In this briefing:

- Delta Thailand’s Tender Offer: Updated Timetable

- Glovis/Mobis Pair Trade: Glovis Being Overpriced Relative to Mobis on Unsubstantiated Speculation

- Komatsu, HCM, CAT: The Stock Punishment Does Not Match the Outlook Deterioration Crime

- Hyundai Autoever IPO Preview

- Hyundai Autoever IPO Pricing: Likely to Be a Dull Event Given No Growth Story & Glovis Merger

1. Delta Thailand’s Tender Offer: Updated Timetable

With Form 247-3 (Intention to Make a Tender Offer) and the FY18 dividend (Bt2.30/share) for Delta Electronics Thai (DELTA TB) having been announced, this insight briefly provides an updated indicative timetable for investors.

The next key date is the submission of Form 247-4, the Tender Offer for Securities, which will provide full details of the Offer.

Date | Data in the Date | Comment |

1-Aug-18 | Announcement | |

13-Jan-19 | Pre-approvals fulfilled | |

18-Feb-19 | Form 247-3 submitted | |

18-Feb-19 | FY18 dividend announced | |

22-Feb-19 | Form 247-4 to be submitted | As per announcement |

25-Feb-19 | Tender Offer open | Assume 1 business day after 247-4 is submitted |

28-Feb-19 | Last day to buy to be on the 4 Mar register | T+2 settlement |

1-Mar-19 | Ex-date for dividend | As announced |

4-Mar-19 | Date to be on the registry to receive full-year dividend | As announced |

22-Mar-19 | Last day for revocation of shares | 20th day of Tender Offer1 |

29-Mar-19 | Close of Offer | Assuming 25 business days tender period |

2-Apr-19 | AGM | As announced |

3-Apr-19 | Consideration paid under the Offer | Assume 3 business days after close of Offer |

11-Apr-19 | Payment of FY18 dividend | As announced2 |

1 assuming the shareholder has not forfeited the right to revoke

2 the dividend is subject to a 10% WHT for non-residents.

This above indicative timetable assumes a conditional offer based on a minimum acceptance level of at least 50%. Payment under the offer may indeed be earlier, as explained below, which also ties in with a shareholders’ right to revoke shares tendered.

In addition, investors should not tender once the offer opens – assuming the tender period commences on the 25 February – but wait until their shares are on the registry as at 4 March to receive the FY18 dividend.

Currently trading at a 2.2%/22% gross/annualised spread. Bear in mind the dividend is subject to 10% tax.

2. Glovis/Mobis Pair Trade: Glovis Being Overpriced Relative to Mobis on Unsubstantiated Speculation

- There are still two schools of thought on the HMG restructuring. Glovis/Mobis merged entity as a holdco is the one. Only Glovis as a holdco with Mobis→HM→Kia below is the other. Since late 3Q last year, the local street started speculating on the latter.

- This has pushed up Glovis price relative to Mobis. They are now near 200% of σ in favor of Glovis on a 20D MA. Glovis made a 2+σ jump upwardly just in 4 trading days. On a 120D horizon, they are almost at the 120D high.

- At this point, neither is a hassle free way. In the latter, Glovis has to come up with nearly ₩2tril to buy Kia’s Mobis stake, highly likely through new debts. This financial burden wouldn’t be light on Glovis. Glovis may also be facing a risk of forceful holdco conversion. This will create a serious headache with Kia as a grand grand son subsidiary.

- The current speculation pushing up Glovis relative to Mobis has yet to be sufficiently substantiated/justified. This suggests Glovis is being overbought on a speculation that will very likely be short-lived. I expect there will soon be a mean reversion for Mobis. I’d go long Mobis and short Glovis at this point.

3. Komatsu, HCM, CAT: The Stock Punishment Does Not Match the Outlook Deterioration Crime

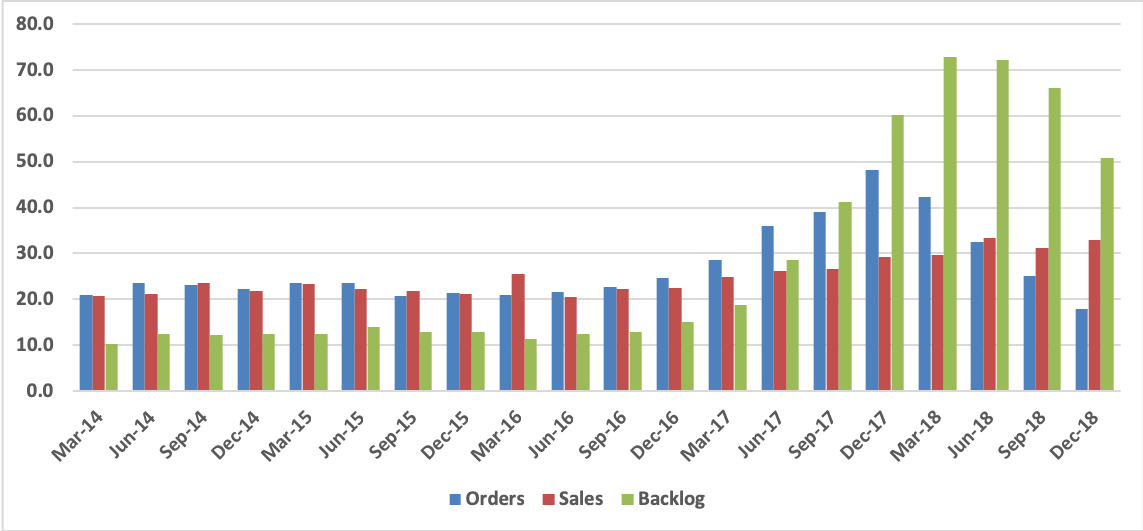

We have been struck by the degree of underperformance of the construction machinery names despite strong earnings performance. While the cyclical nature of the names makes judging performance purely on earnings results (or even the outlook) hazardous, in this case we believe the market has been premature and excessive in its derating of these stocks which have sold off to similar levels as the WFE names such as Tokyo Electron (8035 JP) and Robotics names such as Fanuc Corp (6954 JP).

