and Gap. One of the strong points of PagerDuty is the fact that it has gathered massive amounts of data from its more than 10,000 customers. The company also boasts a very high customer retention rate (139% net retention rate). A combination of the company’s strong AI capability coupled with the increasing amounts of Big Data provide a strong competitive advantage for the company since its AI capability may improve and get smarter with additional Big Data and continuous problem solving of why websites go down.

PagerDuty was most recently valued at $1.3 billion in September 2018 in a private market valuation (led by T.Rowe Price Group investing $90 million in the company), representing 16x the company’s annual revenue of $79.6 million as of 12 months ending January 2018.

3. China Risun (中国旭阳) – Quick Post-IPO Trading Update

China Risun (1907 HK) raised USD 202 million at HKD 2.80 per share, near the low end of its IPO price range. We have previously covered the IPO in:

In this insight, we will update on the deal dynamics, implied valuation, and include a valuation sensitivity table.

4. GDS Holdings (GDS US): Placing a Good Opportunity to Gain Exposure to a High Growth Story

Last Friday, Gds Holdings (Adr) (GDS US), the largest third-party data centre operator in China, announced the placing price of its public offering of 11.9 million ADS. At the placing price of $33.50 per share, GDS will raise net proceeds of $385.5 million which will be used for the development and acquisition of new data centres.

We are positive on GDS as the business remains in rude health due to strong revenue growth, rising margins and high revenue visibility. Overall, we would participate in the public offering at the placing price.

5. ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Starting with bad news in Korea, Homeplus REIT (HREIT KS)‘s IPO was pulled on the 14th of March which when it was supposed to price. The reason cited was weak demand which stemmed from growth concerns and difficulty in valuing this business.

On the other hand, Hong Kong’s IPO market is getting busier. This week alone, we had Dongzheng Automotive Finance (2718 HK) and Koolearn (1797 HK) that have already opened for bookbuilding and will price next week. We also heard that Sun Car Insurance is already started pre-marketing and it will likely open its books next week. The company had only just re-filed their draft prospectus last week.

Another upcoming Hong Kong IPOs would be Tianjin CanSino Biotechnology Inc (1337013D HK) which we heard had already started pre-marketing. Ke Yan, CFA, FRM updated his assumptions and valuation of the company in his insight, CanSino Biologics (康希诺) IPO: Valuation Update (Part 3).

In India, the focus is on Embassy Office Parks REIT (EOP IN) as this is the country’s first ever REIT IPO. It is also the first time there is a strategic tranche in an Indian IPO which has been taken up by Capital Group. Sumeet Singh has pointed out in his insight that with cost of debt of the REIT being at 9 – 9.25%, it is hard to fathom buying equity at a FY2020E dividend yield of 8.25%. This yield had already been inflated by the lack of interest payments. For detailed explanation, read his insight, Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond.

In other countries, we heard that Leong Hup International (LEHUP MK) is aiming to pre-market next month whereas, in Australia, there had been chatter that Prospa Advance Pty (PGL AU) may be back for an IPO again after it had beaten its own estimates from the IPO prospectus.

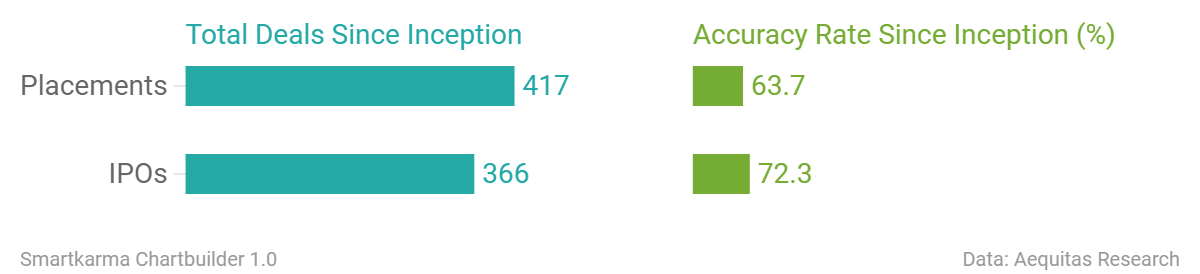

Accuracy Rate:

Our overall accuracy rate is 72.4% for IPOs and 63.7% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- FriendTimes Inc. (Hong Kong, >US$100m)

- Frontage (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- UBS and Rivals to Pay $100 Million to Settle Hong Kong IPO Cases

- Chinese Luxury Car Finance Firm Seeks $428 Million in Hong Kong IPO

- Online Educator Koolearn to Raise up to $233 Million in Hong Kong IPO

- Resurgence in Indian IPO market likely only after general elections

- Homeplus K-REIT Withdraws $1.5 Billion Korean IPO on Weak Demand

- Prospa may revive listing plan after beating prospectus forecasts

- Luckin Coffee chairman said to tap banks for $200m loan in exchange for IPO role

This week Analysis on Upcoming IPO

- Homeplus REIT IPO: A Key Landmark Deal in the History of the Korean REIT Market

- Up Fintech (Tiger Brokers) IPO Quick Take – It’s Not like Futu, Won’t Perform like It Either

- Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond

- CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.