In this briefing:

- Indonesia Property – In Search of the End of the Rainbow – Part 2 – Bumi Serpong Damai (BSDE IJ)

- The Week that Was in ASEAN@Smartkarma – Indonesian Property, XL Axiata, and Singapore’s Economy

- Asia’s External Balances Signal Safety for Investors

- Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

- Indonesia Property – In Search of the End of the Rainbow – Part 1 – Ciputra Development (CTRA IJ)

1. Indonesia Property – In Search of the End of the Rainbow – Part 2 – Bumi Serpong Damai (BSDE IJ)

In this series under Smartkarma Originals, CrossASEAN Research insight providers Angus Mackintosh and Jessica Irene seek to determine whether or not we are close to the end of the rainbow and to a period of outperformance for the property sector. Our end conclusions will be based on a series of company visits to the major listed property companies in Indonesia, conversations with local banks, property agents, and other relevant channel checks.

The second company we explore is leading township developer Bumi Serpong Damai (BSDE IJ), with exposure ranging from landed housing, shophouses, condominiums, as well as the defensive and growing buffer of nearly 20% of revenues coming from recurrent rental income.

Bumi Serpong Damai (BSDE IJ) has one of the largest land banks of any developer, with a land bank of over 4,000 ha, more than half of which is in its flagship township of BSD City in Serpong.

Given its breadth of exposure to the property segment, the company has the flexibility to switch its exposure between different segments depending on the health of the overall market.

Its projects are well connected by toll-roads and railway but it is well positioned to benefit from new infrastructure such as the new MRT, LRT, as well as new toll road extensions, which will enhance the attractiveness of its developments.

Management suggests that they will take a cautious start to the year ahead of the election but see a window for a pick-up in marketing sales in May, with the potential for a much better 2H19.

Despite a run-up in the share price since the start of the year, valuations do not look challenging from a historical basis especially looking at its PBV. It also trades at a significant discount to NAV of 67%, as well as being below its 5 yr historical mean on a forward PER basis.

Catalysts ahead include a post-election pick-up in activity leading to more project launches, completion of infrastructure projects, aggressive mortgage lending by the banks, and a more dovish interest rate outlook. Valuations are already attractive but a rise in property market activity should also lead to earnings upgrades, which if sustained, may lead to property prices moving upwards.

2. The Week that Was in ASEAN@Smartkarma – Indonesian Property, XL Axiata, and Singapore’s Economy

This week’s offering of Insights across ASEAN@Smartkarma is filled with another eclectic mix of differentiated, substantive and actionable insights from across South East Asia and includes macro, top-down and thematic pieces, as well as actionable equity bottom-up pieces. Please find a brief summary below, with a fuller write up in the detailed section.

Highlights this week include the first individual company report in a Smartkarma Originals series on Indonesian Property from CrossASEAN Insight Provider Jessica Irene on Ciputra Development (CTRA IJ) and the potential for a strong data-driven turnaround over the coming few quarters for Xl Axiata (EXCL IJ) in an Insight from our friends at New Street Research. On the Macro front CrossASEAN economist Prasenjit K. Basu presents some insightful thoughts on the Singapore Economy.

Macro Insights

In Mildly Expansionary, but Socially Magnanimous While Staying Focused on Long-Term Competitiveness, CrossASEAN Economist Prasenjit K. Basu zooms in on the Singapore economy and despite expectations of slower growth this year, sees ample room for fiscal stimulus should the global economy weaken further.

In US Dollar Demand – Fading Appetite, Dr. Jim Walker discusses the less than voracious appetite for the US Dollar.

In Prabowo Errs Again; Widodo Lead Intact; Riady’s Mei-Egg-Karta; BI Holds; Repsol’s Find; Debate Text, Kevin O’Rourke provides his value-added commentary on political and economic developments in Indonesia over the past week.

In Philippines: Institutional Reforms that Promote Macro Stability, Phipillines economist Jun Trinidad zeros in on institutional reforms which he sees are providing a stable platform for growth.

Equity Bottom-Up Insights

In the first insight on a company in a Smartkarma Originals series, Indonesia Property – In Search of the End of the Rainbow – Part 1 – Ciputra Development (CTRA IJ), CrossASEAN Insight Provider Jessica Irene takes a detailed look at this leading developer and finds significant upside to the stock.

In XL Axiata Results Show a Strong Turnaround Underway in Indonesia, our friends at New Street Research revisit Xl Axiata (EXCL IJ) post its most recent results and see the potential for a strong data-driven turnaround over the coming few quarters.

In Singtel’s Weak 3Q18 Results but Dividend Looks Sustainable and Long Term Upside from Associates, New Street Research circle back to Singtel (ST SP) post results and remains constructive on the stock.

