In this briefing:

- THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

- Horiba (6856 JP): Long-Term Buy on Pullbacks

1. THK (6481 JP): New Orders Down by Two-Thirds in 4Q, Near the Bottom of the Cycle

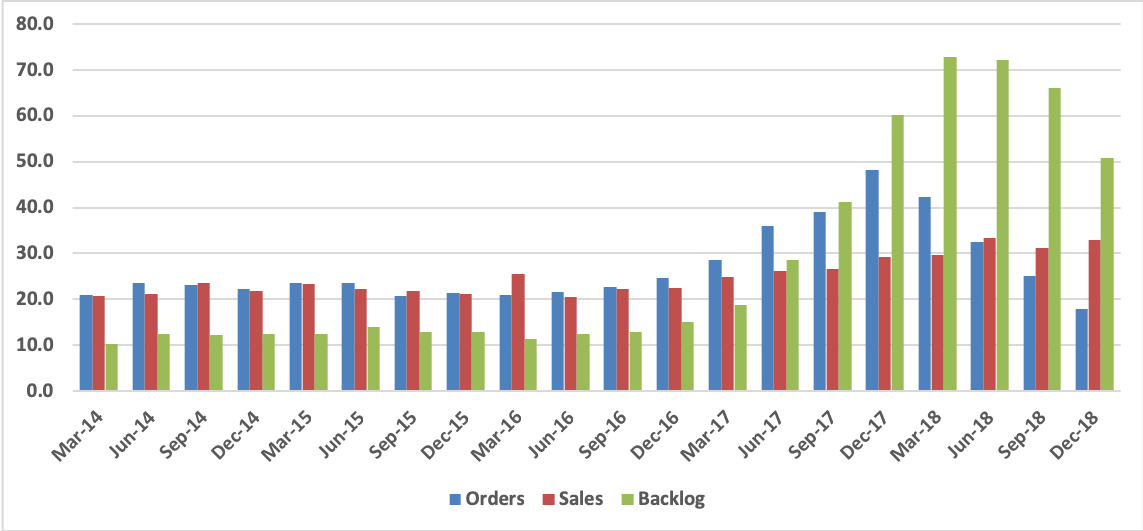

Sales and profits were above management’s guidance in FY Dec-18, with operating profit rising 36.9% on a 10.9% increase in sales. But new orders continuously declined and were down about two-thirds year-on-year in 4Q.

In view of the order flow, management is guiding for a 12% decline in sales and a 44% decline in operating profit in FY Dec-19, a forecast that is roughly in line with our own.

On the positive side, historical data indicates that new orders are at or near the bottom of the cycle. Anticipating a better investment climate after some resolution of the U.S.-China trade problem, we are forecasting an increase in sales and profits going into FY Dec-20.

The shares have rebounded by 41% since the beginning of January. At ¥2,720 (Friday, February 15, close), they are selling at 15.6x our estimate for FY Dec-19 and 13.8x our estimate for FY Dec-20E. These multiples look reasonably attractive in comparison with the company’s recent P/E range.

2. Horiba (6856 JP): Long-Term Buy on Pullbacks

Horiba’s share price has rebounded on FY Dec-18 results that were above management’s most recent guidance and better than we had expected. Consolidated operating profit was up 7.5% on a 7.8% increase in sales, and net profit up 37.0% following extraordinary gains (vs. losses the previous year) and a lower effective tax rate.

4Q results were weak, primarily due to the downturn in semiconductor capital spending, but this was no surprise. Total consolidated operating profit was down 10.3% year-on-year on a 2.3% increase in sales in the three months to December, while operating profit on Semiconductor Instruments & Systems (primarily mass flow controllers) was down 32.8% on a 15.8% decrease in sales.

Looking ahead, management is guiding for year-on-year declines in both sales and profits in the six months to June, again due to weak demand for semiconductor equipment, followed by a sharp rebound in 2H and low single-digit growth FY Dec-19 as a whole. Judging from the semiconductor equipment order flow, it appears that a weak 1H will be hard to avoid, while there is as yet no sign pointing to recovery. Nevertheless, we have raised our own sales and profit estimates for this fiscal year and next based on the absolute levels of orders and sales.

Automotive Test Systems and the company’s other businesses should continue to grow, supported by the acquisition of FuelCon AG of Germany (an industry leader in battery and fuel cell validation) and Manta Instruments of the U.S. (which makes nanoparticle tracking analysis systems). The issue, then, is how soon and how rapidly semiconductor related investments will recover. We suspect later and more slowly than management hopes, but in any case the downturn appears to have been discounted.

At ¥5,980 (Friday, February 15, closing price), Horiba has rebounded by 44% from its January 4 low of ¥4,155, but is still 38% below its ¥9,590 all-time high reached last May. It is now selling at 13.6x our EPS estimate for this fiscal year and 12.3x our estimate for FY Dec-20. These and other projected valuations are on the low side of their 5-year historical ranges. Once the recent bounce has been consolidated, there should be another buying opportunity for longer term investors.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.