In this briefing:

- ZOZO – Buying a Stairway to Heaven

- China Tower: More Details on Non Telco Growth Suggest Further Upside to Share Price

- M1 Offer Despatched – Dynamics Still Iffy

- ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

- StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

1. ZOZO – Buying a Stairway to Heaven

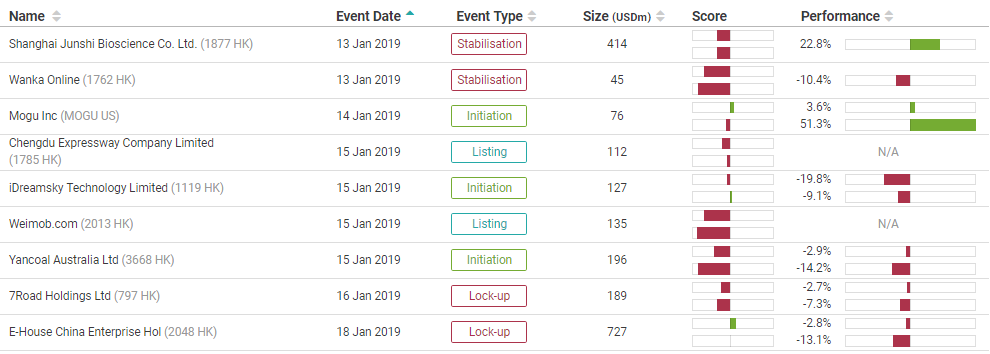

ONWARD AND OUT – ZOZO (3092 JP), formerly Start Today, has been the sixth-most-traded large capitalisation stock over the last ten trading days after Benefit One (2412 JP), Rizap (2928 JP), Takeda Pharmaceutical (4502 JP), Hoshizaki (6465 JP), and Workman Co Ltd (7564 JP). According to Nikkei XTECH, on 25th December apparel maker Onward (8016 JP) suspended selling of its products on ZOZOTOWN and will leave the platform altogether. Although Onward products are estimated to account for less than 3% of total transactions on the site, there are concerns that other apparel makers will follow suit as a result of the emerging direct competition on the site from ZOZO’s private label. Since reaching our 4.0 ‘Overbought’ threshold on 9th July 2018, ZOZO shares have corrected by 57% – the worst performance of any large cap from that date – as concerns mounted over the private brand strategy and the behaviour of CEO Yusaku Maezawa. Since bottoming on 4th January, the shares have risen by 18% following positive comments from the CEO about sales over the New Year holiday period.

PRIVATE-LABEL STRETCH GOALS– The ‘teething problems’ of ZOZO entering the private-label apparel business have been well-documented by Michael Causton in a recent Insight on Smartkarma. Michael rightly questions the feasibility of the company scaling a ¥200b apparel business within the next three years while targeting an additional incremental ¥400b in e-commerce revenue, particularly as it has taken ZOZO twenty years to reach the first ¥100b in annual revenues. In the DETAIL section below, we shall examine ZOZO’s current and possible future financial condition as it strives to become one of the top-ten global fashion retailers.

‘ZOSO’ & THE STAIRWAY TO HEAVEN – In addition to some notable purchases of modern art at record-breaking prices, CEO Maezawa also last year booked himself on Space X’s first flight to the moon. With apologies, the lyrics of the peerless song from Led Zeppelin’s untitled fourth album – known by fans as ‘Zoso’ after the symbol designed by Jimmy Page for the inner sleeve – come to mind:-

There’s a lad(y) who’s sure

All that glitters is gold

And (s)he’s buying a stairway to heaven

When(s)he gets there (s)he knows

If the stores are all closed

With a word (s)he can get what (s)he came for.