In M1 Offer Unconditional as Axiata Tenders, Events Specialist Travis Lundy revisits the ongoing M1 Ltd (M1 SP) deal which seems to have reached a conclusion following Axiata Group (AXIATA MK) ‘s acceptance.

In Best World (BEST SP): Not the Best Financials to Disprove The Business Times Allegations, Arun George takes a look at the company following an article in the local press casting dispersions on its China sales.

In Delta Thailand’s Tender Offer: Updated Timetable, David Blennerhassett circles back to the ongoing tender offer for Delta Electronics Thai (DELTA TB).

In Sing Holdings – Surge in Full-Year Earnings with a Surprise Hike in Dividend. 67% Upside. BUY., Royston Foo comments on the company following a strong set of results.

In MAJOR: Impressive 4Q18 Earnings, our friends at Country Group comment on Major Cineplex Group (MAJOR TB) following stellar numbers. MAJOR’s 4Q18 net profit was Bt259m (+247%YoY, +26%QoQ).

Sector and Thematic Insights

In this week’s REIT Discover: The Three R’s Driving Starhill Global REIT (SGREIT SP), Anni Kum zeros in on Starhill Global Reit (SGREIT SP) and finds an interesting story.

3. Asia’s External Balances Signal Safety for Investors

Asian currencies are, in general, well supported by economic fundamentals in the form of external surpluses and interest rate differentials. Indeed, most Asian currencies display an appreciating bias, contrary to perceptions in 2018 when all of them lost ground to the US dollar. Over the last year the underlying external strength has been reflected in Asian currency appreciation against the US dollar.

4. Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

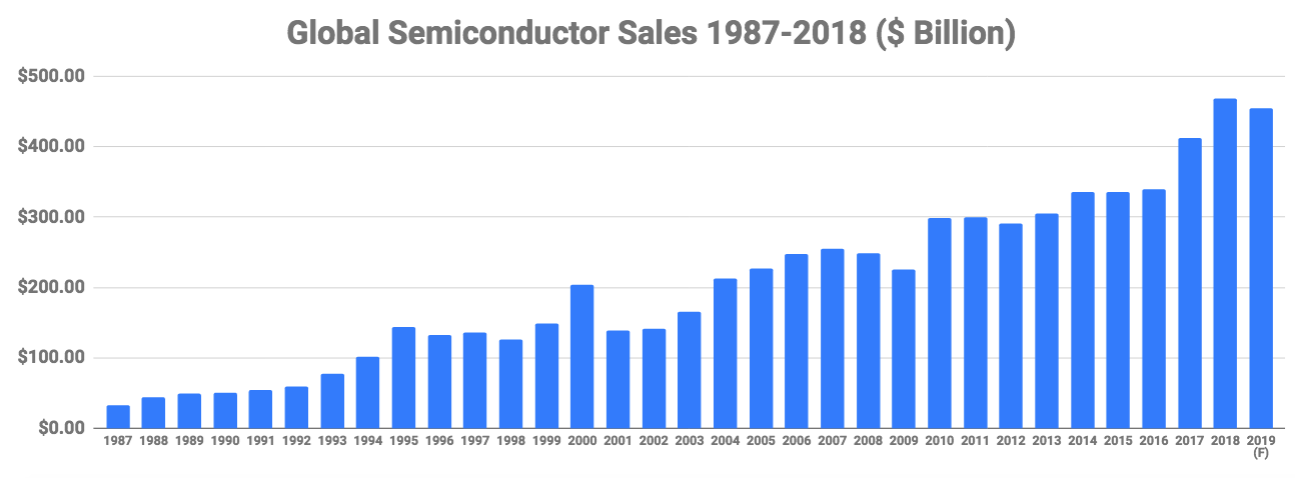

According to SEMI, North American (NA) WFE sales for January 2019 fell to $1.9 billion, down ~10% sequentially and ~20% YoY. This was an abrupt reversal of the recovery trend implied by the December 2018 sales of $2.1 billion and is the biggest monthly sales YoY decline since June 2013.

Just as declining monthly WFE sales preceded the current semiconductor downturn by some six months, the continuation of December’s MoM WFE decline reversal trend was a prerequisite for a second half recovery in the broader semiconductor sector. With that trend well and truly broken, we now anticipate a more delayed, gradual and prolonged recovery, one which is now unlikely to materialise until late third, early fourth quarter 2019.

5. Indonesia Property – In Search of the End of the Rainbow – Part 1 – Ciputra Development (CTRA IJ)

In this series under Smartkarma Originals, CrossASEAN insight providers AngusMackintosh and Jessica Irene seek to determine whether or not we are close to the end of the rainbow and to a period of outperformance for the property sector. Our end conclusions will be based on a series of company visits to the major listed property companies in Indonesia, conversations with local banks, property agents, and other relevant channel checks.