While it is possible that Komatsu Ltd (6301 JP), Hitachi Construction Machinery (6305 JP) and Caterpillar Inc (CAT US) have sold off partly due to their China exposure, it needs to be emphasised that 1) these companies are no longer heavily dependent on China and revenue exposure is 12% for HCM, 10% for CAT and 7% for Komatsu, and 2) while the Chinese market at about 60k excavators is probably close to the top of its cycle, it is not a bubble like in 2010 when it 111k units and thus a collapse in demand is unlikely (though a decline is).

As the table below notes, earnings estimates for the construction machinery companies have only tapered marginally from their peaks, and while find the forecasts for continued growth into 2020 somewhat optimistic the resilience of mining demand means we are disinclined to dismiss them out of hand. On the other hand estimates for WFE and Robot names have dropped significantly, but despite this, share price performance is similar for all three categories of stocks. We discuss this stark discrepancy further below.

Change in 2019 OP Estimate Vs. Peak | Peak OP Estimate Date | Peak to Trough Share Price Change | Share Price Vs. Peak | Peak Share Price Date | |

Caterpillar | -6.4% | Aug 18 | -35.2% | -21.4% | Jan 18 |

Komatsu | -2.1% | Dec 18 | -49.7% | -38.8% | Jan 18 |

Hitachi Construction Machinery | -4.6% | Oct 18 | -50.5% | -41.2% | Feb 18 |

Average | -4.4% | -45.1% | -33.8% | ||

ASML | -10.1% | Jan 19 | -31.2% | -14.4% | Jul 18 |

Applied Materials | -38.4% | Apr 18 | -53.2% | -36.8% | Mar 18 |

LAM Research | -28.7% | Apr 18 | -46.4% | -21.3% | Mar 18 |

Tokyo Electron | -36.6% | Jul 18 | -49.9% | -32.4% | Nov 17 |

Average | -28.5% | -45.2% | -26.2% | ||

Fanuc | -44.7% | Mar 18 | -52.9% | -42.4% | Jan 18 |

Yaskawa | -34.7% | Mar 18 | -58.5% | -47.0% | Jan 18 |

Harmonic Drive Systems | -43.2% | May 18 | -65.9% | -49.3% | Jan 18 |

Average | -40.9% | -59.1% | -46.2% |

4. Hyundai Autoever IPO Preview

- Hyundai Autoever is ready to complete its IPO in March 2019. Established in 2000, Hyundai Autoever is the IT service arm of the Hyundai Motor Group. Hyundai Autoever is expected to play a key role in the Hyundai Motor Group’s push to become a leading global player of autonomous driving in the coming decade.

- The IPO price range is between 40,000 won and 44,000 won. The IPO base deal size is from $125 million to $138 million. According to the bankers’ valuation, the expected market cap is expected to range from 840 billion won to 924 billion won.

- The bankers used four companies including Samsung SDS, POSCO ICT, Lotte Data Comm, and Shinsegae I&C to value Hyundai Autoever. Using the annualized net profit of the comps in 2018, the bankers derived an average P/E multiple of 24x for the peers. Then the bankers took the annualized net profit of Hyundai Autoever in 2018 (52.2 billion won) and applied the peers average P/E multiple of 24x to derive the implied market cap of 1.25 trillion won. After applying additional IPO discount of 26.4% – 33.1%, the bankers derived the IPO price range of 40,000 to 44,000 won.

5. Hyundai Autoever IPO Pricing: Likely to Be a Dull Event Given No Growth Story & Glovis Merger

- Hyundai Autoever offers a total 3,510,000 shares. Split is 9.9% primary and 90.1% secondary. Shares are preliminarily priced at ₩40,000~44,000. This puts the company value at ₩840~924bil. Bookbuilding will be Mar 13~14.

- Valuation is a bit aggressive. It is being heard that local institutions are not particularly excited about this IPO mainly because of Autoever’s 90% captive business. That is, growth story isn’t looking fancy. At a 17x PER on Autoever’s FY19 expected earnings, it is sitting in the middle of the indicative price band. There shouldn’t be much room to play around.

- The major shareholder was expected to sell as much as 50% of their shares through secondary distribution. Actual offering size is much smaller. This sparks the speculation that Autoever will soon be merged with Glovis. Much smaller offering size may be for facilitating the merger. It can pave a less controversial path for another merger attempt with Mobis.

- But this speculation can render this IPO meaningless though. I expect this IPO will be a dull event. I wouldn’t avoid it completely though. Stable income stream and connected car are are still something worthy. I’d buy them at the right price. Low end should be the right price.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.