2. China Tower: More Details on Non Telco Growth Suggest Further Upside to Share Price

After initially being very skeptical of the China Tower (788 HK) IPO given it is essentially a price take to its three largest shareholders, we changed our view in early December to a more positive outlook. What changed our view has been series of calls and meetings with the company that suggested a more shareholder friendly approach than expected and a real opportunity to reduce capex substantially through the use of “social resources” (e.g. electricity grid, local government sites). These can be used to deliver co-locations without building towers and poles and imply much lower capital intensity at a time when revenue growth will be accelerating as 5G is rolled out. Management has also given more detail on non-Tower business prospects which can generate higher returns (not under the Master Services Agreement). While small now (2% of revenue) they are growing rapidly. With lower capex than initially guided and a more shareholder friendly management (i.e. higher dividends are possible) we reduce the SOE discount and raise our forecasts (again). We remain at BUY with a new target price of HK$2.20

3. M1 Offer Despatched – Dynamics Still Iffy

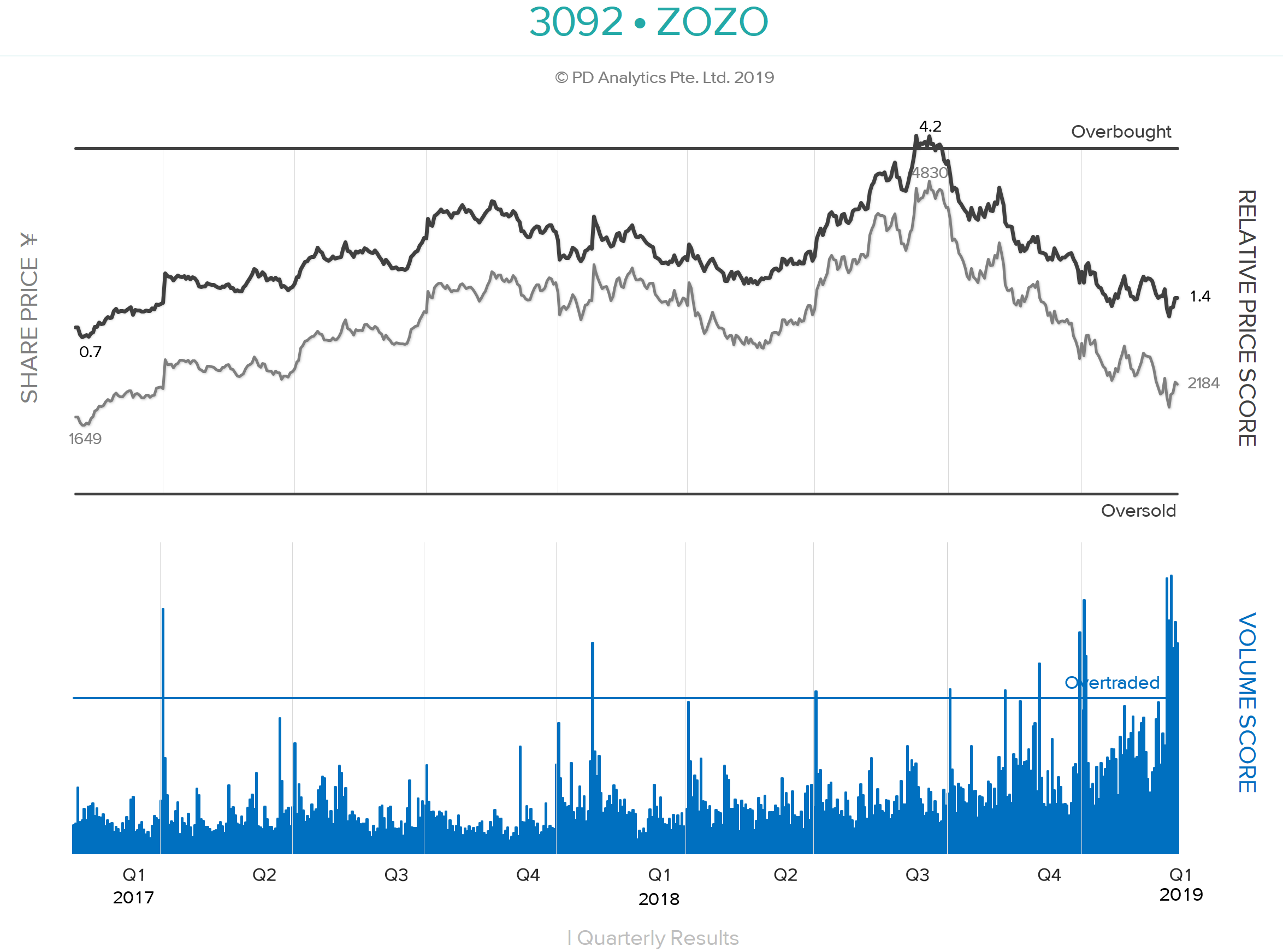

On January 7th after the close of trading, Konnectivity Pte. Ltd officially announced the launch of its Offer to by M1 Ltd (M1 SP).

