In this briefing:

- RRG Global Macro Weekly – Election Volatility Expected in India, Indonesia and Thailand

- India: Retail SIP Inflows Show Sharp Slowdown

- Weekly Oil Views: Crude Rises to 3-Month High but Further Upside May Be Limited

- Asia’s External Balances Signal Safety for Investors

- Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

1. RRG Global Macro Weekly – Election Volatility Expected in India, Indonesia and Thailand

- Volatility set to rise as Thailand, Indonesia and India all Face ElectionsRussia: Michael Calvey, a US citizen and one of Russia’s most prominent foreign investors, has been detained.

- Indonesia: Incumbent President and his challenger from the military are trying to outdo each other in spending largesse targeting rural poor ahead of the May election.

- South Africa: Recent inflation readings have been the lowest in a long time on lower fuel expenses. Expected to stay low.

2. India: Retail SIP Inflows Show Sharp Slowdown

- 62% of small cap funds, 38% of mid cap funds have negative 3-year SIP returns

- 33% of large cap funds have 3-year SIP returns lower than FD rate

- AMFI data shows 50% of SIP accounts were registered since April-17

- Discontinued SIP accounts in 9MFY19 are 24% higher than those over entire FY18. Net SIP additions are down 70% in last 6 months.

- Even though gross SIP inflows are holding up, industry experts indicate net inflows have fallen from 70% of the gross in mid-2018 to 40% currently.

3. Weekly Oil Views: Crude Rises to 3-Month High but Further Upside May Be Limited

Another week of US-China negotiations and another big boost to market sentiment. Stock markets as well as crude rallied last week on the back of news from Washington that the US and China were preparing to sign a framework deal in the form of several MoUs covering trade and structural issues.

But there are other economic concerns around the globe, and a preliminary deal between the US and China is not going to curb all the headwinds. Further upside to crude may also be limited because much of the anticipated rapprochement between the two countries has already been factored in. WTI prices stabilising well above the $50/barrel threshold are also likely to support strong growth in US production, which hit the 12 million b/d mark last week.

Nonetheless, there are factors on the supply front that could trigger a spike beyond $70/barrel for Brent, especially if combined with a turnaround in economic and oil demand growth expectations.

If that happens, we believe the Saudis will ease up on over-compliance with their own production cuts, either voluntarily or under renewed pressure from US President Donald Trump.

4. Asia’s External Balances Signal Safety for Investors

Asian currencies are, in general, well supported by economic fundamentals in the form of external surpluses and interest rate differentials. Indeed, most Asian currencies display an appreciating bias, contrary to perceptions in 2018 when all of them lost ground to the US dollar. Over the last year the underlying external strength has been reflected in Asian currency appreciation against the US dollar.

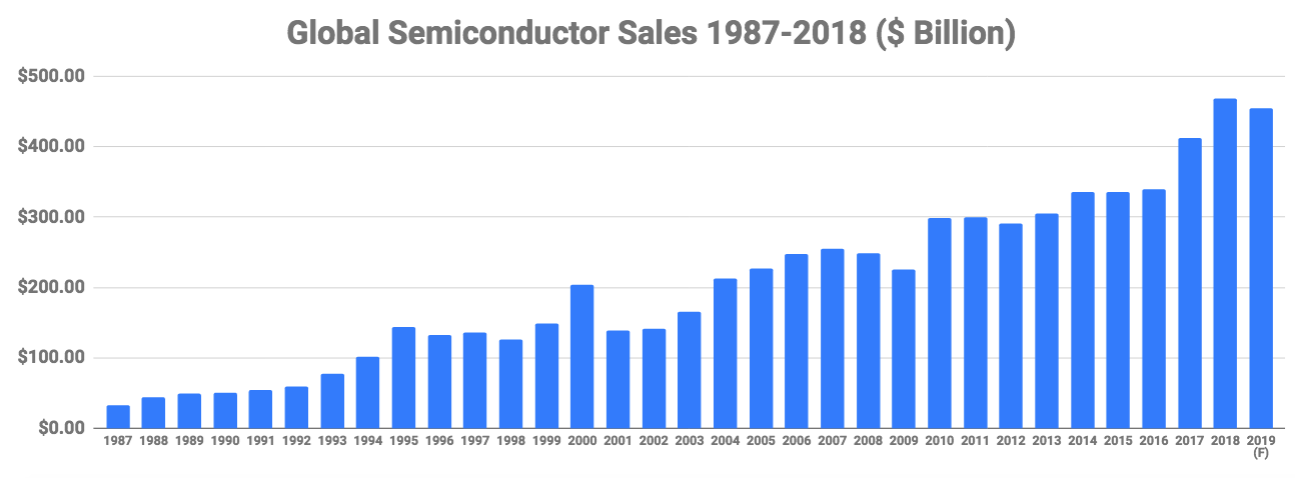

5. Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

According to SEMI, North American (NA) WFE sales for January 2019 fell to $1.9 billion, down ~10% sequentially and ~20% YoY. This was an abrupt reversal of the recovery trend implied by the December 2018 sales of $2.1 billion and is the biggest monthly sales YoY decline since June 2013.

Just as declining monthly WFE sales preceded the current semiconductor downturn by some six months, the continuation of December’s MoM WFE decline reversal trend was a prerequisite for a second half recovery in the broader semiconductor sector. With that trend well and truly broken, we now anticipate a more delayed, gradual and prolonged recovery, one which is now unlikely to materialise until late third, early fourth quarter 2019.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.