In this briefing:

- StubWorld: Can One’s Offer For Kian Joo Can; Mahindra At Possible Set-Up Levels

- Uzbekistan Is a Promising Latecomer, but Investors Need to Watch Out and Stay on Top of Data

- Fortis Healthcare: OK Results and a Cost-Cutter CEO

- TRADE IDEA – Mahindra & Mahindra (MM IN) Stub: Rise

1. StubWorld: Can One’s Offer For Kian Joo Can; Mahindra At Possible Set-Up Levels

This week in StubWorld …

- Can One Bhd (CAN MK)‘s gets shareholder approval to launch a Mandatory General Offer for 33%-held Kian Joo Can Factory (KJC MK). (note, both legs are illiquid)

- Curtis Lehnert sees Mahindra & Mahindra (MM IN)‘s discount to NAV at its widest since 2015.

Preceding my comments on Can One/Kian Joo, Mahindra and other stubs are the weekly setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity threshold of US$1mn on a 90-day moving average, and a % market capitalisation threshold – the $ value of the holding/opco held, over the parent’s market capitalisation, expressed in percent – of at least 20%.

2. Uzbekistan Is a Promising Latecomer, but Investors Need to Watch Out and Stay on Top of Data

Last week, Uzbekistan placed a debut Eurobond, which attracted high interest from investors. Following a change of leadership in 2016, the country embarked on a path or rapid development. So far, its reform record has been quite impressive. However, new challenges often arise during periods of rapid transition. We expect both demand and supply-related pressures to lead to a rise in headline inflation towards the 20% mark in the next 12 months. We think that given the evidence of a rapid deterioration in the trade and current accounts in 2018, further depreciation of the local currency should be expected in the short term. Investors who have bought the Eurobond, or consider participation in further placements by Uzbek corporate issuers in the coming months, should watch out for signs of the build-up of persistent imbalances in Uzbekistan’s economy.

3. Fortis Healthcare: OK Results and a Cost-Cutter CEO

Fortis Healthcare (FORH IN) ‘s hospital business continued to improve in FQ3 while the lab business remained stable. This Insight briefly focuses on the highlights of the results and their implications. The hiring of a CEO out of Narayana Hrudayalaya (NARH IN) signals continued (and likely intensified) focus on efficiency to improve profitability.

We continue to think that Fortis is a promising turnaround story. Refer to the Insight Stream for the history of this situation.

4. TRADE IDEA – Mahindra & Mahindra (MM IN) Stub: Rise

The company that brought the off-road vehicle to post-war India in the 1940s has grown into a leading personal vehicle manufacturer covering land, air and sea. Merely making cars, planes and boats wasn’t ambitious enough for this company though, the conglomerate wouldn’t be complete without a financial services and tech consulting business under the corporate umbrella.

Indian holding companies typically trade a wider discount to NAV than their East Asian counterparts, however the 42% discount to NAV that Mahindra & Mahindra (MM IN) currently trades at, is a trough level historically for the company. In the body of this insight I will present my case for a stub trade on the company, detailing the business structure, performance and the unlisted stub businesses.

In this insight I will cover:

I. The Trade

II. Group Overview and Stub Business Review

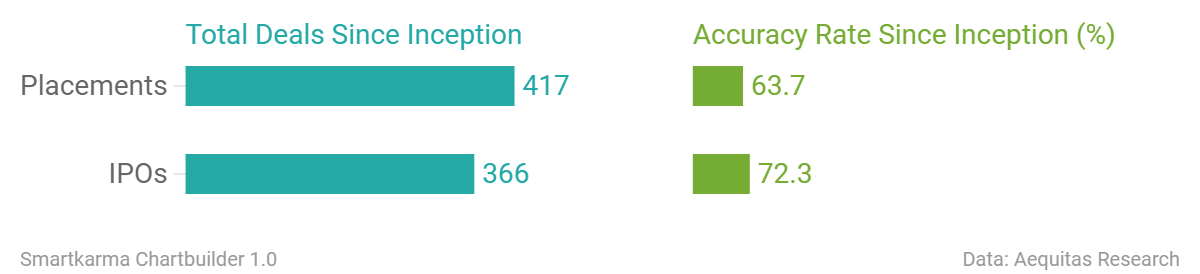

III. My Track Record with Stub Trades

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.