The closing date, as clear there, is 4 February.

After three-plus months of speculation that Axiata Group (AXIATA MK) was unhappy with the price and might make a counter-offer, no offer has been forthcoming.

After I wrote on the 2nd in M1 Offer Coming – Market Odds Suggest a Bump But… that the reward/risk did not look that great, shares drifted downward from the S$2.09-2.11 area and into the afternoon of the 7th, traded in the S$2.05-2.07 range, which was the first time in months the shares had traded at or below the prospective offer price.

Some 20mm+ shares (5.5% of the shares out other than the three major holders) traded between 3pm Singapore time on the 7th and a few minutes after the open the day after the announcement. Then part-way through the day, someone bought a large number of shares lifting the share price two spreads for a while. Since then, the shares have settled back down to the $2.07-2.08 range.

Depending on your opinion of the likelihood of a bump, your execution strategy will differ. It’s still not clear that a bump or counterbid will be forthcoming, but at S$2.07, the risks are better than they were higher.

4. ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

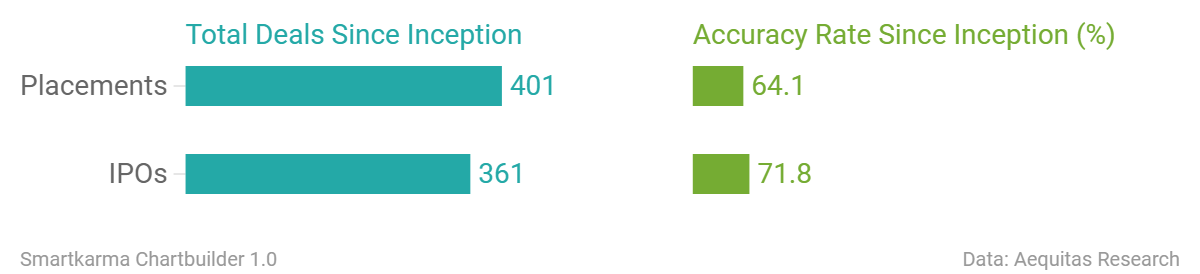

Over 2017-18, the Australian Securities & Investments Commission (ASIC) undertook a review of allocation in equity raising transactions. The review involved large and mid-sized licensees (brokers), Issuers, International investors and other international regulators. The results of the review were published by ASIC in Dec 2018. This insight highlights some of the key findings.

It’s good to see that some of the standard practices of banks allocating more to existing clients and participants of earlier deals have at least been acknowledged. Even though some institutional investors have outright labelled the allocation process as a “black box”, ASIC doesn’t seem to want to do much about it.

The area where ASIC is more concerned is the messaging to investors which highlights the different definitions of “well-covered” across banks. Although, the banks seem to have mislead the regulator on interpretation of “real-demand” with ECM bankers saying that all orders are taken at face-value. That raises a whole new level of questions on the messaging around demand for the deal.

5. StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard

This week in StubWorld …

- With concerns over its tender offer for BGF Retail (282330 KS) now behind it, now may be the time for a BGF Co Ltd (027410 KS) setup.

- Kingboard Chemical (148 HK) gets a boost after buying properties from its major shareholder, however, the implied yield is uninspiring.

Preceding my comments on BGF and KBC are the weekly setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity threshold of US$1mn on a 90-day moving average, and a % market capitalisation threshold – the $ value of the holding/opco held, over the parent’s market capitalisation, expressed as a % – of at least 20%.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.