The first company that we explore is Ciputra Development (CTRA IJ), a township developer with 38 years of track record. With 75 ongoing township projects in 33 cities, CTRA has the widest coverage of any developer in Indonesia. However, tightening policies by the Bank Indonesia (BI), in particular the presales mortgage disbursement regulation caused a significant drop in operating cashflow and increased gearing level.

Earnings have been on a downtrend, as slower revenue recognition coupled with higher interest costs have weighed on the bottom line. As BI has recently started to relax property regulations, we may begin to see some positive impact on cash flows over the next few quarters, although earnings are likely to remain weak from declining presales over the past three years.

As we enter the election year, presales announcements may not be positive in the short term, but activities may improve after the electoral contest, helped by a pick up in sentiment and boosted by a better interest rate environment and positive regulatory tailwinds. Potential portfolio inflow to high beta stocks and rising risk appetite for smaller cap underperforming stocks should also drive CTRA’s share price outperformance in 2019. We see a 50% upside to our target price of IDR1,352 per share.

Summary of this insight:

- The property development product portfolio includes landed housing, high-rise condominiums, and offices. Landed housing projects are still CTRA’s bread and butter, comprising more than half of the company’s revenue and more than two-thirds of presales. As the property demand is currently dominated by the end-users, CTRA’s product offering is shifting towards smaller more affordable units. We have put together an example mortgage calculation and determine a key affordability level based on the average income per capita in the Greater Jakarta to illustrate how much should a housing unit be worth for the end users market.

- The investment properties portfolio consists of 4 malls, 9 hotels, and 4 hospitals across the major cities in Indonesia, making up 13%, 8%, and 6% of 9M18 total consolidated revenues respectively. This is a 68% increase in revenue contribution versus five years ago. The company has been actively building its investment property portfolio to weather out the volatility in the non-recurring or development revenue.

- Accessibility is a key factor to land appreciation and hence, company’s total NAV. With the traffic worsening around the Greater Jakarta area, time to commute is an increasingly important factor in determining where to stay and access to public transportation such as MRT and LRT will be a powerful driver going forward. CTRA has a very diverse property development portfolio, hence the benefit of the infrastructure rollout is more widespread across the different projects.

- 65% of CTRA’s presales are generated from units priced IDR2bn and below, which indicate that the majority of CTRA’s buyers are in the middle to middle-low segments. These buyers are price sensitive and are highly dependent on financing. CTRA’s mortgage and in-house installment proportion is one of the highest in our property universe, making the company more susceptible to the changes in the property mortgage regulation by the Central Bank (BI).

- The property mortgage regulation in Indonesia has had few rounds of changes in the past decade, with a series of tightening measures taking place between 2013-2014, and the start of loosening measures in 2016-2018. We will discuss in depth the various property regulations issued and its impact on CTRA’s cashflow. We also constructed a cashflow simulation time series for a sample housing sale to determine the time needed for the project to turn net cashflow positive and when can the developer reinvest for future landbank of equivalent value.

- Pros: as we expect a better rate of cash inflow from future mortgages, our model shows that the advances-to-inventory ratio, which is an indicative figure for the property developers’ working capital, will begin to rise in 2019, leading to an inflection point for CTRA’s FCF. One-off adjustment in the earlier booking of 2019’s first mortgage disbursement is the key driver.

Cons: CTRA booked three consecutive years of negative presales growth with a decline rate of -11% Cagr. This indicates that the accounting revenue growth will more likely be weaker over the next 12-18 months. We also estimate that margin should continue to trend down until 2020. As we continue to see a larger proportion of units priced below IDR1bn in the past 2 years, it is unlikely to see a pick up in margin in 2019-2020.

- Cons: Election year to election year, we may see some similarity between the 2014 and 2019’s quarterly presales split. 1Q14 and 2Q14 contributed 41% to total FY14 presales, while 4Q14 contributed a chunky 33%. If we assume the same quarterly split for 2019 presales target, we may potentially see 13%-27% YoY declines in the next three quarters of presales reporting. Note however that the BI issued its first round of tightening regulations at the end of 2013 and this may have an impact to the 1H14 presales. Also there is a difference in the election schedules as the 2014 election was dragged on until late August, while the 2019 contest will be done by end of April.

- Recommendation & catalyst: CTRA share price has underperformed the JCI by 24% in the past 12 months. Though the share price has a nice 28% rebound from its 5-year low point, CTRA’s discount to net asset value (NAV) and price-to-book (PB) ratio is still at more than -1 standard deviation below its historical mean. Its price-to-earnings (PE) ratio however is only slightly below the historical mean. Improving risk appetite for high beta stocks, better interest rate environment, accomodative policies from the government, and potential pick up of activity after the election are a few of the key catalysts for the stock and sector. This underlines our BUY recommendation on CTRA with 50% upside. Our bull case scenario of rerating to +1 standard deviation above mean valuation offers 26% additional upside to our TP.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.